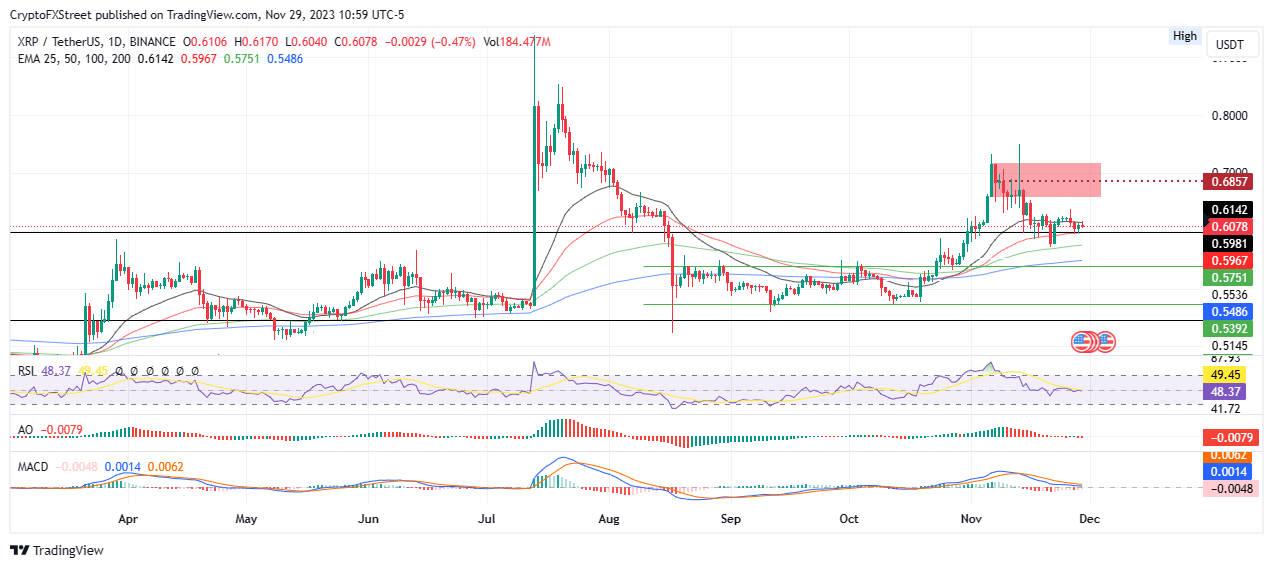

- Ripple price has flipped the 25-day EMA to a resistance hurdle at $0.6142 as it thinly holds above $0.5891 support.

- XRP could extend south if the $0.5891 support breaks, spiraling 10% lower to consolidate under $0.5751 in a dire case.

- The bearish thesis will be invalidated once the price breaks and closes above $0.6857, the supply zone’s mean threshold.

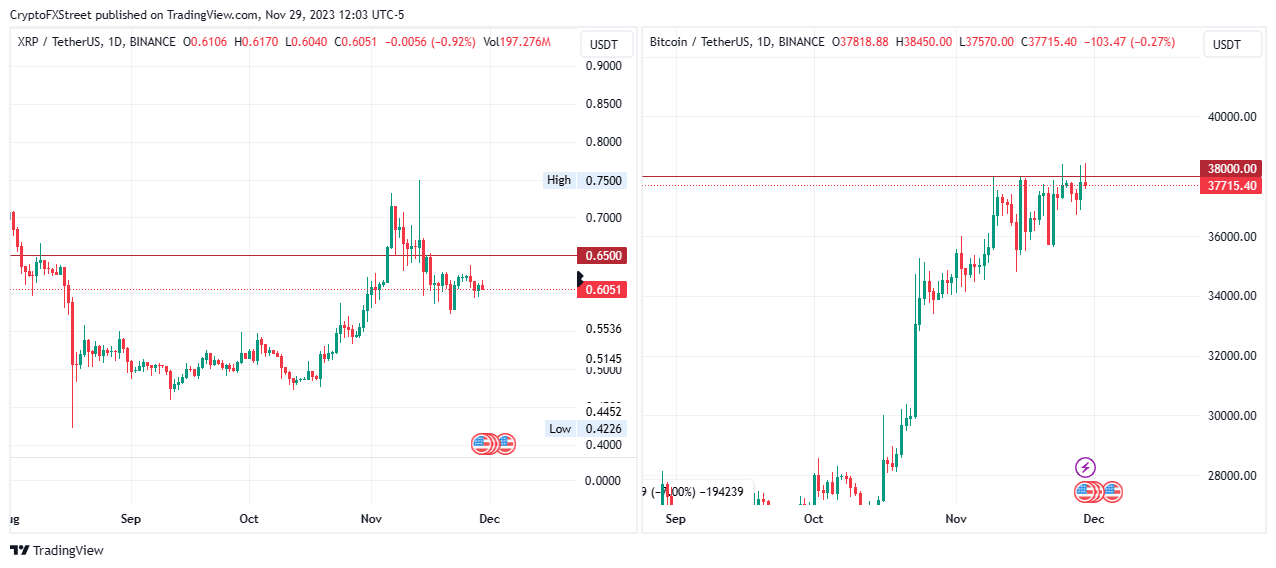

Ripple (XRP) and Bitcoin (BTC) prices do not show parity. Despite both featuring among the crypto top three, Ripple price is stuck under $0.6500 while Bitcoin has managed to foray north, testing the $38,000 psychological level for the third time in a week.

Wow. I never realised XRP’s price performance was this poor compared to other major coins and not only compared to Bitcoin and Ethereum. It has of course been under the cloud of a SEC investigation and then lawsuit that entire period but you would think it would have caught up… https://t.co/Eyflqp0JZq

— bill morgan (@Belisarius2020) November 29, 2023

XRP/USDT 1-day chart, BTC/USDT 1-day chart

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

XRP and Bitcoin on the weighing scale

Following the court’s determination about XRP’s security status, and its confirmation by Judge Analisa afterwards, the Ripple community has a lot of hope for the token. CEO Brad Garlinghouse at some point said that XRP is the next Bitcoin if it solves a multi-trillion dollar problem.

On this comparison, legal expert Bill Morgan challenges the narrative that selling pressure is what is keeping Ripple price stunted.

Is that selling pressure suppressing XRP price? I say no. Firstly, it’s not 3 billion XRP per quarter. That much is released from Escrow by Ripple but about 800 million XRP per month is put back into escrow.

Secondly 200 million XRP per month is not much compared to XRP volume… https://t.co/95HsNYT8An pic.twitter.com/gKzEqkUjcs

— bill morgan (@Belisarius2020) November 29, 2023

Meanwhile, Ripple price has investors at the edge of their seats. They continue to remember September 4, when Ripple CTO Stuart Alderoty opined that XRP could emerge as the world’s reserve currency one day. In his opinion, much of the world would be satisfied with a currency that no one controls being used as the world’s reserve currency.

Ripple could settle with US SEC on November 30

There are speculations about a possible settlement between Ripple and the SEC, after a report that the financial regulator will be holding a closed-door meeting on Thursday. Neither the subject of the meeting nor the other attendee is known, for now, leaving all things to speculation as XRP community members watch the clock.

If a settlement does happen, it could inspire optimism among XRP holders, inspiring a buying frenzy. This is due to the cultic following that is characteristic of the Ripple community which tends to run with positive news.

The ongoing slump could, therefore, be a buying opportunity ahead of a possible settlement. If history is enough to go by, Ripple price could rise between 10 to 30%, akin to what happened when Judge Analisa Torres determined that XRP was only a security when sold to institutional investors.

XRP price outlook as Morgan absolves selling for suppressing Ripple price

Ripple (XRP) price is down 1% as trading volume dwindles 2% over the last 24 hours, but community members remain on the ready to ride on the wave of a bullish development in the ecosystem. This is indicated by the position of the Relative Strength Index (RSI) hovering just around the 50 level for days on end, showing indecisiveness.

The price is trapped between the 25-day and 50-day Exponential Moving Averages (EMA) at $0.6142 and $0.5967, respectively. A breakout from this consolidation zone in either direction could determine the next directional bias.

For a confirmed uptrend, Ripple price must foray into the supply zone extending from $0.6582 to $0.7186 and break and close above its midline at $0.6857. Such a move would set the tone for XRP to tag the $0.7000 psychological level.

XRP/USDT 1-day chart

On the flipside, a break and close below the 50-day EMA at $0.5967 would expose Ripple price to a cliff that could culminate in a 10% fall into the consolidation zone between $0.5392 and $0.5750.