- XRP price has not moved much in the past day after noting a 4% decline the day before, hovering around $0.70.

- HSBC bank announced its new upcoming service, providing crypto asset custody service to institutional clients at Swell.

- The announcement came less than a day after Ripple partnered with Onafriq to provide services globally.

XRP price did not rally as much as was expected out of it in the past day given Ripple’s developer conference has begun as of this moment. While the event will only be held over two days, it is expected to have a significant impact on the altcoin.

Daily Digest Market Movers: XRP price stagnant as Ripple’s Swell fails to impress

- Ripple kicked off its event, Swell, on Wednesday and is expected to bring many influential people from the crypto space. Thus, some major announcements, including a conclusion to the Securities and Exchange Commission (SEC) vs. Ripple saga, are being awaited.

- However, the first day of the conference did not seem to have anything of major importance be announced. The only crucial development that took place was the announcement from HSBC. The bank announced that in collaboration with Metaco, it would be launching a digital asset custody service.

- The collaboration will mostly benefit institutional investors as it would place the security and management of crypto funds at the forefront. While the announcement may be of utmost importance, it did not impact the altcoin in any significant way since the majority of the Ripple base is still non-institutional investors.

- The last major development capable of impacting the price action was the partnership between Ripple and Onafriq. Joining hands with the African fintech organization will result in Onafriq utilizing Ripple Payments to open up three new payment corridors between Africa and the rest of the world.

The market is still awaiting crucial announcements from the conference.

Technical Analysis: XRP price rise has not come to an end

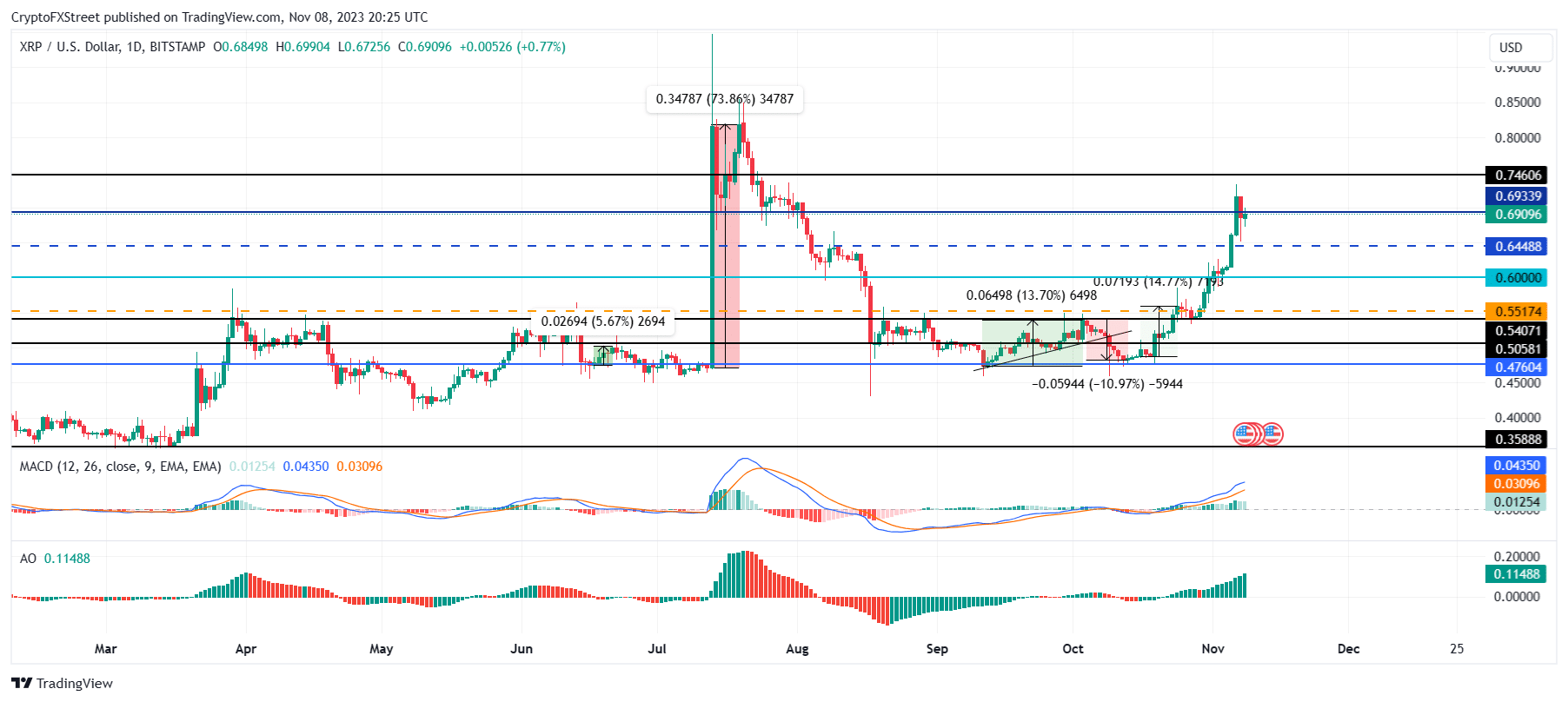

XRP price, at the time of writing, is just at the cusp of slipping on the daily chart. Following the recent rally, the altcoin fell by more than 4% to bring the price action to the current level of $0.69. Testing the support line marked at the same level, the altcoin still has an opportunity to bounce back.

In addition to the ongoing conference, the Awesome Oscillator is also not indicating any sudden shift in trend. The indicator is maintaining its rising green bars, and one could consider a likely shift in trend when the green bars turn red.

But since the event is expected to bear a positive impact on the price action, XRP could also bounce back and reclaim the $0.69 line as a support floor. This would allow the cryptocurrency to continue its uptrend and breach $0.74 to attempt to tag the 2023 high of $0.83.

XRP/USD 1-day chart

However, the Moving Average Convergence Divergence (MACD) indicator suggests that the strength of the active bullish trend is waning, as evidenced by the declining green bars on the histogram.

Thus, if bearishness takes over, the XRP price could fall back to $0.64. Losing this line would push it to test the $0.60 price as support. If the Ripple token fails to bounce back from here and falls through the support level, the bullish thesis would also be invalidated.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.