Last weekend, the cryptocurrency ecosystem saw a sudden but massive spike in bullish momentum. As a result, many altcoins saw a huge rally. For example, Chainlink’s LINK token rallied 21% on Saturday, Solana’s SOL token surged 12%, while Bitcoin price tagged $30,000 and is hovering close to $31,000.

This uptick has pushed many investors to believe that this is the start of a bull rally.

Read more: Here’s what to expect from Bitcoin price after false ETF approval rumors

Has crypto’s bull run begun?

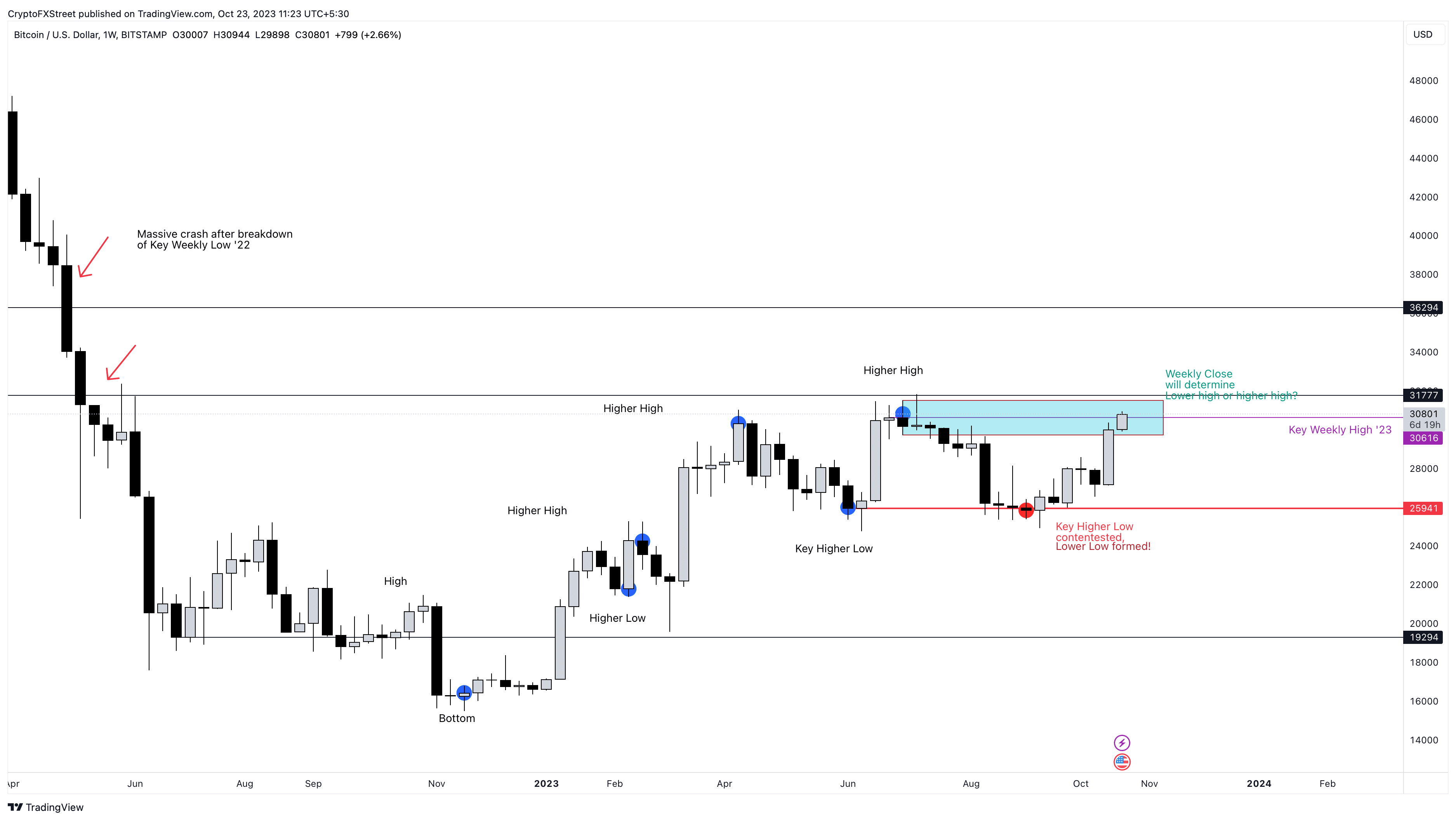

Bitcoin price threatened the 2023 bull rally in September when it formed a weekly lower low at $25,386. But the recent uptick has pushed BTC above a key weekly high of $31,777. If the pioneer crypto produces a higher high above this level, it would indicate the sustenance of the 2023 bull rally.

However, a weekly candlestick close below $31,777 will form a lower high and potentially kick-start a correction,

Key levels to watch:

- $36,294, in case BTC closes a weekly candlestick above $31,777

- $28,082 and $25,941, in case BTC closes a weekly candlestick below $31,777.

BTC/USDT 1-week chart

Also read: Bitcoin Weekly Forecast: BTC bulls can make or break 2023 rally

While Bitcoin price presents an ambiguous outlook, here are key events that could affect the broader markets.

- Fed Chairman Powell Speech – October 25

- Core PCE Price Index – October 27.

- Fed Interest Rate Decision/Fed Press conference – November 1.

- Nonfarm Payrolls – November 3.

While the jobs report on November 3 is important, for the upcoming week or ten days, the most important event will be the Fed’s interest rate decision, which could shift investor sentiment from risk-on to risk-off and vice versa.

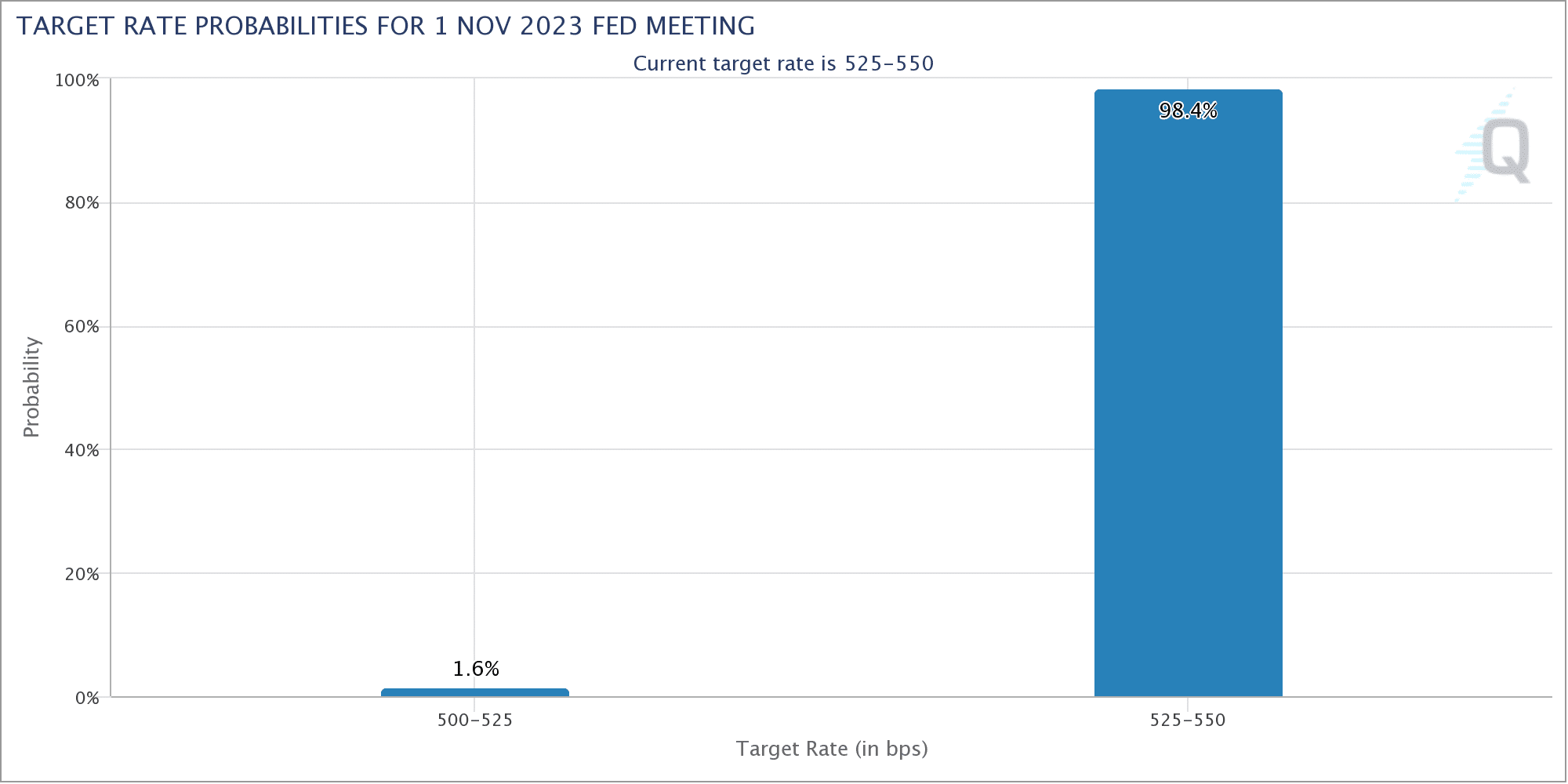

Fed unlikely to hike rates on November 1

The FedWatch Tool from CME Group shows a 98.4% probability of a pause in interest rate hike on November 1. There is, however, a 1.6% probability that the Fed will pivot and cut rates. But as the numbers suggest, the chances of this happening are slim after higher-than-expected jobs and inflation reports.

CME Group FedWatch Tool