- Uniswap price fell by nearly 6% in the past 24 hours after posting a 53% rally started in mid-June.

- Active deposits on the network fell to a 6-month low, suggesting UNI holders are less likely to take profits at the moment.

- More than 23% of all UNI investors have shed their status of “being at a loss,” and in order to shift that to “enjoying gains,” they will hold off on selling.

Uniswap price made good gains for its investors these past few weeks, however, this run came to a pause this week. With Bitcoin price slipping to $29,000, the broader market cues turned slightly bearish, and most of the cryptocurrencies appear to be correcting. But in the case of UNI, this may not extend for too long.

Uniswap price expected to rise further

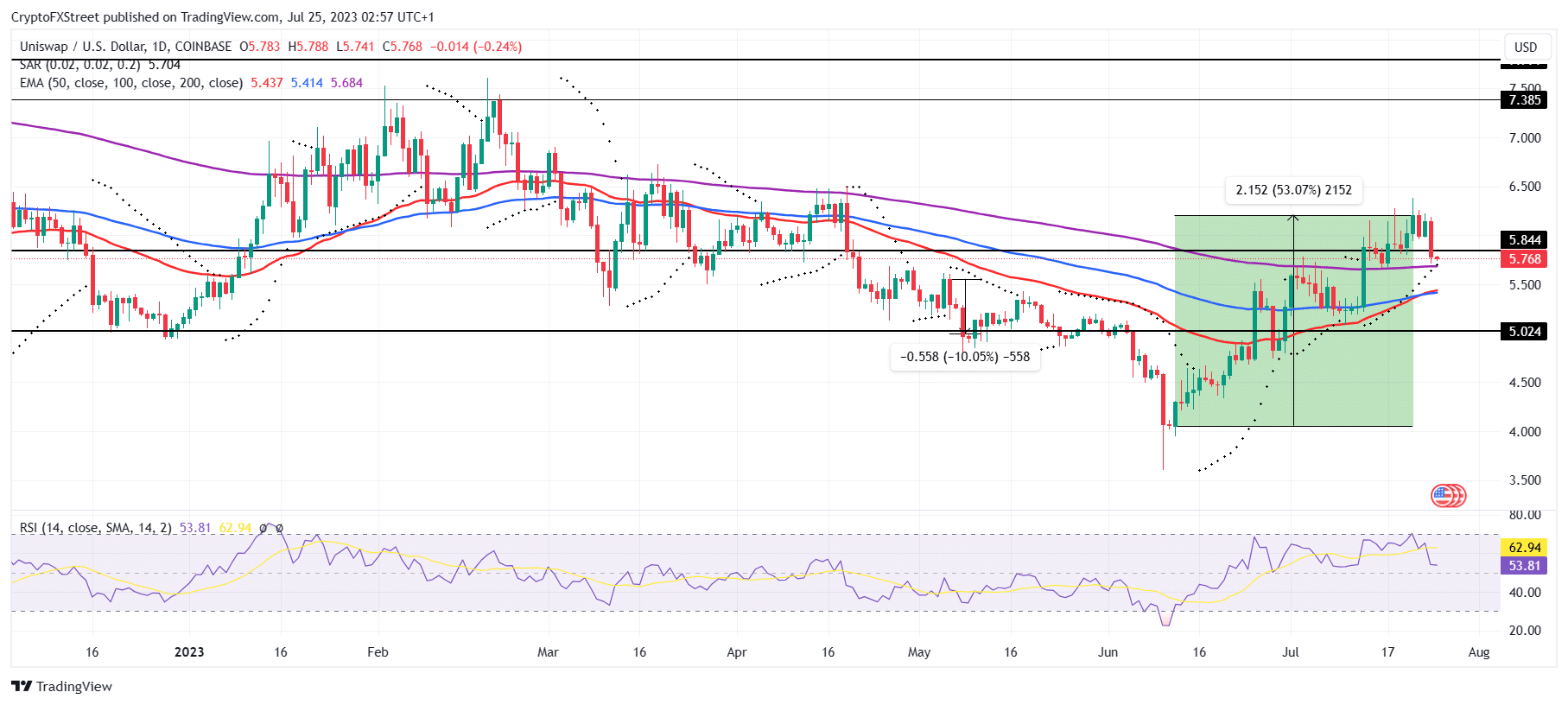

Uniswap price could be seen trading at $5.76 after noting a 6% decline in the last 24 hours. The correction came about a month and a half since the rally started, during which UNI managed to rise by more than 53%. But now that the green candlesticks might be taking a break from appearing, it comes down to the investors to prevent a sudden decline.

UNI/USD 1-day chart

Generally, following periods of increases, investors tend to take profits to secure the gains they achieved on their holdings. This is possible only through selling, which in turn leads to declines since it negatively affects the demand-supply dynamics. Consequently, the price falls and erases part of the rally observed earlier.

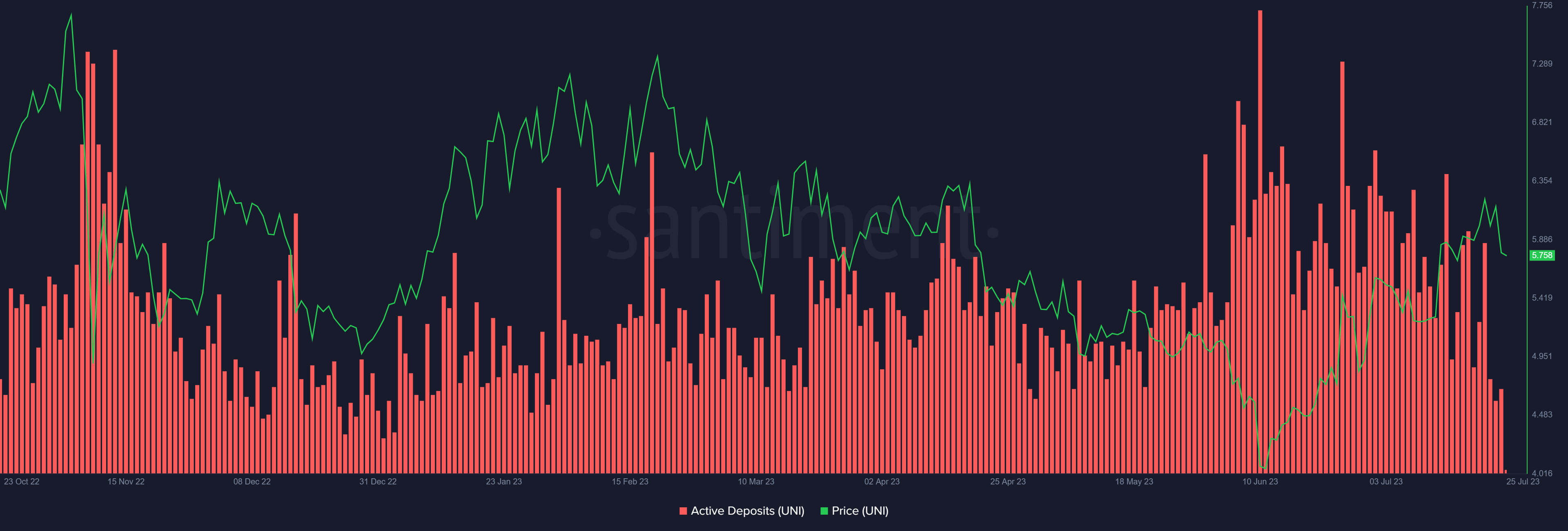

However, Uniswap investors are not likely to follow this path as they have already pulled back on selling. This is observed using active deposits, which measure the transfer of assets from the investors’ wallets to the exchanges’ wallets. In fact, UNI holders have held back to the extent that active deposits have declined to a six-month low in January this year.

Uniswap active deposits

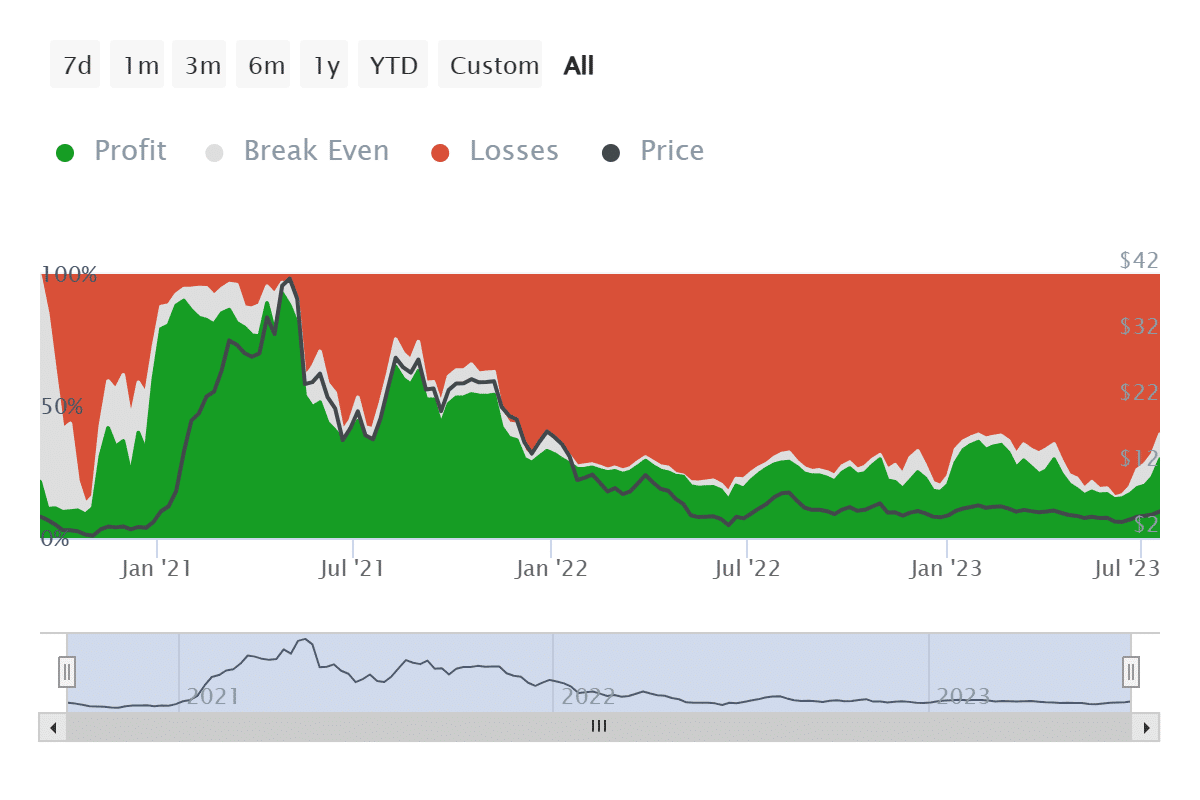

This is justified since, in complete fairness, most of the investors that seem to have made gains have not actually secured their profits yet. Between mid-June and the time of writing, the percentage of investors at a loss declined by 23%, but the percentage of those noting profits rose by only 14%.

Uniswap investors at loss and profits

This means that about 9.5% of the investors are still only breaking even as they shed their status of “being at a loss”. However, they are yet to join the league of investors enjoying profits, and that would happen only if the price rises further.

To support the same, UNI holders will refrain from selling, potentially triggering an uptick in the coming weeks.

Like this article? Help us with some feedback by answering this survey: