- Bitcoin price consolidation could resolve into a short-term correction to $27,330.

- Ethereum price sell signal triggers an initial downtrend but bears target $1,767.

- Ripple price eyes a retest of stable support levels at $0.433 and $0.413.

Bitcoin (BTC) price continues to move sideways in a tight range with no resolution. However, a closer look at the price action suggests that a steep correction could be on its way. If bears are successful, Ethereum (ETH) and Ripple (XRP) could be in trouble as well.

Also read: Bitcoin ETFs are not a winner take all, experts say, as influence on crypto exhausts

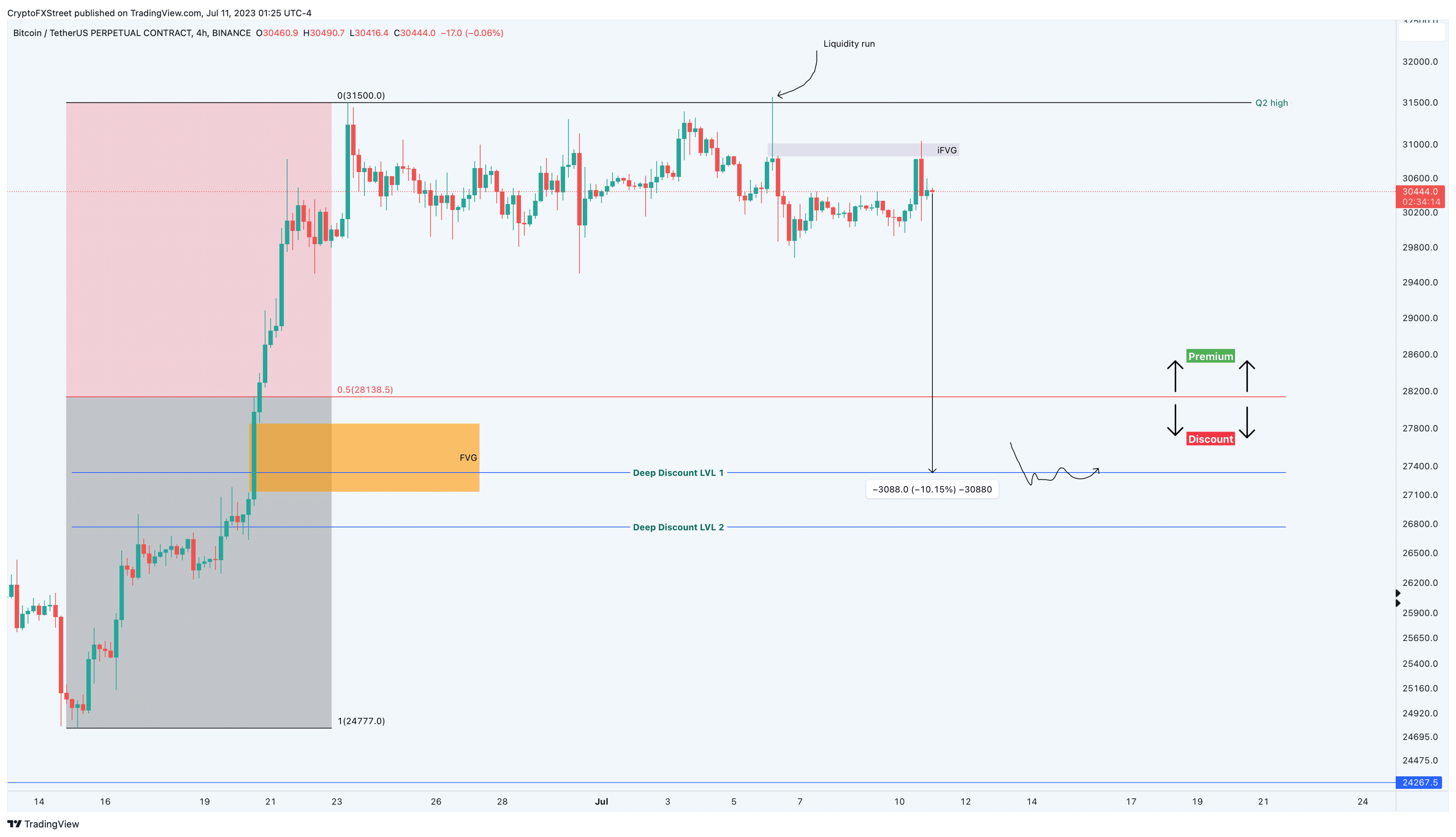

Bitcoin price ready to shed weight

Bitcoin (BTC) price shot up 27% from $24,777 on June 15 to set up a local top at $31,500 on June 23. As the third quarter takes off, BTC swept the $31,500 level for buy-stop liquidity and set up a new high at $31,568. It has since shed 3.65%.

Currently, Bitcoin price trades at $30,438 and could end its two-week consolidation with a downward breakout that drives BTC into deep discount mode. The midpoint of the 27% ascent at $28,138 is equilibrium. Any move below this level would technically place BTC at a discount for buyers.

Likewise, the $27,330 and $26,767 are two deep discount levels where sidelined buyers could step in. Hence, bears could consider booking profits after a 10% and/or 12% descent from the current position.

BTC/USD 4-hour chart

On the other hand, if Bitcoin price flips the second-quarter high at $31,500 into a stable support floor, it would invalidate the bearish thesis. In such a case, BTC could attempt a rally to the $35,000 and $36,000 levels.

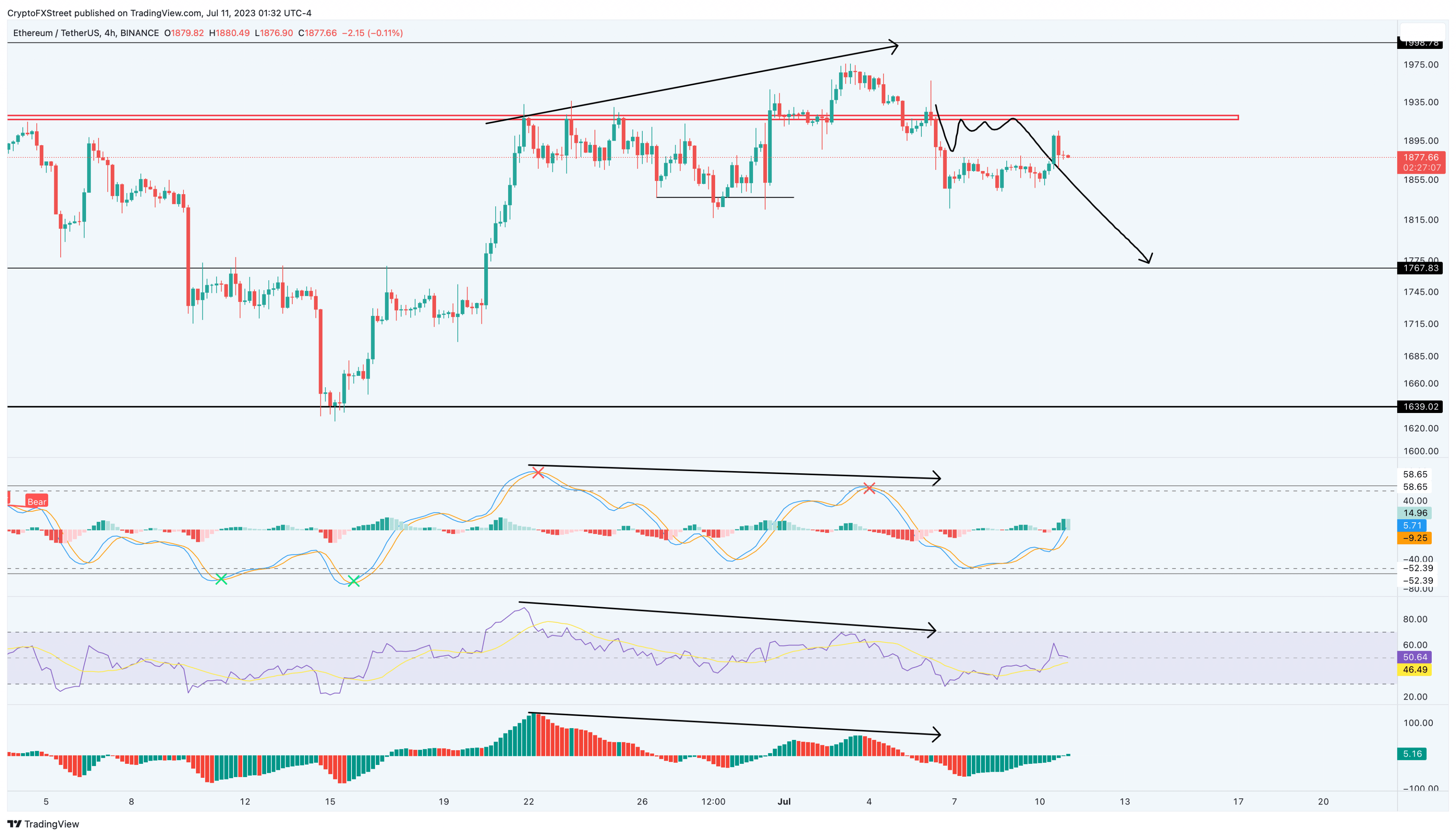

Ethereum price continues to descend

Ethereum (ETH) price created a bearish divergence setup above the four-hour time frame. The resolution of this technical formation led to a 7.6% downtrend between July 3 and 6. Since then, ETH has recovered and currently trades at $1,877.

If bulls fail to take control of Ethereum price, it could lead to a nearly 6% downswing that retests the $1,767 support level.

ETH/USD 4-hour chart

While the bearish outlook for Ethereum (ETH) price makes logical sense, bulls need to retake the 1,921 hurdle. A flip of this level into a support floor would invalidate the pessimistic outlook. Such a development would see ETH revisit the $2,000 psychological level and attempt a retest of the $2,700 critical hurdle.

Ripple price stagnates between key levels

Ripple (XRP) price has been ranging between two critical barriers at $0.548 and $0.413 for nearly four months. The recent retest of the range high has led to a 10% downtrend, where XRP price currently trades at $0.476.

If bears continue their rampage, Ripple price could retest the $0.433 and $0.413 support floors.

XRP/USD 1-day chart

Regardless of where Ripple price is currently trading, if Bitcoin price rips higher, the chances for XRP bulls will improve vastly. In such a case, if XRP price manages to turn the $0.548 hurdle into a support floor, it will invalidate the bearish thesis. This development could potentially push the remittance token higher and tag the $0.774 barrier.

Read more: XRP holders want to write letters to Judge Torres, lawyer says no good can come from it

Like this article? Help us with some feedback by answering this survey: