- Bitcoin price remains promising into the new week, toned by a modest foray above $31,000.

- Ethereum price eyes the zone above $2,000 as correlation with the flagship crypto continues.

- Ripple price eyes a deepening correction unless buyer momentum raises XRP above $0.491.

Bitcoin (BTC) price saw a spurt in buying pressure on July 3, which pushed it to $31,395, but the lack of momentum caused a retracement of the move. As a result, altcoins, including Ethereum (ETH) and Ripple (XRP) have remained lull. Additionally, the lack of a proper catalyst has sapped crypto traders’ optimism.

Also Read: Will Bitcoin price face negative effects from Federal Reserve’s two rate hikes?

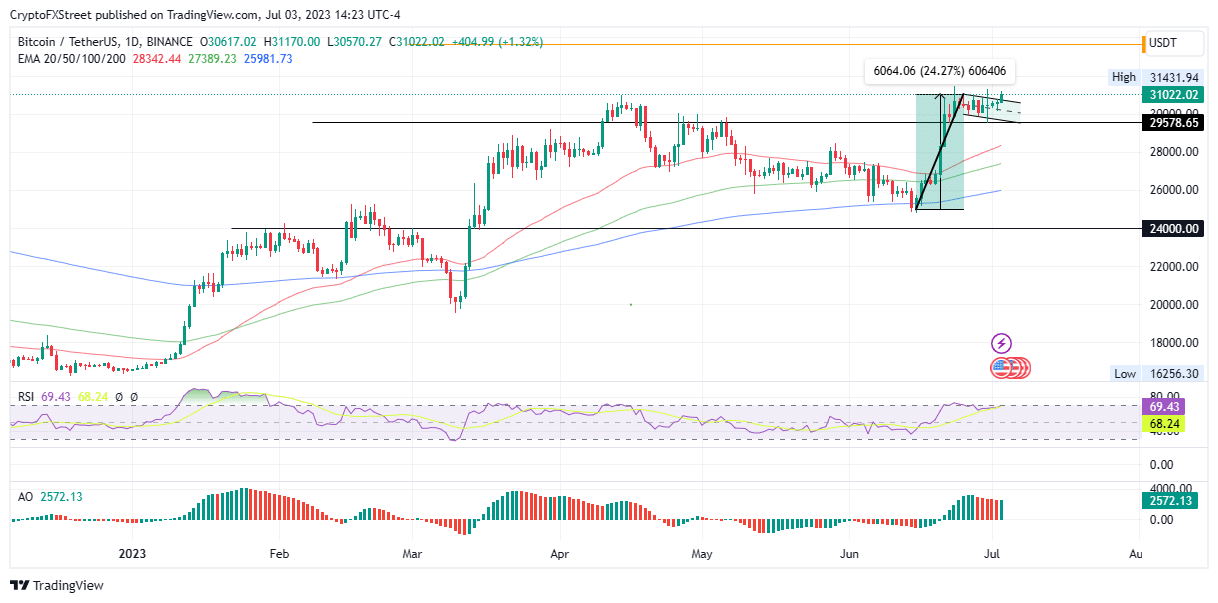

Bitcoin price makes a modest foray above $31,000

Bitcoin (BTC) price is trading with a bullish bias, up almost 5% since the new week started. The king of crypto has taken a subtle step above the $31,000 level, pointing to a growing buying activity after the start of the third quarter. The price action since June 15 has led to the appearance of a bullish flag pattern.

The pattern is resolved considering that Bitcoin price broke out of the flag formation in the direction of the prevailing trend, which is bullish. A decisive break above the June 23 high of $31,458, however, would provide cast-iron confirmation of the pattern’s activation. Decisive would mean a long green candle breaking above the confirmation level and then closing near its high or a break by three green candles in a row.

The target of the flag is estimated by measuring the length of the pole and extending it in the direction of the breakout. A common stop level is just outside the flag on the opposite side of the breakout.

Based on this estimation, Bitcoin price could rally 24% in the long term toward the $40,000 level. Meanwhile, experts anticipate a strong upward trend, with conservative investors speculating a breach of the $35,000 area. Another possible target lies at $33,650, the 61.8% extrapolation of the flagpole higher.

Optimism is bolstered by a positive assessment of the probabilities that the major financial institutions seeking regulatory approval for a Bitcoin Exchange Traded Fund (ETF).

will be successful, according to $650 billion asset manager Bernstein, who said the US SEC will likely approve a spot Bitcoin, in a recent note.

BTC/USDT 1-Day Chart

Conversely, early profit-taking could cut the rally short, sending Bitcoin price back into the fold of the flag pattern. In a dire case, BTC could lose the support offered by the lower boundary of the flag at $29,578 before a possible trend reversal.

Also Read: Bitcoin options strategy: How to trade July’s Q2 earnings

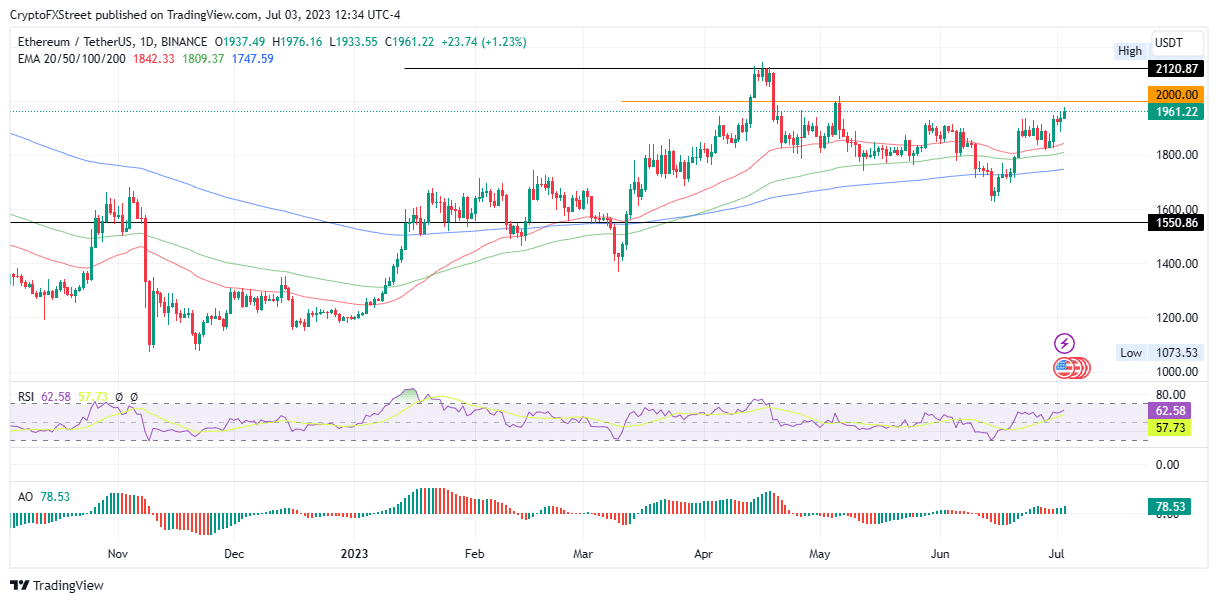

Ethereum price eyes $2,000 amid positive correlation with BTC

Ethereum (ETH) price is on a course north, joyriding the Bitcoin rally. A sustained uptrend could see the largest altcoin by market capitalization cross into the $2,000 zone. The PoS token is up almost 10% from the June 29 correction, with signs of a continued ascent as technical indicators communicate optimism.

The Relative Strength Index (RSI) faces north, suggesting rising momentum. Similarly, the Awesome Oscillators (AO) are above the midline with deep green histograms, further adding credence to the upside.

An increase in buying pressure from the current level could see the Ethereum price rise around 2%, crossing into the $2,000 zone. In a highly bullish case, ETH could reprint the mid-April highs around $2,120, denoting a 7.95% ascent from the current price.

ETH/USDT 1-Day Chart

Conversely, a rejection from the $2,000 level could send Ethereum price back to the 50- and 100-day EMA at $1,842 or $1,809, respectively. In the dire case, ETH could tag the 200-day EMA at $1,747, constituting a 10% downswing.

Also Read: Ethereum eyes $2,000 target as institutional investors pour capital into ETH funds

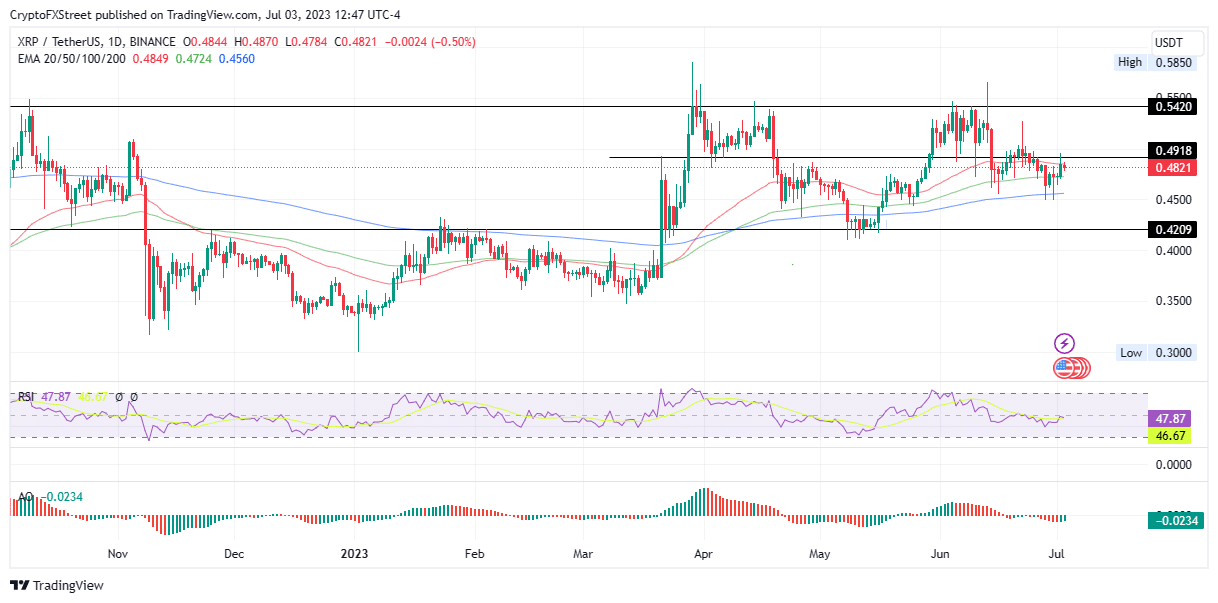

Ripple price could breach $0.491 unless buying momentum wanes

Ripple (XRP) price has regained momentum after a successful flip above the 50-day EMA at $0.485. The remittance token is up around 5% since the beginning of the new month as bulls push to breach the $0.491 resistance level.

An increase in buying pressure could facilitate the 0.61% climb, clearing the hurdle for the remittance token’s foray above $0.500. A sustained bullish momentum could propel XRP up 10% from the current level to tag the $0.542 hurdle.

This optimistic outlook draws support from the up-moving RSI and green-flashing AO histograms, suggesting increasing buying activity among XRP bulls.

XRP/USDT 1-Day Chart

On the other hand, day traders looking to make a quick profit could interrupt the rally by selling XRP at its current market value. The ensuing selling pressure could send Ripple price back under the foothold of the 100-day EMA at $0.472 or lower, below the 200-day EMA at $0.456.

Failure by the bulls to leverage these buyer congestion zones could see Ripple price head lower, breaking below $0.450 and approaching the $0.420 support level.

Notice that the AO is still negative while the RSI is under 50, suggesting bears still have a grip on XRP.

Also Read: Pro-XRP attorney John Deaton says SEC Chairman Gary Gensler could resign

Like this article? Help us with some feedback by answering this survey: