The lack of substantial price movements for Bitcoin continue through the entire weekend, as the asset failed to deviate from its $43,000 level.

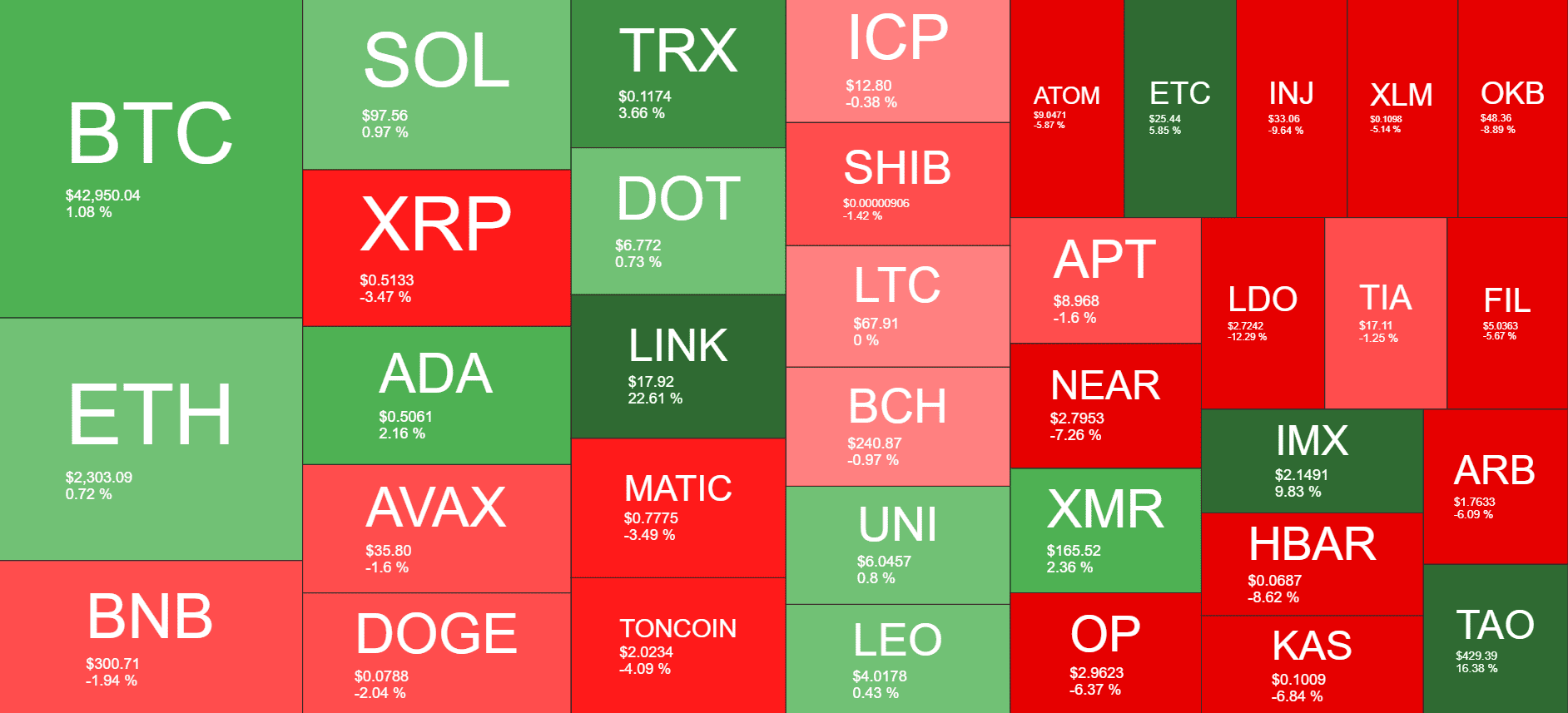

The alternative coins are also untypically stable, with minor losses from the likes of ADA, DOT, LINK, MATIC, and SOL.

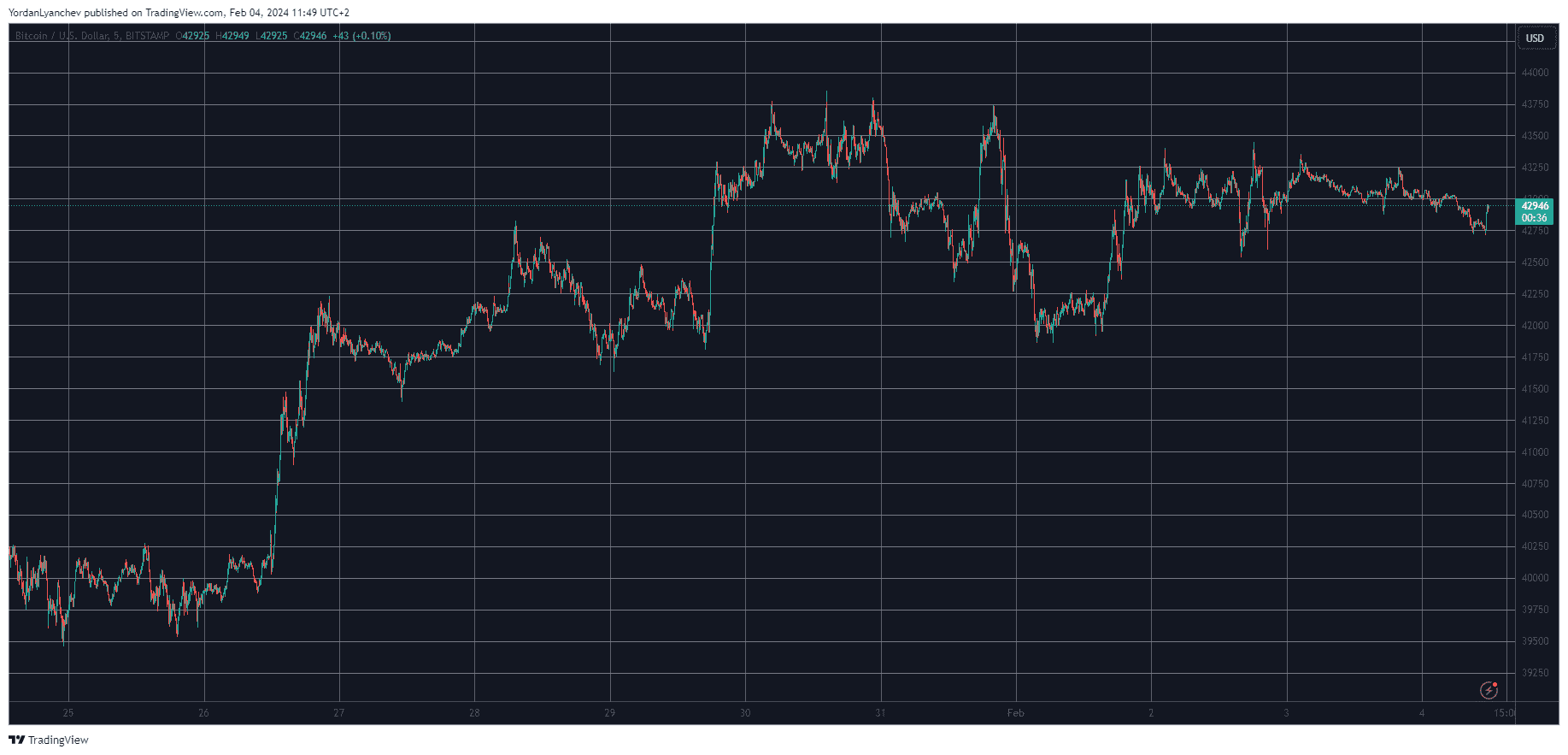

BTC Stagnates at $43K

The primary cryptocurrency bounced off last Thursday from the post-ETF approvals decline that pushed it south by over ten grand in weeks. Following that massive drop to $38,500, the asset went on the offensive and quickly jumped to $40,000 during the previous weekend.

The business week started on an even more impressive note, as BTC began climbing on Monday and saw itself surging toward $44,000 on Tuesday and Wednesday. However, it failed to continue upward, and the bears drove it south to $42,000 on Thursday after the US Fed Chair said there will be no changes in the central bank’s monetary policy.

Bitcoin recovered some ground on Friday but failed to overcome $43,000 decisively. Since then, the asset has been predominantly calm at around that level and sits there now as well.

Its market capitalization remains inches above $840 billion, and its dominance over the alts is at 51.2% on CMC.

This Week’s Most Notable Performers

The alternative coins have produced little movement over the past day, with SOL, MATIC, ADA, and DOT trading slightly in the red. The weekly scale is quite similar for most.

Ripple, Avalanche, Binance Coin, Dogecoin, MATIC, and Toncoin have declined by 2-3% within the past week. In contrast, ETH, SOL, ADA, TRX, and DOT are with insignificant gains.

Chainlink has stolen the show within the past seven days, having soared by 22%. As a result, LINK now trades close to $18. Other impressive weekly performers include FLR (36%), PENDLE (21%), and PYTH (17%).

On the other hand, JUP has slumped the most (65%), followed by MANTA (-25%), 1000SATS (-18%), BONK (-17%), and LDO (-13%).

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.