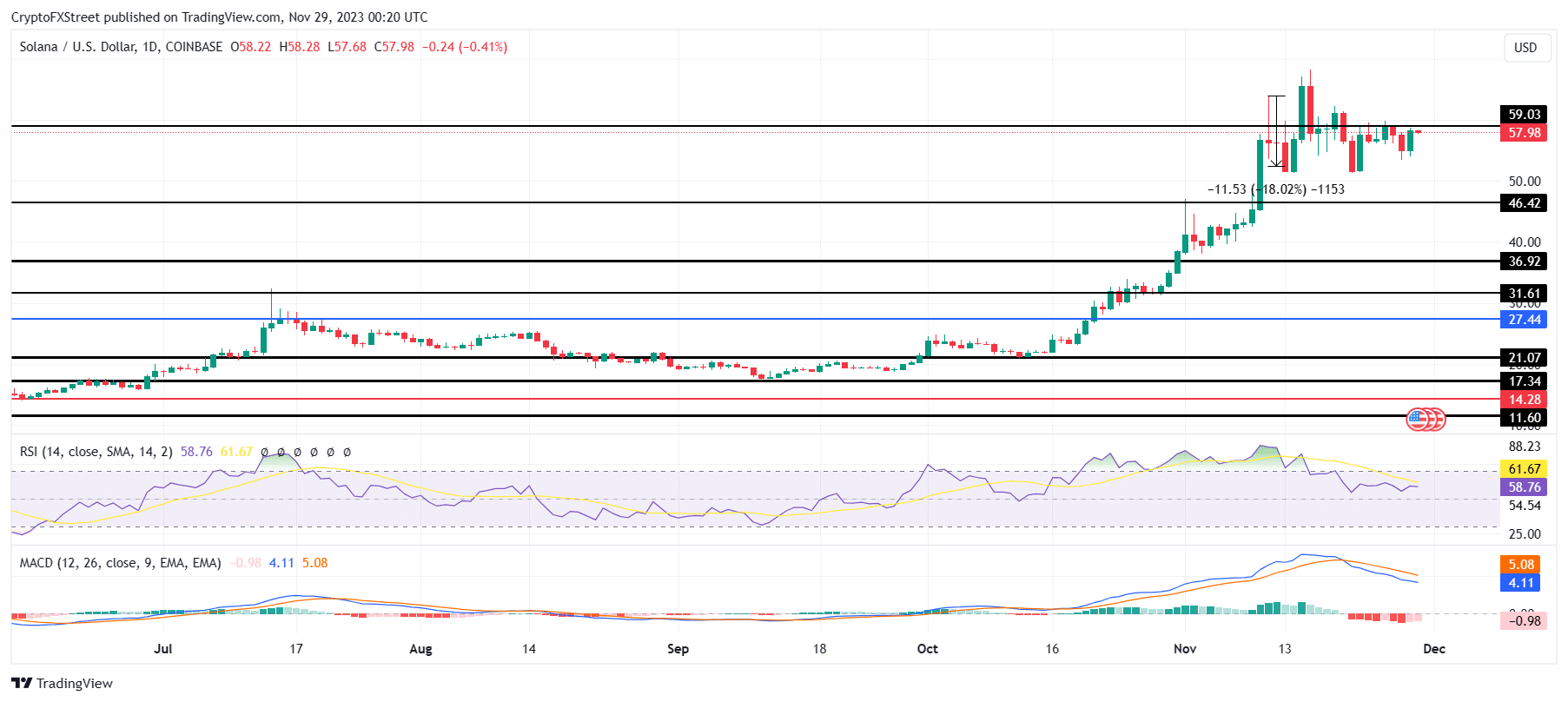

- Solana price trading at $58 is presently attempting to breach through the resistance level marked at $59.

- A rally is possible, given that SOL is witnessing a resurgence in bullishness.

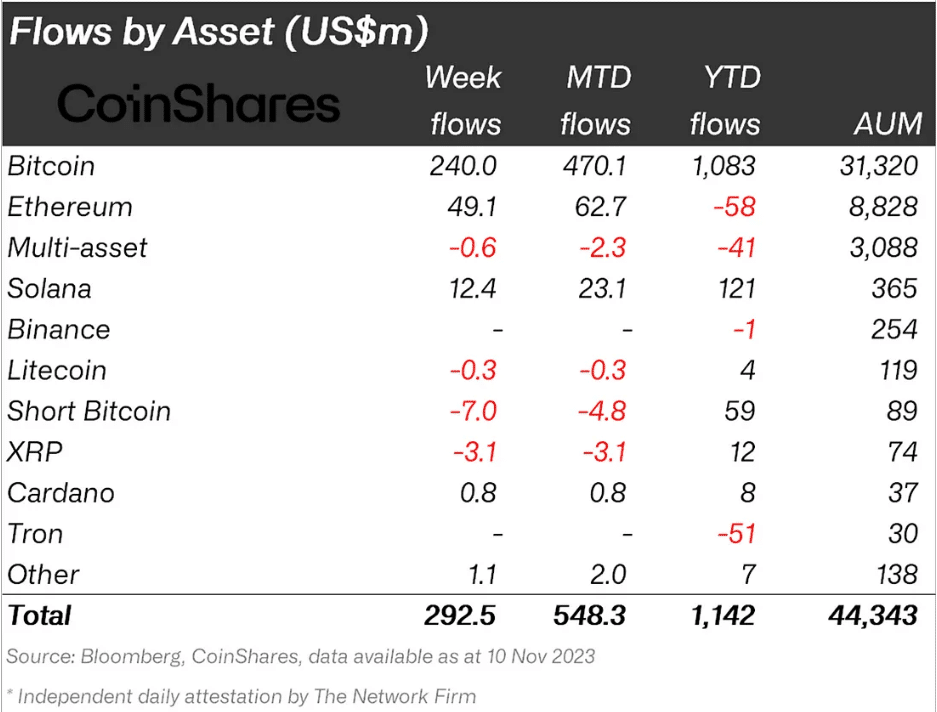

- Month to date, Solana has witnessed inflows worth $40.2 million, nearly half of what Ethereum has managed to.

Solana price has consistently impressed investors this past year with continued growth. This sentiment has been shared by institutions as well, who have made SOL their most preferred altcoin.

Solana finds institutional backing

Solana has seen inflows worth nearly $3.5 million in the week ending November 24. While this may not seem like much, it is significantly more than the rest of the altcoins’ inflows combined. This $3.5 million was also added to the monthly flows, bringing the month-to-date inflows to $40.2 million.

In comparison, Ethereum noted about $99.6 million worth of inflows in the same time period, making Solana nearly half of the home of DeFi. the other altcoins do not even come close in this regard, with Litecoin noting outflows worth $0.6 million and Ripple (XRP) observing $2.4 million worth of outflows. Only Cardano has noted inflows other than SOL amounting to $2.1 million.

Solana institutional inflows

This shows that when it comes to institutions, Solana is presently the best-performing altcoin with the potential of a long-term rally much higher than other cryptocurrencies.

Solana price at a crucial resistance

Solana price is trading at $57 at the time of writing, testing the barrier marked at $59. This line has been tested as a resistance for a while now. If this line is flipped into a support floor, SOL would be able to rise beyond $60 and mark fresh 2023 highs.

The price indicators are showing potential for an increase, with the Relative Strength Index (RSI) sitting above the neutral line in the bullish zone. Furthermore, the Moving Average Convergence Divergence (MACD) indicators also note receding red bars, suggesting waning bearishness. If the bars flip above the neutral line and observe a bullish crossover, an uptrend momentum would be confirmed.

SOL/USD 1-day chart

However, if the breach fails and bearish momentum picks up, Solana price would positively decline. This would send the altcoin towards $50 and test the support at $46. Losing this line would invalidate the bullish thesis, resulting in a dip to $40.