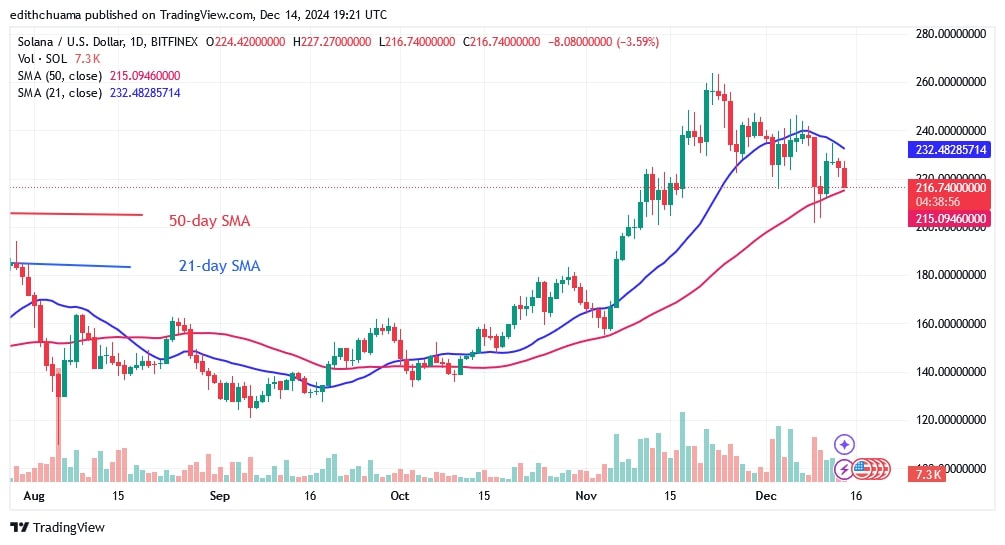

The price of Solana (SOL) has fallen between the moving average lines since December 2nd. Latest price analysis by Coinidol.com.

Long-term forecast for the Solana price: bearish

The price of Solana has been trapped within the moving average lines over the past week. In terms of price possession, neither the bulls nor the bears have a clear advantage. The bulls failed to push the price above the resistance at $240 and the 21-day SMA.

The bears pushed the price below the 5-day SMA, but the bulls bought the dips. Currently, the price is between the moving average lines. Once the moving average lines align, Solana will develop a trend. However, based on the price indication, Solana will drop below the 50-day SMA and to a bottom above $171.

Solana price indicator analysis

Solana has been trading between the moving average lines for more than a week. Neither the bulls nor the bears have been able to break through the moving average lines. Interestingly, the altcoin will move when the moving average lines are broken. A long candlestick tail signals strong buying pressure at lower price levels. The 4-hour chart shows that the moving average is sloping downwards, indicating a decline.

Technical indicators

Key supply zones: $220, $240, $260

Key demand zones: $140, $120, $100

What is the next move for Solana?

Solana has continued its downtrend. The price of the cryptocurrency is forming a series of lower highs and lower lows. Currently, the decline has stalled and the altcoin has initiated a move between $205 and resistance at $230. The uptrend will start when the price rises above the moving average lines and resistance at $240.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.