- Ripple price continues to hold above the 50-day SMA at $0.5897, as community members anticipate a move soon.

- XRP must break and close above the $0.6873 level to confirm the continuation of the uptrend.

- The main narrative at play is the SEC’s meeting amid speculation that its theme is Ripple case settlement.

Ripple (XRP) price could close the month of November in style and usher in December on a high note, depending on what November 30 brings. Currently, all eyes remain peeled on the US Securities and Exchange Commission (SEC), with the financial regulator expected to hold a closed-door meeting on Thursday. Amid rumors of a settlement, such an outcome could see Ripple price jump.

Also Read: XRP price stuck under $0.65 despite Bitcoin hitting $38,000 three times in one week

Ripple at an inflection point as MicroStrategy buys nearly $600 million worth of Bitcoin

Ripple (XRP) price lacks directional bias even as Bitcoin (BTC) price remains shy of $40,000. It could be a make-or-break moment for either of them depending on how the bulls play their hand. For Ripple, however, there remains speculative hope as the US Securities & Exchange Commission (SEC) is holding a closed-door meeting with an unknown party. The absence of disclosure or clarity has many speculating that it could be a Ripple-SEC meet-up for the two to reach a settlement.

On the Bitcoin camp, recent revelations indicate that MicroStrategy has bought an additional 16,130 Bitcoins, worth approximately $593.3 million at current rates, at an average price of $36,785 per BTC.

This brings the firm’s total BTC holdings to 174,530, acquired for approximately $5.28 billion and at an average price of $30,252 per bitcoin.

The firm has also filed for up to $750 million at-the-market offering of stock that will be used to fund further BTC purchases.

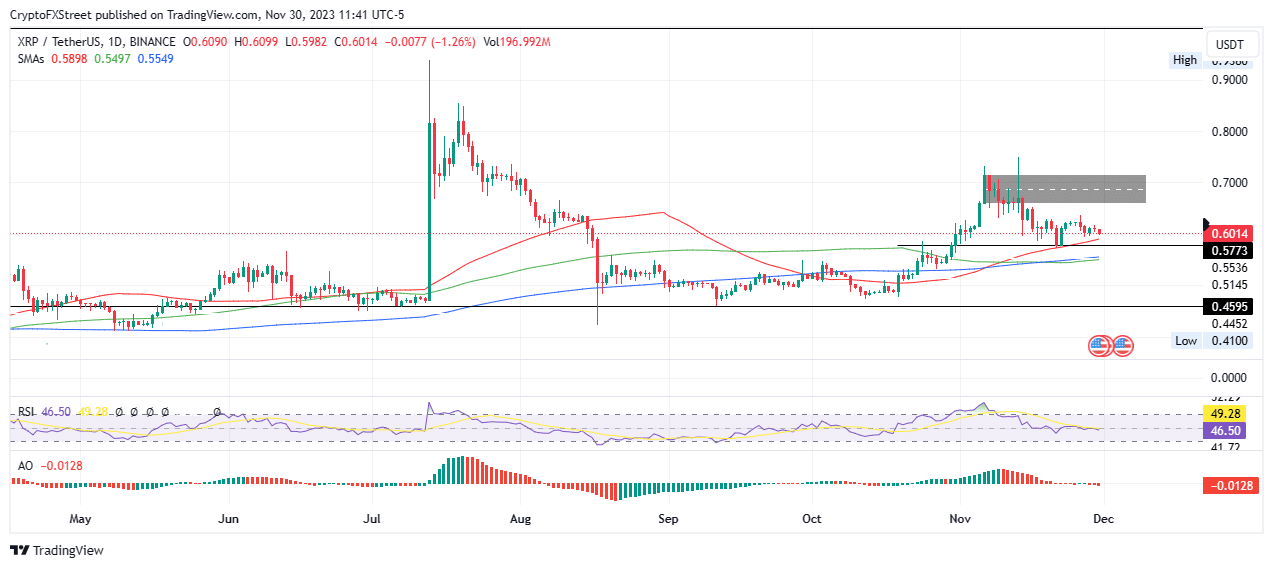

Ripple price consolidates near 50-day SMA

Ripple price is coiling up for its next move as it sits above the support offered by the 50-day Simple Moving Average (SMA) at $0.6005. The Relative Strength Index (RSI) is inclined south, showing that momentum is falling. This is bearish, especially when the Awesome Oscillator (AO) hints at the same with its histogram bars soaked red and in negative territory.

With the bears maintaining a solid grip on Ripple price, XRP could extend the fall, breaking below the 50-day SMA support before confronting the $0.5773 support level. If that level fails to hold the sell-off could extrapolate to test the 100 and 200-day SMAs at $0.5549 and $0.5496, respectively.

XRP/USDT 1-day chart

On the flip side, Ripple price could pull north, reaching for the supply barrier ranging from $0.6572 to $0.7161. For a confirmation of the intermediate trend, the XRP price must break and close above the midline at $0.6873. A break and close above this barricade could set the tone for XRP market value to reach $0.8000 in a move that would constitute a 30% climb above current levels.

-module-container”>

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.