- Optimism price has risen from $1.09 to trade at $1.68 over the past six weeks.

- The addresses holding 100,000 to 1 million OP sold over 5 million OP in the last 24 hours, resulting in a 6.5% decline.

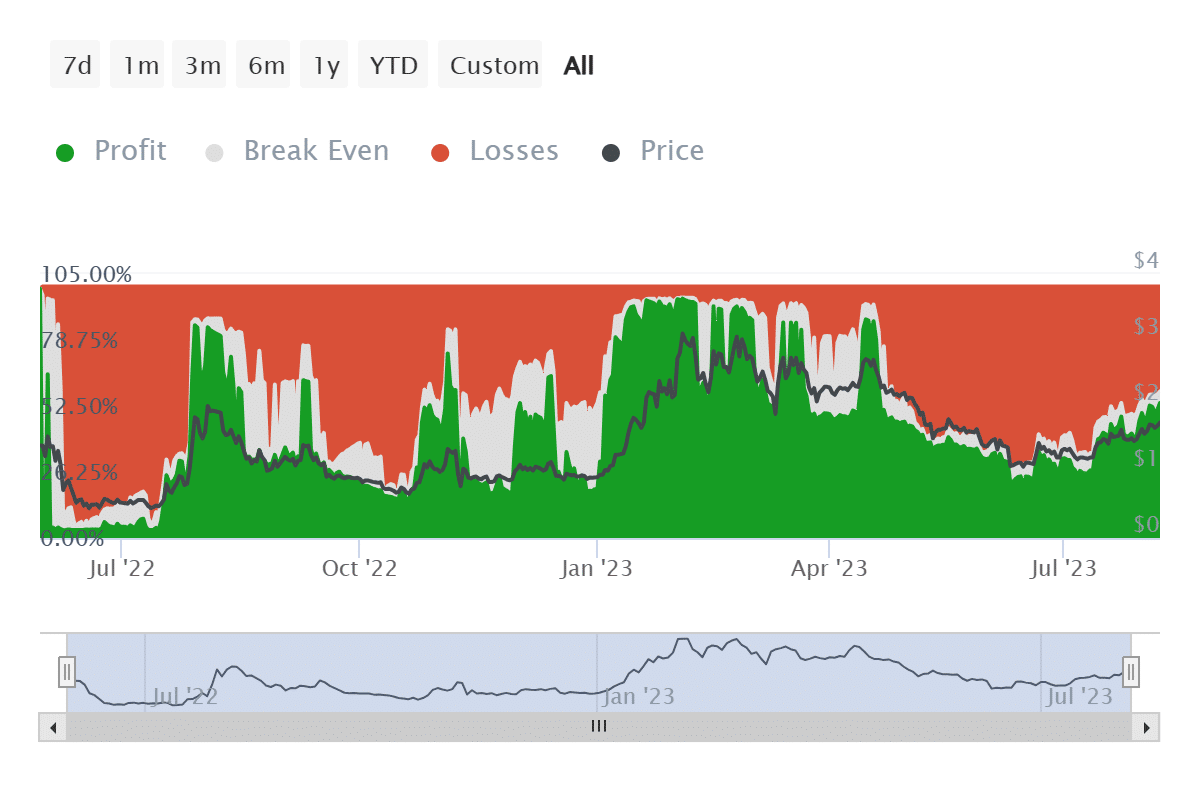

- Profit-taking might be more frequent in the case of Optimism, as nearly 25% of the investors are experiencing profits for the first time in four months.

Optimism price took a hit this week after charting significant gains owing to the investors’ want for profits. In fairness, OP holders have been patiently waiting to make money on their investment that has paid off successfully.

Optimism price rise brings gains

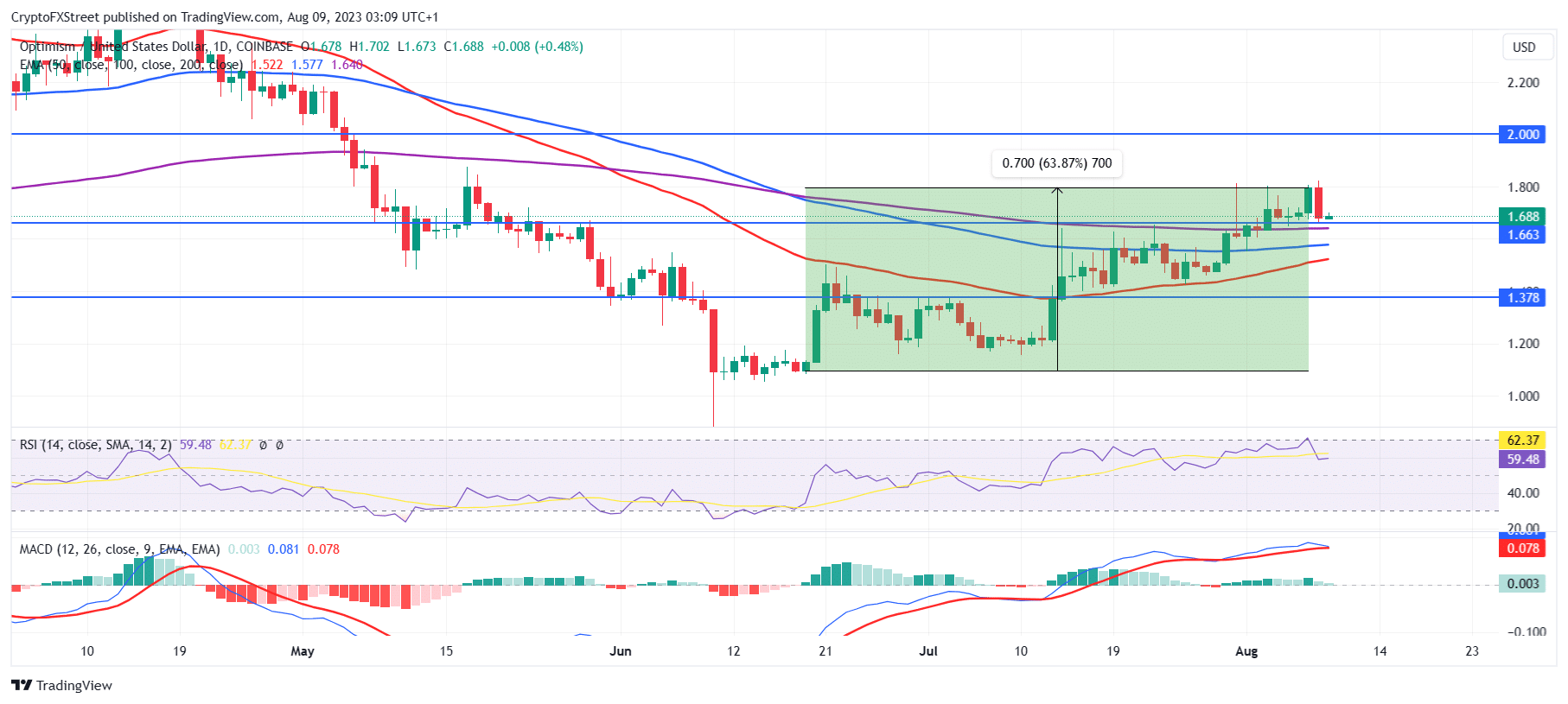

Optimism price noted a 6.5% drop on Tuesday as investors moved to offload their holdings to make money. This resulted in the token falling back to testing the support line at $1.663, which OP last bounced off from three months ago in May. Price indicators are also suggesting a potential bearish outlook going forward.

The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover as the signal line (red) is close to crossing over the MACD line (blue). The histogram also suggests waning bullishness with the receding green bars. Similarly, the Relative Strength Index (RSI) is also trending downwards toward the neutral line at 50.0 after hitting the overbought zone above 70.0.

OP/USD 1-day chart

This also coincided with investors opting to book profits on their investment, which was noted in the change in the supply held by a particular cohort. The addresses holding between 100,000 OP to 1 million OP sold about 5 million OP in the span of a day, bringing their holdings down from 100 million OP to 95 million OP.

Optimism investors’ supply

Some selling was bound to take place eventually as investors have been patiently waiting to make money on their investment. Over the past month and a half, the total concentration of investors in profit has risen from 25% to 53%, doubling, thanks to the 63% rally.

Optimism investors in profit

This is the most profits experienced by OP holders in about four months now, making their selling a valid move. Going forward, more profit-taking can be the course of action as investors would opt to exit before further decline takes place.

Like this article? Help us with some feedback by answering this survey: