The first week of November 2024 will surely go down in crypto history. Up until this point, we saw multiple institutions, asset managers, and even smaller countries endorse Bitcoin. We have the likes of BlackRock, Fidelity, VanEck, multiple billionaires, celebrities, and countless others show their support for the cryptocurrency industry.

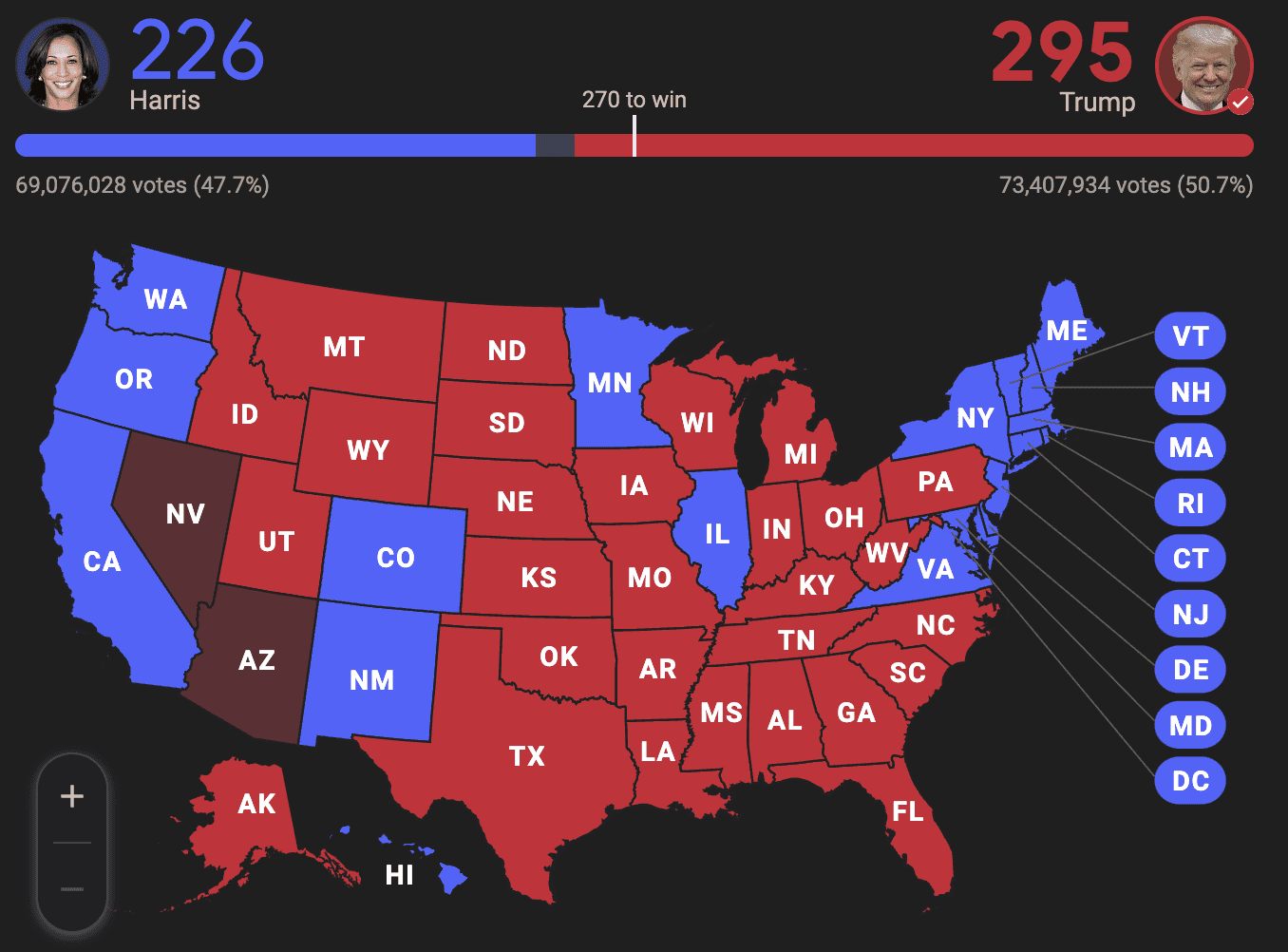

But on November 5th, the people of the United States made their choice as to who would run the country for the next four years, and that person was Donald Trump. Now, this election marked a bunch of “firsts,” but perhaps what’s most important for the crypto industry is that Trump will be the very first president of the United States who is both pro-crypto and pro-Bitcoin. And that’s important.

Throughout his election campaign, he was incredibly vocal about his support for the industry, making a few critical promises. The one that would likely carry the biggest implications for the broader crypto field, however, is his vow to fire the current Chairman of the United States Securities and Exchange Commission. To understand why this matters, you should know that the SEC, under Gensler, has filed over 100 lawsuits against crypto-focused companies such as Coinbase, Kraken, Binance, and countless others.

What this means is that the current regime instilled by the Biden administration pretty much waged a war on crypto. Companies within the US and abroad were under constant pressure of prosecution, hindering their reach and prospects. Will all of this change under Trump? We have yet to see, but putting someone knowledgeable and willing to craft meaningful regulations and engage in conversations with industry leaders while keeping the best interest of individual investors would be a breath of fresh air – that’s for sure.

Trump also said that they will create a strategic national Bitcoin stockpile, promising to keep 100% of the BTC that the United States acquires while also trying to keep BTC mining domestically. This is also incredibly important. It’s one thing for smaller economies like El Salvador to embrace Bitcoin. It’s a whole different ball game for the world’s largest one to endorse it in a meaningful way.

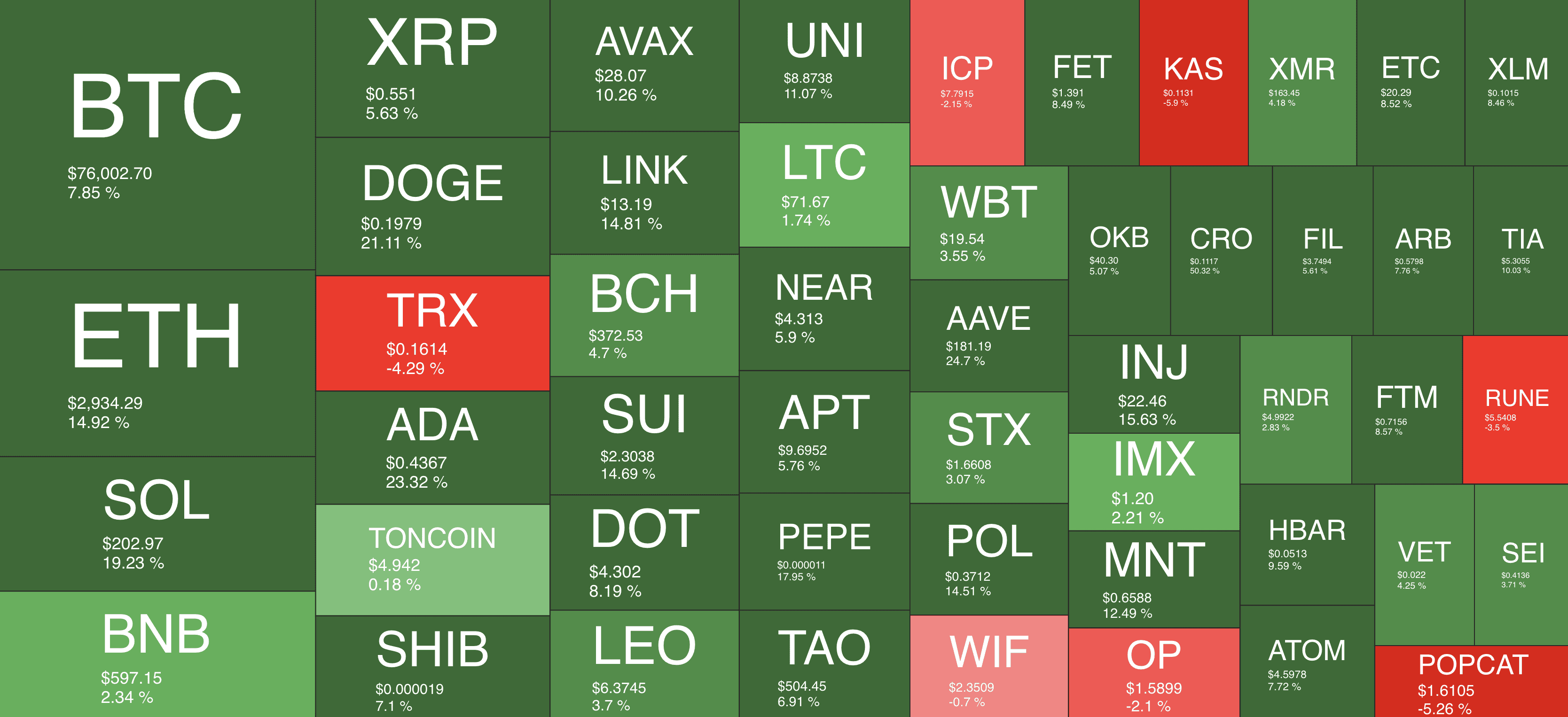

The markets reacted very positively to the news of his election, and it’s interesting to see whether or not this momentum will carry through his inauguration on January 20th. Both Biden and Harris have publicly stated that the transfer of power in the administration will be peaceful, so barring any surprises, the tailwinds for the industry are apparent.

Of course, it’s now a matter of “if” Trump will keep his promises. However, during his election campaign, he accepted millions of donations in crypto from industry companies and leaders. If one thing is certain, it’s that the entire community is now looking forward to him honoring his word.

The entire cryptocurrency market is surging, with altcoins popping left and right. Many analysts have already called this the start of a prolonged bull market, but we have yet to see how things will pan out.

The industry has never been in a better position, at least in theory, so stay tuned and we will keep you updated, as always!

Market Data

Market Cap: $2.69T | 24H Vol: $172B | BTC Dominance: 55.8%

BTC: $76,176 (+8.5%) | ETH: $2,943 ( +16.2% ) | BNB: $598 (+3.2)

This Week’s Crypto Headlines You Can’t Miss

US Presidential Elections 2024 Results: Donald Trump Declares Victory. Perhaps the most important development for the Western World this week became official on Wednesday when the US elected a new president for the next four years, Donald Trump. His inauguration will be on January 20, and here are some of the major promises he has made for the cryptocurrency industry.

Bitcoin Price Explodes to New All-Time High at $75,000. As Trump’s lead started to become evident during the early poll results, BTC began to gain traction. It skyrocketed past its March all-time high of $73,737 and charted a new peak of over $75,000.

BTC’s Rally Continued as Fed Cuts Interest Rates by 25 Basis Points. That was just the beginning of the historic week for bitcoin as the cryptocurrency’s rally continued, and it culminated at $76,800 (on Bitstamp) on Thursday evening. The latest high came after the US Federal Reserve cut the interest rates by another 25 basis points to 4.5%-4.75%.

Institutional Investors Are Back With Record $1.4B Bitcoin ETF Inflow. Investors had a cautious approach in terms of BTC ETF allocations ahead of the elections, but once the dust settled, they returned in full force. November 7 was a record-setting day, with nearly $1.4 billion in net inflows. BlackRock’s IBIT was at the forefront with over $1.1 billion alone.

Solana Tops BNB, Rises to Become 4th-Largest Crypto Asset By Market Value. Solana’s native token has been among the top performers since the Trump election. SOL is up by more than 21% on a weekly scale and trades at a multi-month peak of its own at just over $200. Moreover, it became the fourth-largest digital asset by market cap after it surpassed BNB.

Bitcoin Mining Difficulty Reaches New High at 101.6T. Ahead of BTC’s price surge to uncharted territory, the network’s robustness was displayed once again as the mining difficulty surged to an all-time high of over 101 trillion. The metric has increased by roughly 15% within the past month, solidifying the blockchain’s security.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.