- Litecoin price has been observing and suggesting a downtrend since the beginning of July.

- The ratio of active investors at the money versus those at a loss in the case of LTC is lower than that of Bitcoin.

- The declining prices might shake the investors as they are likely to face more losses unless the optimism surrounding the upcoming halving is high.

Litecoin had a spectacular run throughout the second half of June, but since the beginning of July, the same cannot be said. The series of red candlesticks continues to disappoint investors, but they still happen to be performing better than Bitcoin holders. This shred of optimism might keep them from making any rash move.

Litecoin price continues its downtrend

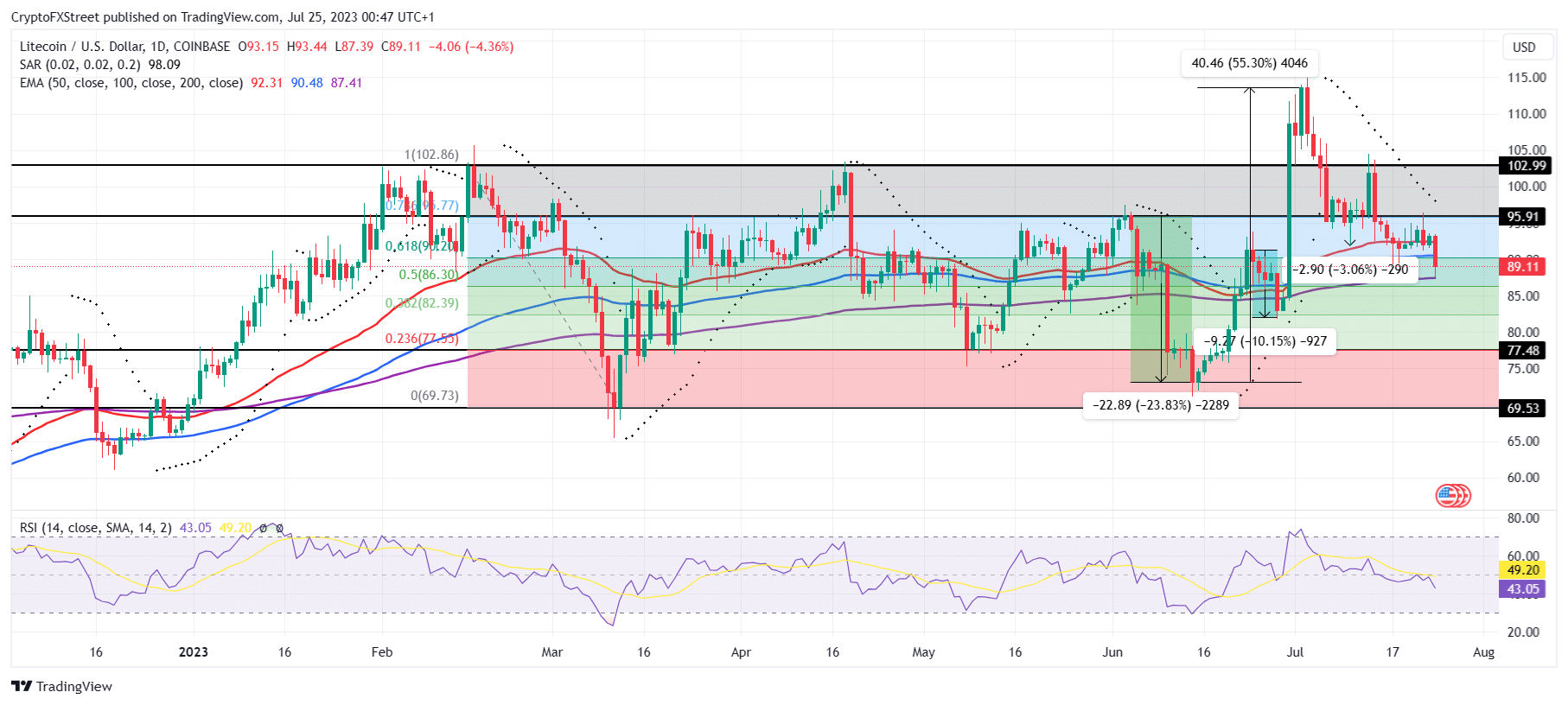

Litecoin price lost another crucial support level over the past 24 hours as the altcoin fell by more than 4% to trade at $88. The status of ‘silver’ to Bitcoin’s ‘gold’ has lost close to 22% since the beginning of the month, and the downtrend only seems to be intensifying. The Relative Strength Index (RSI) has lost the support of the neutral line at 50.0, which means that the altcoin is vulnerable to further losses.

LTC/USD 1-day chart

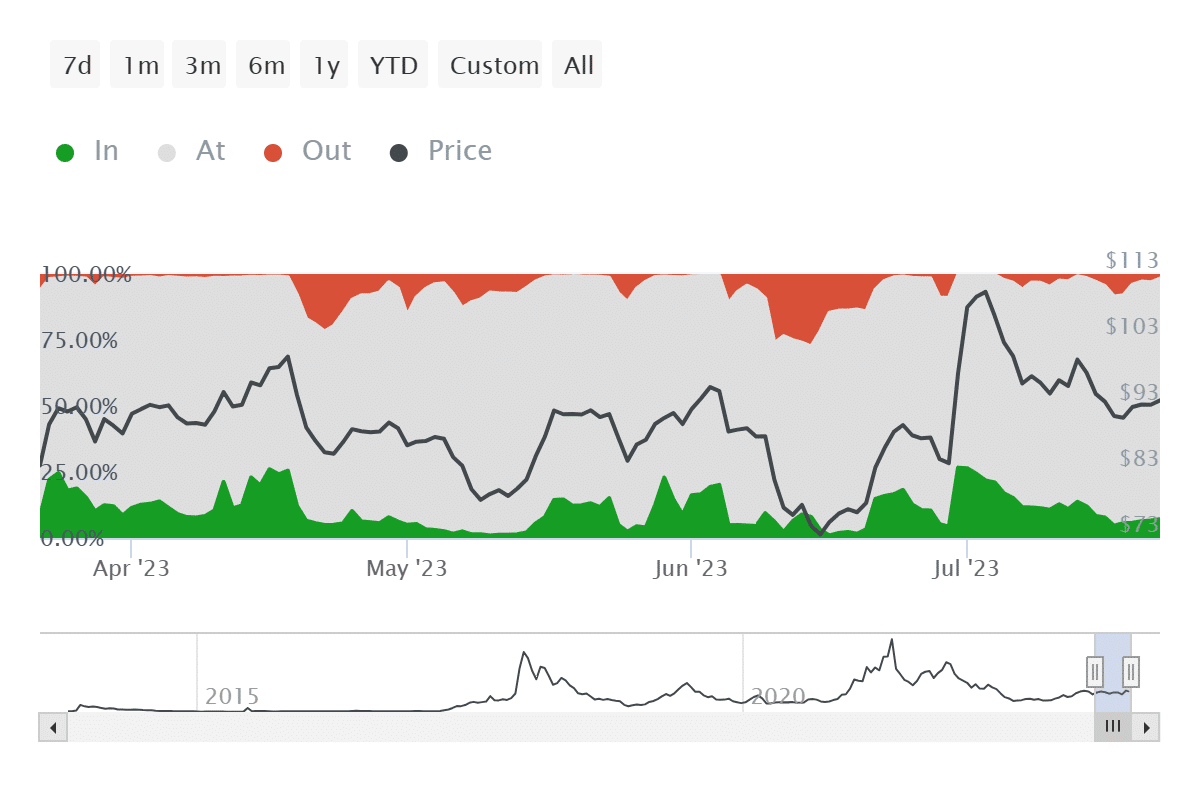

Bitcoin price, too, has declined, falling to $29,000 earlier this week but not as much as LTC did. This brought forward an interesting revelation. Despite a larger chunk of Litecoin investors being underwater, the ones who are present on the network making transactions are not facing significant losses.

According to the active addresses by profitability, the presence of investors who are contributing to the Litecoin network eclipses Bitcoin in terms of losses. About 91% of the active investors are at the money, which means they are breaking even, while only 1.75% of active addresses are at a loss.

Litecoin active addresses by profitability

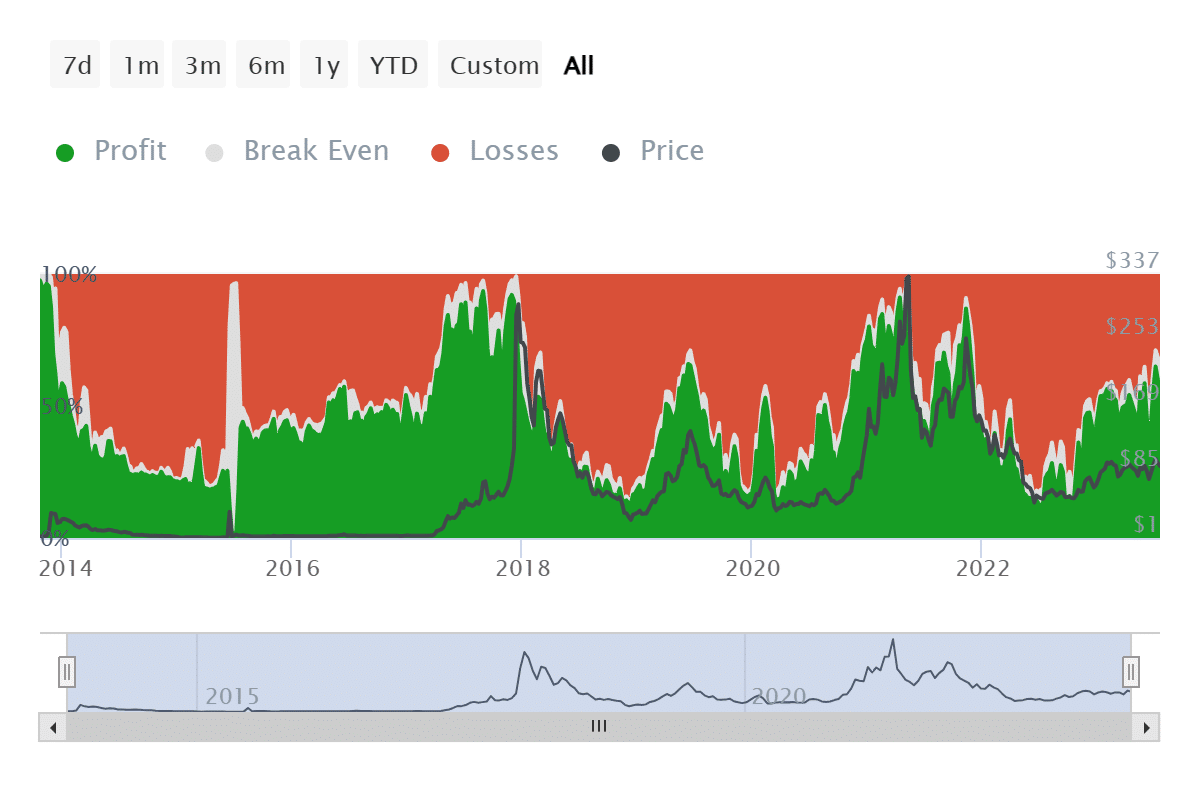

This shows that LTC investors are cowering due to the declining prices and might pull back if the losses intensify, which is the likely scenario. Looking at the overall market condition, their actions do seem justified since, in regard to the total addresses on the network, about 34% of investors are at a loss.

Litecoin investors at a loss

To keep this from increasing, investors are less likely to participate unless the upcoming halving changes the sentiment surrounding the Litecoin market. Scheduled over the next two weeks, the halving might shoot up the demand for the altcoin, which would, in return, act as a boost for Litecoin price. This might also reduce the investors’ losses or at least increase their activity on the network.

Like this article? Help us with some feedback by answering this survey: