- Institutional investment in Bitcoin noted outflows worth over $30 million for the fifth week.

- ARK Invest’s Cathie Woods blamed the regulatory system for the Bitcoin movement losing strength.

- 3iQ’s CEO stated that Canadian institutions view BTC as a significant investment option.

Even though Bitcoin price has rallied considerably since March, investors’ interest in the cryptocurrency has been consistently declining. This seems to be extending to one of the crypto market’s biggest investors – the institutions.

Bitcoin loses institutions’ focus

Earlier this week, the founder of US investment management firm ARK Invest, Cathie Woods, stated that the Bitcoin movement was losing strength. She blamed the reason behind this on the regulatory system in the United States, adding,

“It would be nice if the US were leading this movement, but we’re losing it, and we’re losing it because of our regulatory system.

Her statement came days after the wealth and asset management company Northern Trust’s global head of digital assets and financial markets, Justin Chapman, stated that crypto has lost its shine from the institutional perspective. The executive, in an interview with CNBC, noted that even the hedge funds that are usually active in the markets have reduced their exposure to crypto. He further iterated,

“We’re not focused that much on the asset class because the client isn’t at the moment,” Chapman said. “So we’re not seeing that appetite to have that within their portfolios. If that changes, as a firm, we can account for those capabilities.

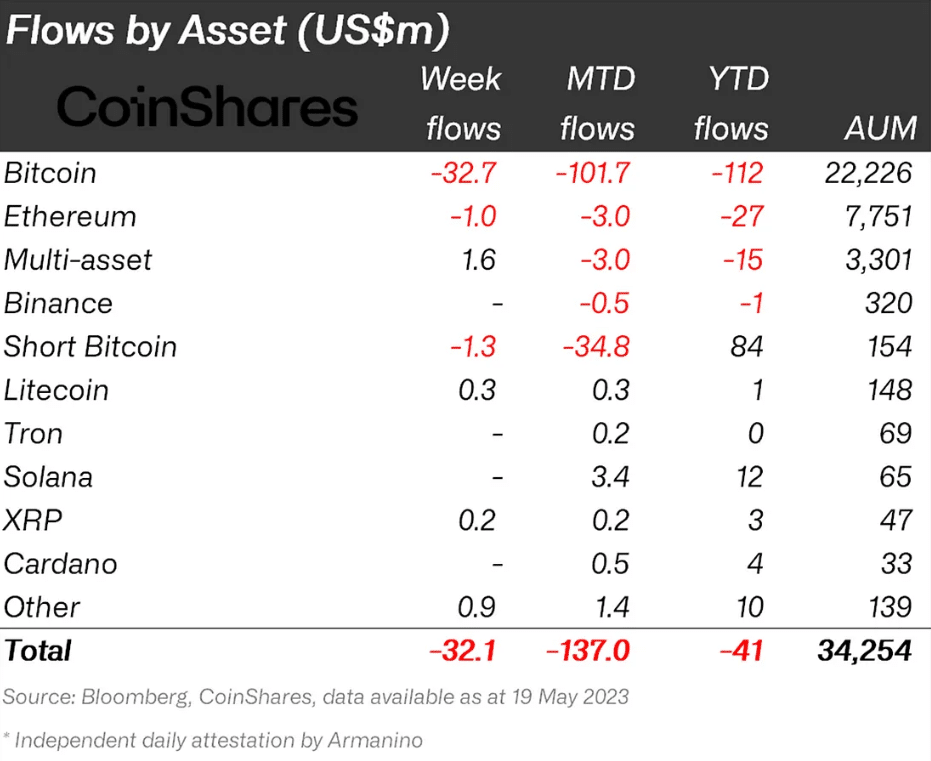

This is visible in their actions as well, given Bitcoin has been observing consistent outflows for the fifth week from institutional investors. For the week ending May 19, nearly $33 million worth of BTC outflows were registered, bringing the year-to-date outflows to $112 million.

Institutional investment in crypto assets

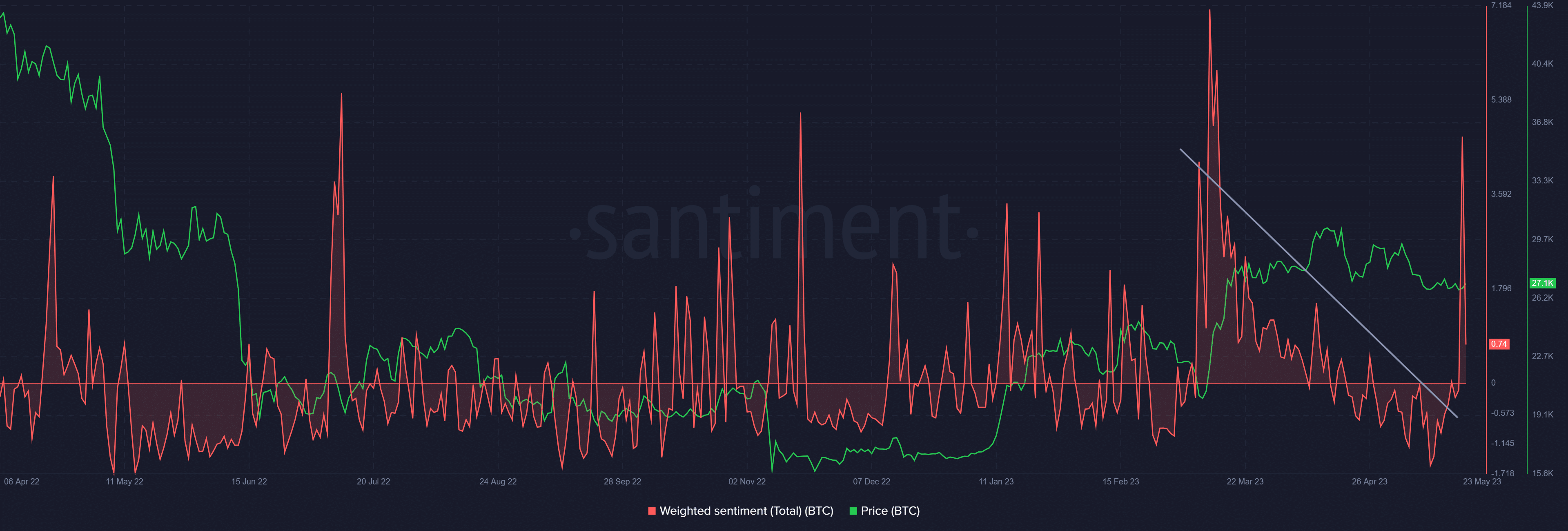

To add to that, the overall optimism in Bitcoin price has dissipated. As observed in the investors’ sentiment since March, the positive outlook has vastly diminished, except for a spike observed this week that turned out to be a fakeout.

Bitcoin investors’ sentiment

However, portfolio managers in Canada have started considering Bitcoin as a “serious venue” to invest in. According to the CEO of 3iQ, Fred Pye, the reason behind this is the FOMO (Fear Of Missing Out) people had regarding Bitcoin moving to Artificial Intelligence, which has been growing immensely thanks to ChatGPT.

As it is, the regulatory uncertainty has driven crypto out of the country, with Coinbase being the best example. The world’s second-biggest cryptocurrency exchange launched its offshore derivatives exchange in Bermuda earlier this month owing to the lack of clarity regarding regulation in the US.

Consequently, the current situation makes the Securities and Exchange Commission (SEC) vs. Ripple case very important. The outcome of the lawsuit would remarkably impact the regulatory outlook of the country, potentially increasing the optimism of not just retail investors but institutions as well.