- US SEC Chair Gary Gensler has recently commented on AI, describing it as “the most transformative tech of our time.”

- Nevertheless, Gensler noted that securities law could be implicated based on how AI tech is used.

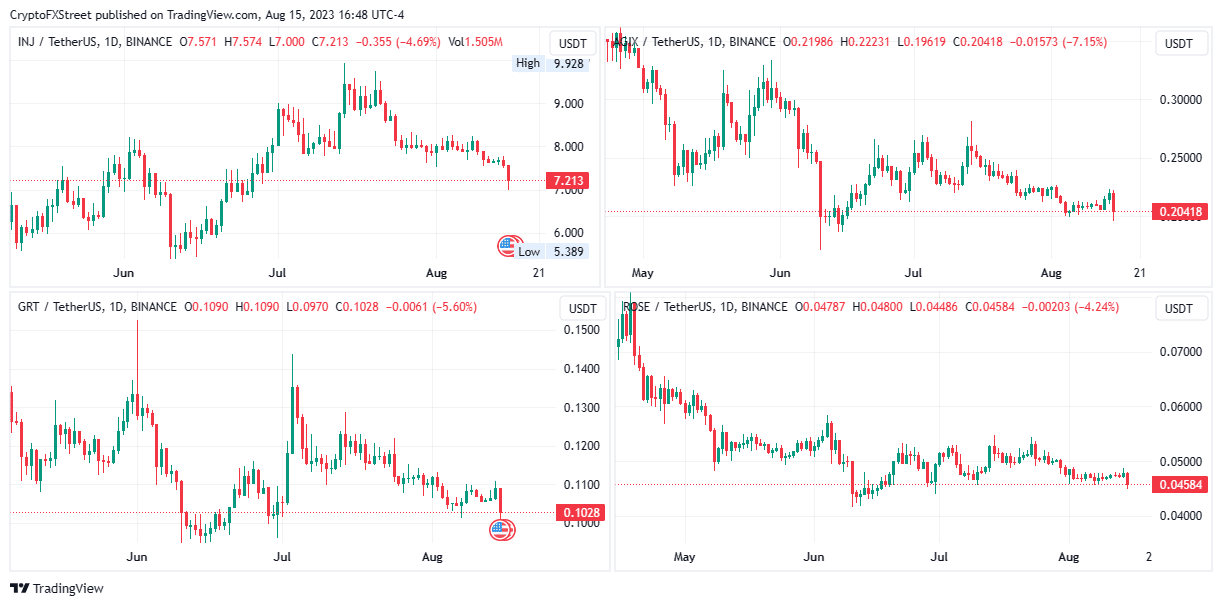

- As the post suggests a regulatory shift in focus toward AI, related tokens such as INJ, GRT, AGIX, and ROSE have plummeted.

Injective (INJ), The Graph (GRT) SingularityNET (AGIX), and the Oasis Network (ROSE) token prices have suffered in the wake of recent remarks by US Securities and Exchange Commission (SEC) chair Gary Gensler. After recent regulatory jabs against cryptocurrency firms like Binance and Coinbase, the commission’s helm office may have shifted focus toward Artificial Intelligence (AI).

Also Read: Bitcoin volatility at record low as funding rate hits $200 million; signals impulse move ahead.

AI tokens suffer as US SEC chair redirects toward Artificial Intelligence

AI tokens INJ, GRT, AGIX, and ROSE have recorded notable slumps over the last 24 hours. On average, the tokens are down between 5% to 10%, with the load-shedding exercise tracing back to after US SEC chair Gary Gensler made remarks about artificial intelligence.

INJ/USDT 1-day chart, AGIX/USDT 1-day chart, GRT/USDT 1-day chart, ROSE/USDT 1-day chart

SEC’s Gensler’s remarks on AI suggest regulatory interest

In a recent post on giant social media platform X, Gary Gensler addressed AI as “the most transformative tech of our time.” Likening it to the internet, the SEC official wagers on the technology’s ability to transform science, technology, and commerce as we know it. Nevertheless, he urges that users should remain cognizant of AI challenges.

We @SECGov are technology neutral. We focus on the outcomes, rather than the tool itself. Securities laws, though, may be implicated depending upon how AI tech is used. Within our current authorities, we’re focused on protecting against both the micro & macro challenges of AI.

— Gary Gensler (@GaryGensler) August 15, 2023

Narrowing down to what may affect AI crypto tokens, Gensler called out the possible conflict of interest in the field, saying that platforms must be able to prioritize customer interest over the optimization function in the AI system.

If the optimization function in the AI system is taking the interest of the platform into consideration as well as the interest of the customer, this can lead to conflicts of interest.

With this, the SEC chair articulated the agency’s impartiality on technology matters, highlighting that the commission was more focused on outcomes than the tool. Where things got interesting, however, is when Gensler explains the possibility of securities laws coming into play based on how AI technology is used. In his opinion, this is part of the agency’s consumer protection endeavors, both micro and macro.

With the allusion of the regulator shifting gaze to the AI space, related tokens started dipping as market players often ‘sell the rumor’.

Controversial AI-related tokens

Regarding controversies relating crypto to AI, Worldcoin (WLD) is in the front-row seats, with multiple authorities from various states calling the project out for threatening users’ privacy. The project, whose brainchild is ChatGPT founder and OpenAI CEO Sam Altman, is the subject of international debates, with regulators and privacy advocates questioning its overzealous commitment to ” provide universal digital identities.”

With criticism still brewing, critical concerns for Worldcoin include data security and possible privacy violations, setting Worldcoin up for scrutiny and investigations by authorities from different jurisdictions. One pronounced case is in Kenya, whose Interior Minister noted:

Relevant security, financial services, and data protection agencies have commenced inquiries and investigations to establish the authenticity and legality of the aforesaid activities.

The activities in question include the project’s method of data collection, iris scans, as there is no clarity as to what happens to the data. With data security and possible monetization theories, a recent report by Reuters made matters worse when the general manager of Tools For Humanity admitted that “Worldcoin could make the collected data available to corporations and governments.” Noteworthy, Tools For Humanity is the company behind the Worldcoin project. Bottomline, there is a lot of fear around the potential for user data misuse.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.