- BlackRock iShares Bitcoin Trust (IBTC) is back online, after hours of being delisted amid the DTCC network crash.

- The relisting comes after the US SEC levied charges against BlackRock for failing to disclose some of its investments.

- Bitcoin price remains volatile, indecisively fluctuating around the $34,000 psychological level.

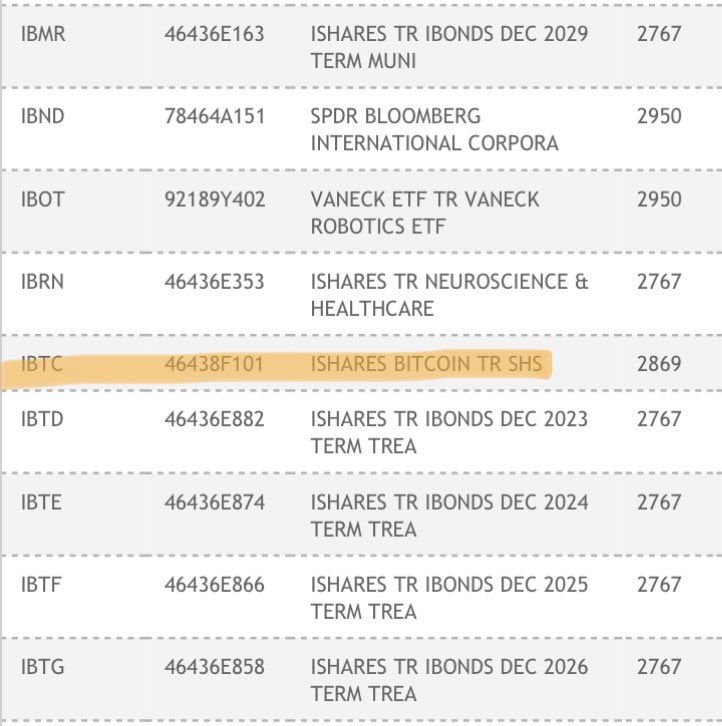

IBTC, the ticker for BlackRock iShares Bitcoin Trust, made headlines during the early hours of the New York session after it disappeared from the catalog of the Depository Trust & Clearing Corporation (DTCC).

Also Read: Bitcoin price shakes, DTCC website crashes after BlackRock iShares BTC Trust delisting

IBTC back on DTCC catalogue

BlackRock iShare’s Bitcoin Trust was a trending topic in the cryptocurrency community after its disappearance from the listing on DTCC. The incident caught the market by surprise as the DTCC website went down simultaneous to the delisting of IBTC, in what many attribute to traffic as investors sped off to confirm the developments.

In an interesting twist, however, the product is back online, relisted as the DTCC website is now accessible.

IBTC on DTCC

It comes after reports that financial regulator SEC levied charges against BlackRock, citing failure to disclose investments. Based on the announcement, the firm will have to part with up to $2.5 million in penalty fees.

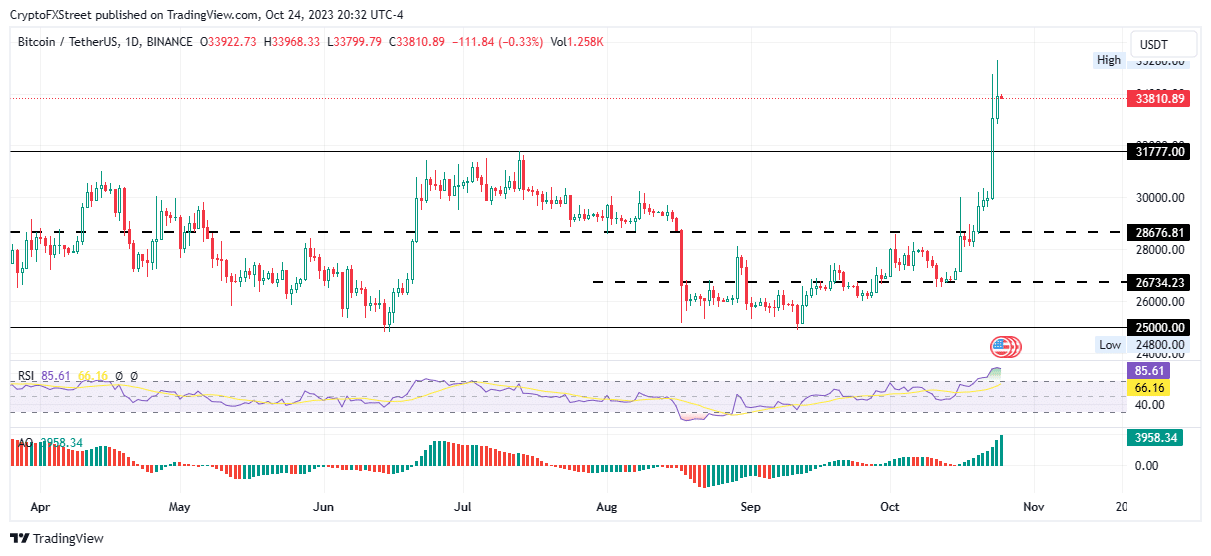

Bitcoin price tries to reclaim $34,000

Riding on the news, the bulls have pumped Bitcoin price to reclaim above the $34,000 level, but downside risks remain as investors contemplate the price action. Even so, technical indicators remain in favor of the bulls, at least for now, suggesting the bulls could still lead the market.

The Relative Strength Index (RSI) is in the overbought zone but without sell signals, retaining its northbound orientation that reflects rising momentum. In this respect, Bitcoin price could still reclaim its October 24 high of $35,280, or in a highly bullish case, extrapolate to tag the $36,000 psychological level.

BTC/USDT 1-day chart

On the other hand, increased selling pressure could see Bitcoin price lose the $31,777 critical support, potentially going as low as the big psychological support of $30,000 before an attempt to cross below the $28,000 psychological level. In the dire case, the slump could see the people’s currency break below the $25,000 psychological level. Such a move would constitute a 25% drop below current levels.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.