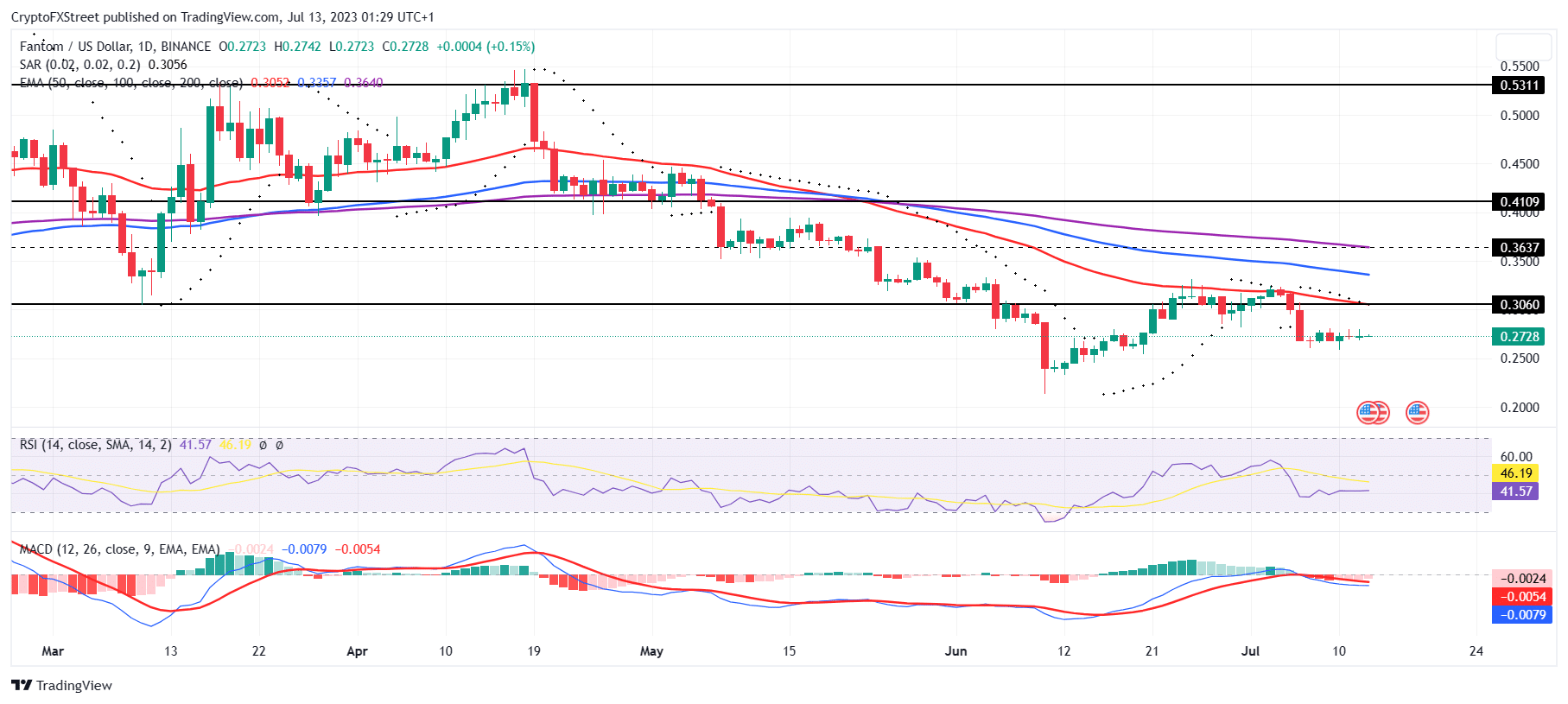

- Fantom price is currently at a standstill, stuck under the key barrier of the 50-day EMA for nearly three months now.

- The network has seen a growth of 97% in the span of 30 days adding new addresses at a rapid pace.

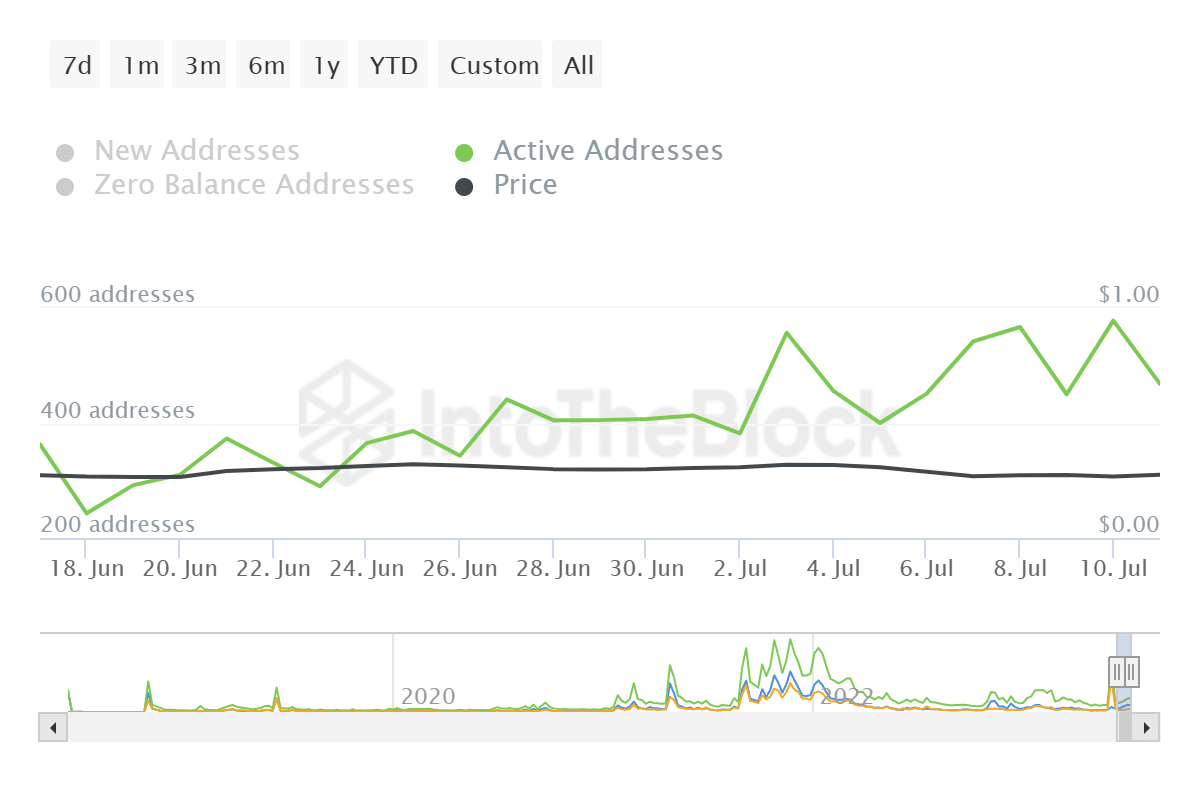

- Rising active addresses could lead to increased transactions in the market, in turn pushing FTM price up.

Fantom price is following the broader market cues awaiting a trigger to begin recovery again, but the delay is not being entertained by FTM holders. Investors are changing their stance from depending on the market to dictate their behavior to potentially altering the price action through their behavior.

Fantom price needs a bullish trigger

Fantom price, trading at $0.2720 at the time of writing, has been moving sideways for the majority of the past week, after failing to breach the 50-day Exponential Moving Average (EMA) coinciding at $0.3060 at the beginning of the month. While the price action decided to stick to a standstill, the investors did not, and the same can be observed in their behavior on-chain.

FTM/USD 1-day chart

FTM holders’ presence has been growing with every passing day, and in the last month, their activity has grown by 97%. The active addresses, which lingered in the lows of 164 on average in June, currently stand at 264. While the growth may not seem like much, given the present market condition, it does serve as an optimistic growth.

Fantom active addresses

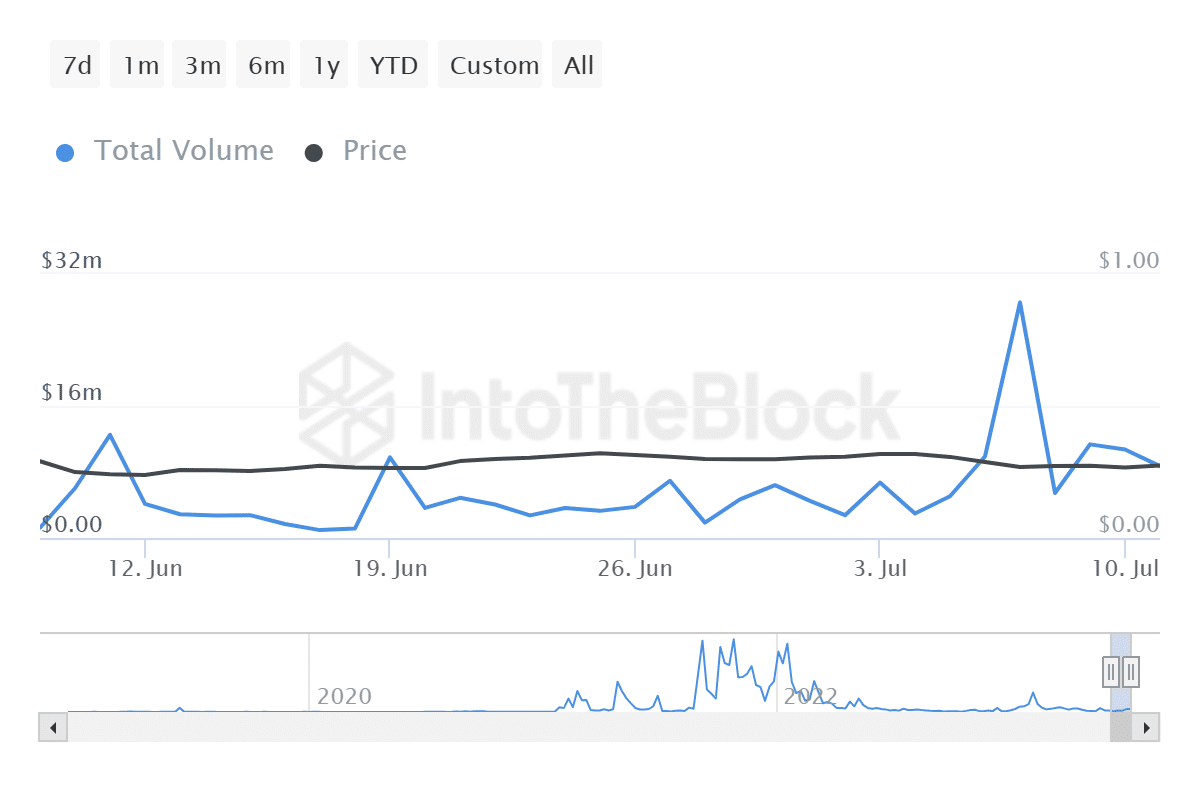

This increase in activeness is not just limited to presence but to their actions as well. The network has seen a surge in the transactions conducted on-chain, with volumes rising immensely. At this time last month, Fantom network was noting transactions worth $2.87 million, while the same at the moment stands at $8.72 million.

Fantom transaction volumes

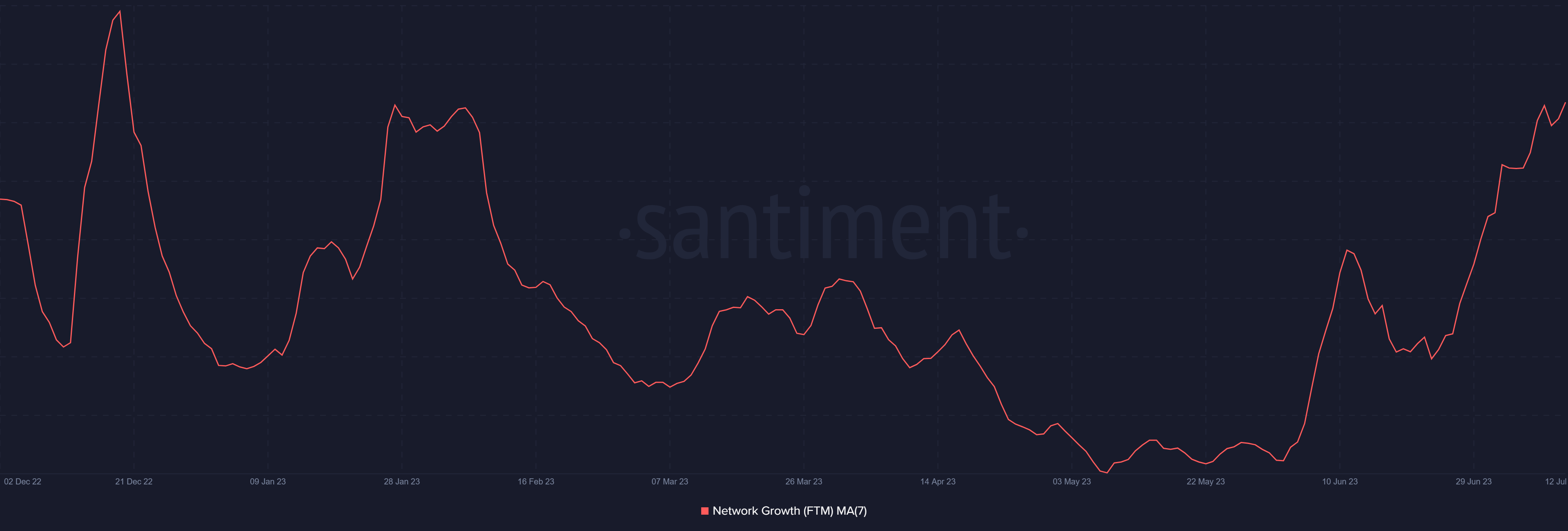

Interestingly, this bullishness extends to the newer addresses as well that are just joining the network. This is evinced by the network growth indicator, which gauges the rate at which new addresses are formed on the network.

Between mid-June to date, this rate of new address formation has grown by 45% and continues to rise at the time of writing. Rising network growth is considered to be a bullish signal as it indicates towards potential price rise over a period of time.

Fantom network growth

If such is the case for Fantom price as well, the key barrier would be the 50-day EMA which would only be breached once enough bullishness is generated. The price indicators – Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) – are both noting bearish signals at the moment. As and when these signals switch to bullish, FTM hodlers can expect Fantom price to note a rise as well.

Like this article? Help us with some feedback by answering this survey: