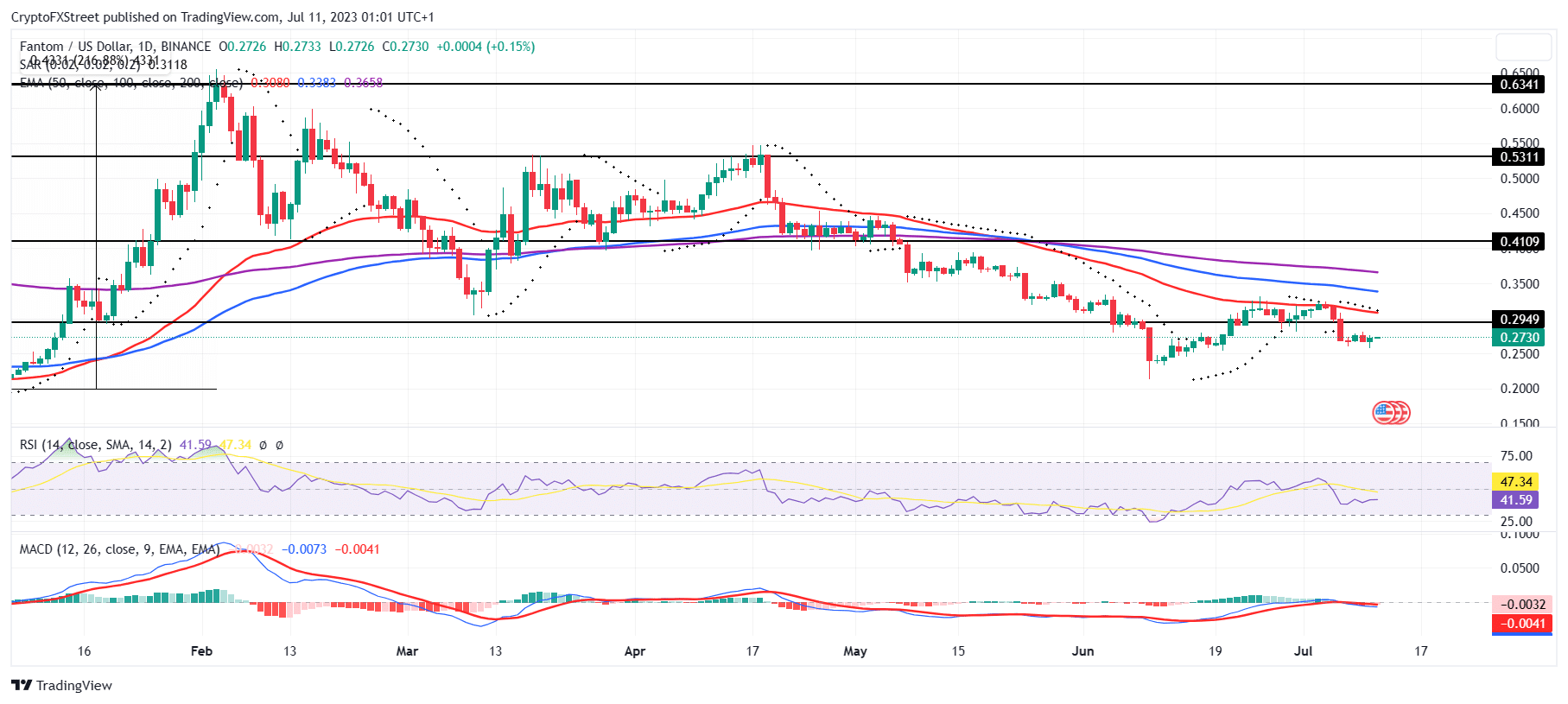

- Fantom price is trading at $0.2730 after failing to rise through the 50-day Exponential Moving Average (EMA).

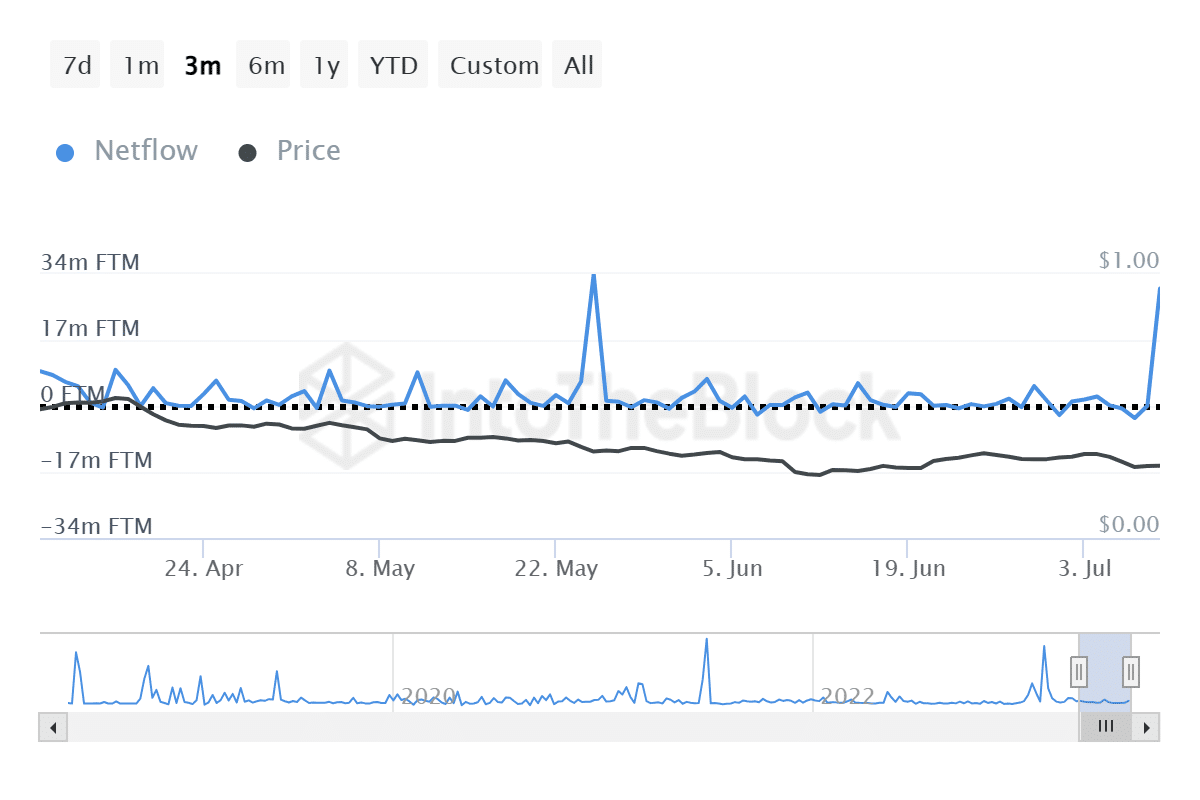

- FTM whales were highly active over the weekend, with volumes hitting a high of $8.2 million.

- Investors are generally more bullish at the moment, expecting a rise in value over the coming days.

Fantom price was recovering at a consistent pace until July 7, when the altcoin declined to nearly three-week lows. The change in price action’s direction was expected to change the investors’ behavior as well, and it did, but unlike expectations.

Fantom investors become more bullish

Fantom price attempted to breach the 50-day Exponential Moving Average (EMA) last week, but its failure to do so resulted in a slight dip in value. Trading at $0.2730, the altcoin slipped after it failed to flip the 50-day Exponential Moving Average (EMA).into a support floor after attempting to breach it last week.

FTM/USD 1-day chart

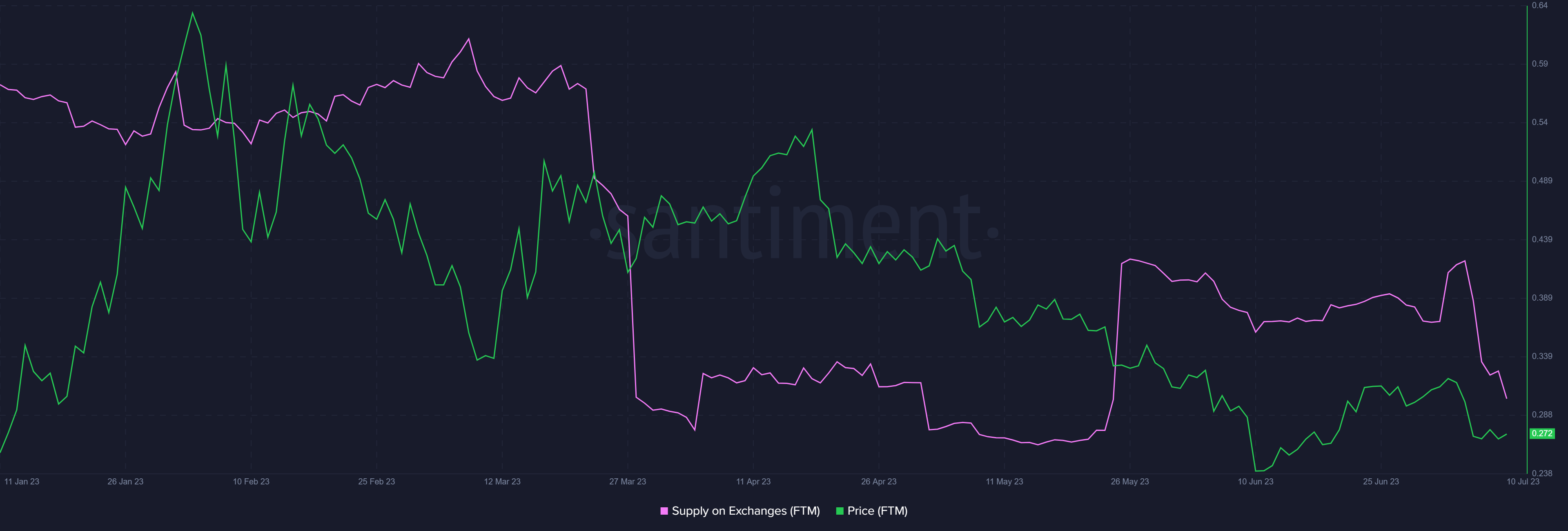

Generally, investors following such a development tend to act more cautiously and hold back until they see an opportunity to recover and claim profits. Interestingly they acted much differently this time. Over the last week, FTM holders sought to accumulate a huge chunk of the circulating supply despite the decline.

Since July 7, over million FTM tokens have been picked up by enthusiastic investors. But it is not just buying that has been investors’ choice these last few days, selling has also been observed.

Fantom supply on exchanges

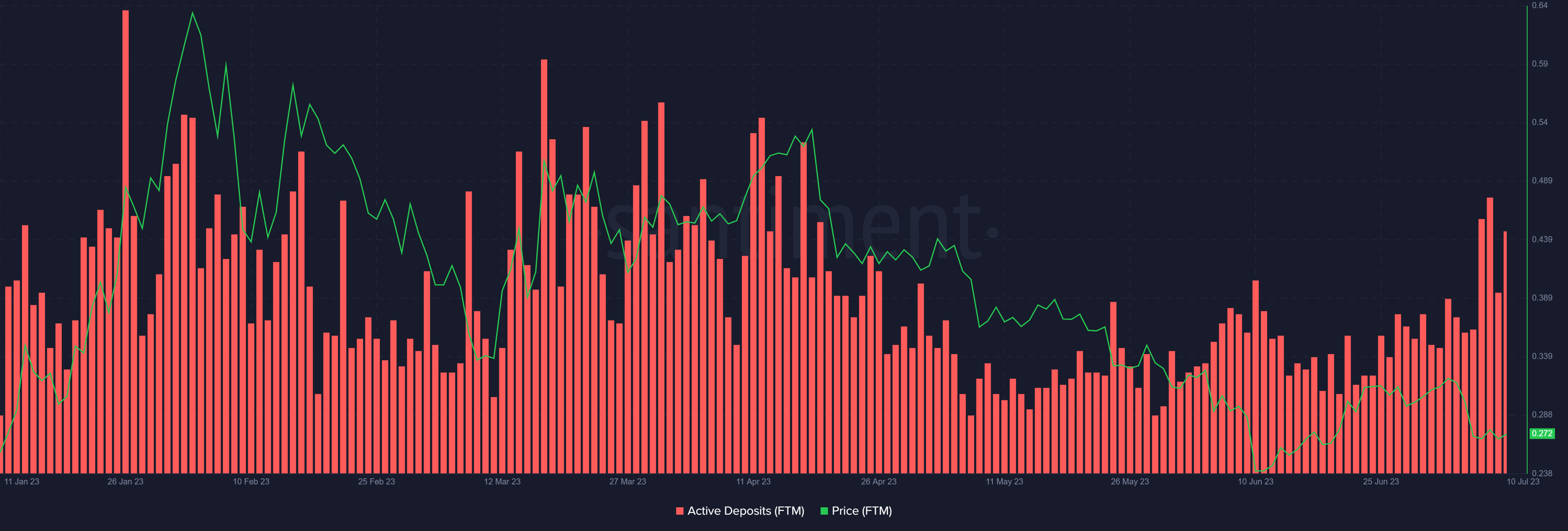

The active deposits on the chain have been gradually increasing, rising by nearly 100% in the past 30 days, with the same hitting a three-month high towards the end of last week. These deposits are generally indicative of selling at the hands of investors, which also include whales.

Fantom active deposits

The investors conducting transactions worth more than $100,000 noted an immense increase in volumes of FTM leaving their addresses than entering them. The overall outflows around the weekend hit 30.26 million FTM worth around $8.2 million.

Fantom whale transactions

While the recent accumulation may not be able to counter whale selling, it surely does highlight that retail investors are likely still bullish and are hopeful of a recovery soon.

Like this article? Help us with some feedback by answering this survey: