Bitcoin tried to take down the $52,000 level during the weekend but saw little success and is now down to $51,000 once again.

Ethereum jumped to a new multi-year peak at over $3,100 but was stopped there, while XRP, ADA, and DOGE have turned red now.

BTC Slips to $51K Again

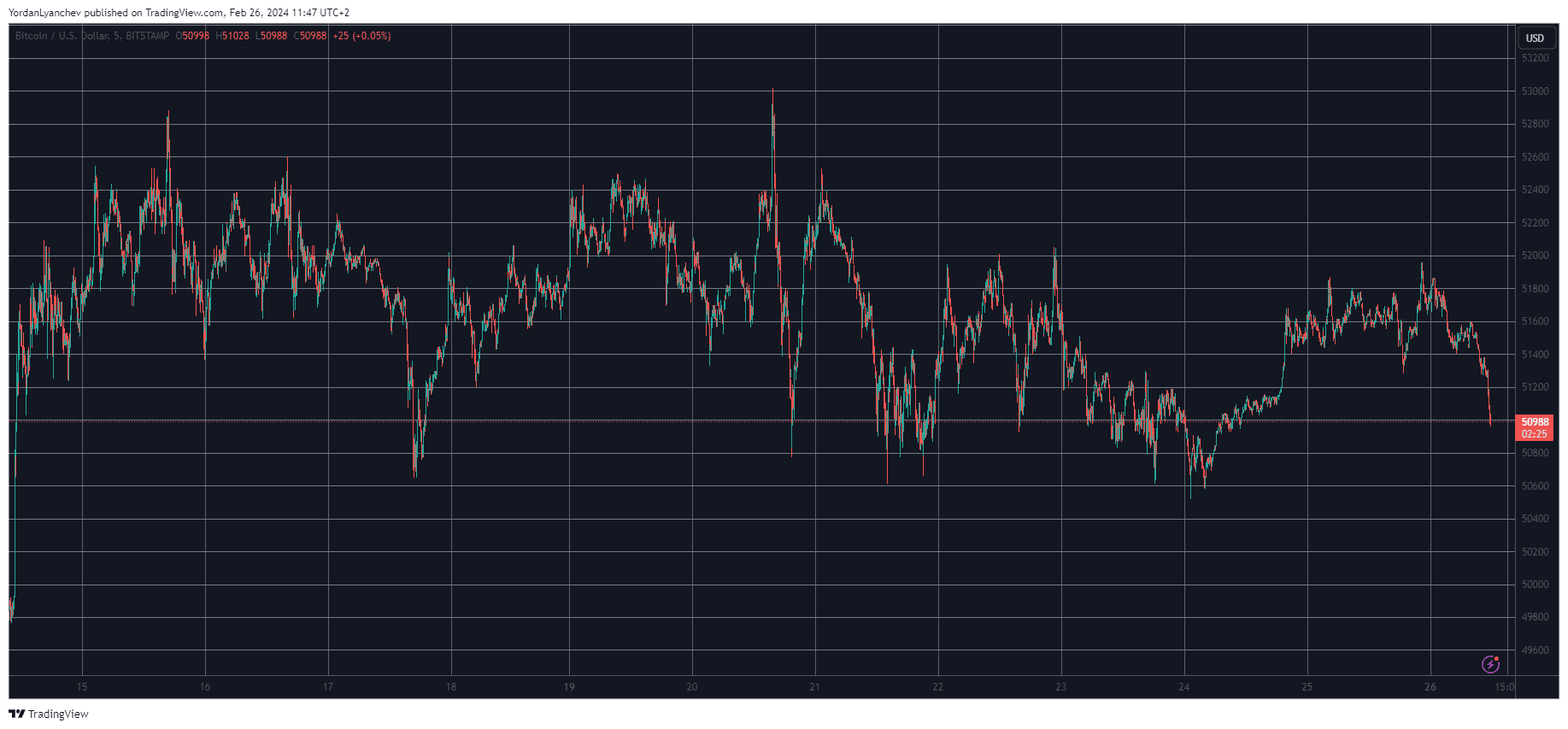

The past seven days were quite different than the previous ten, in which the primary cryptocurrency gained over ten grand and shot up above $50,000 for the first time in over two years. The last week, though, finally brought some calmness in the market, and BTC remained relatively still in a range between $51,000 and $52,000.

The most substantial fluctuations came mid-week when Bitcoin soared to $53,000 to tap a new multi-year peak. However, it was quickly driven south and slumped by over two grand in hours.

Since then, BTC has been unable to resume its bull run and came close to breaking above $52,000 on a few occasions, but to no avail. The last rejection came during the weekend, and the cryptocurrency is now struggling to remain above $51,000.

Its market cap has slipped back down to $1 trillion on CG, and its dominance over the alts is at 48.3%.

ETH Stopped at $3.1K

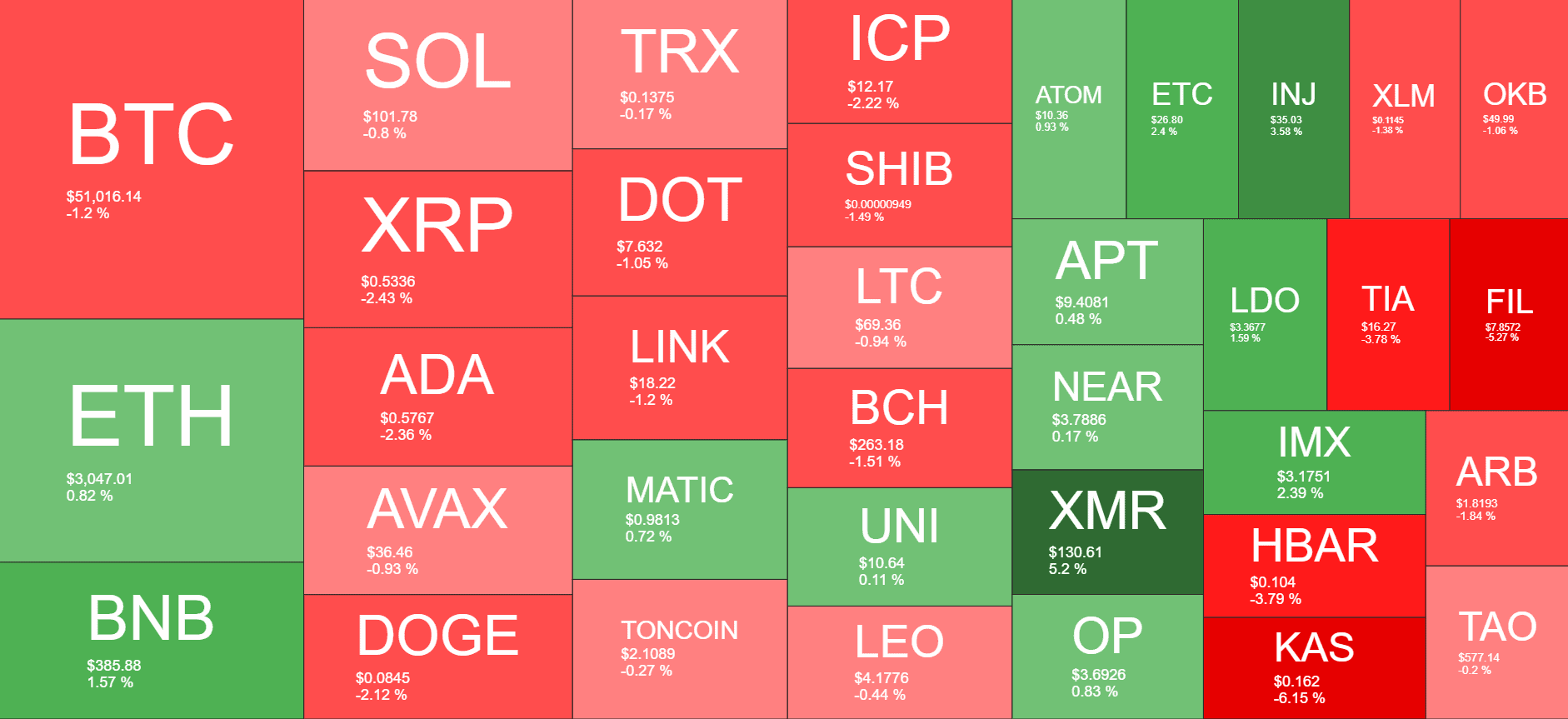

Ethereum continued its recent impressive performance in the past 24 hours and skyrocketed to over $3,100 earlier today. This was its highest price tag in almost two years. However, ETH failed to maintain there, at least for now and has slipped by roughly $100 since then.

BNB also tapped a local peak of $390 earlier today after a 2% increase but has retraced slightly. The rest of the larger-cap alts are in the red, with losses of around 1-3% from the likes of SOL, XRP, ADA, AVAX, DOGE, DOT, and LINK.

In contrast, Flare, Mantle, and GALA have taken the main stage with double-digit price increases. FLR is up by 19%, MNT by 14%, and GALA by 10% in the past 24 hours.

The total crypto market cap touched $2.1 trillion on CG today but has declined by $20 billion since then.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.