- Fantom price keeps its head above $0.32, while the risk of more downside hangs in the balance.

- FTM price could still see some support at $0.30 though the road is open to $0.26.

- A nosedive move could bring FTM near the 2023 low.

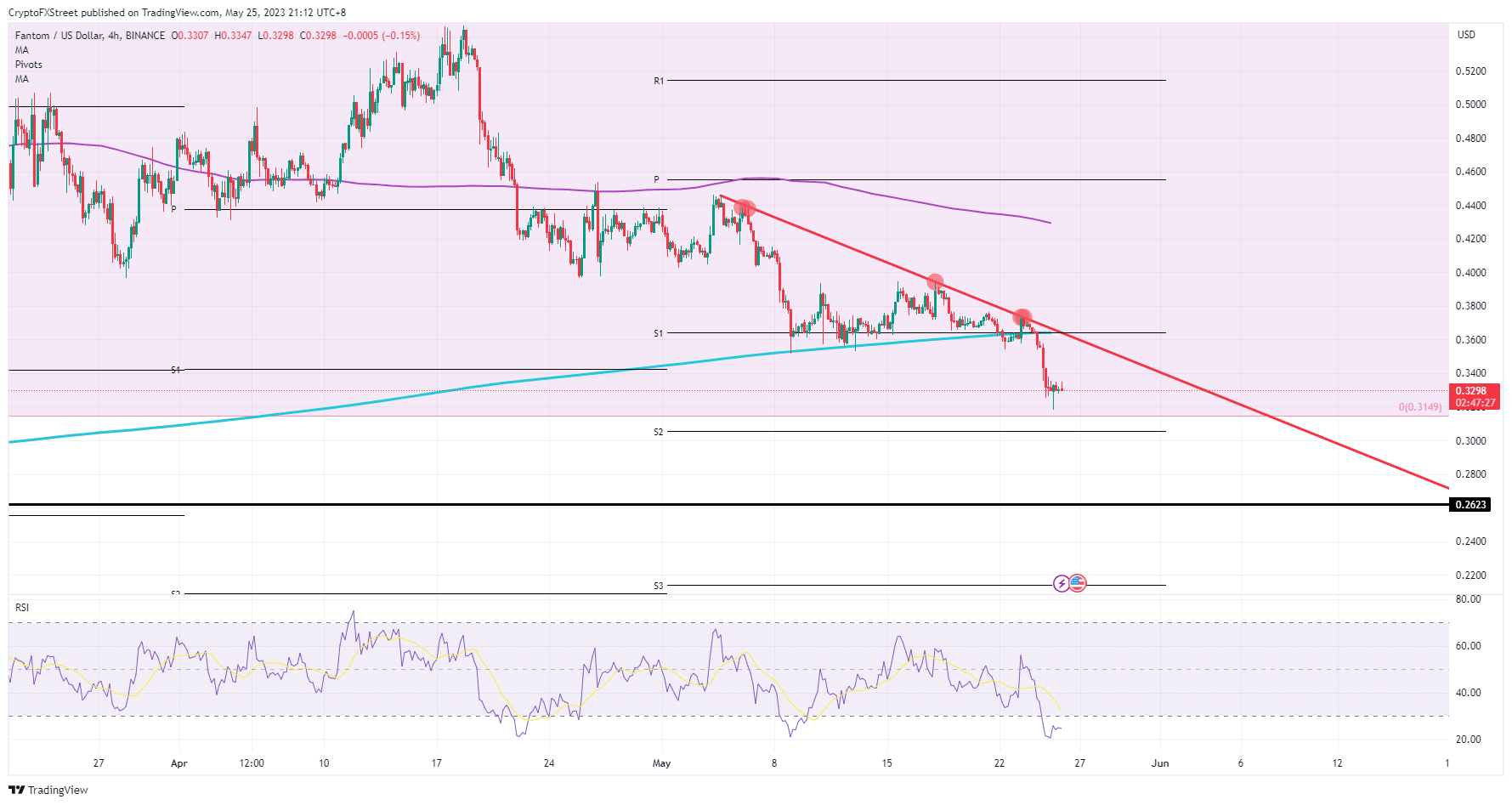

Fantom (FTM) price is at risk of imploding after bears have been able to break a substantial support this week. Bulls have vacated the premises and are not expected to pop up any time soon. With these trading conditions, Fantom price is setting itself up for a free fall that could easily go as far as $0.26 and bear a 20% devaluation.

Fantom price inclined to drop another leg lower

Fantom price got sucker-punched in the past trading sessions with a 10% decline, and the pain is not over yet. With bulls running for the hills, it appears that bears are going in for the kill here. Even though the Relative Strength Index (RSI) is deeply oversold, bears have little to no resistance from bulls to take this sell-off to the next level.

FTM is thus ripe for being knocked out and hitting the canvas. That knockout move would be a 20% nosedive plunge to $0.26. Certainly, once $0.30 is taken out, it will be a smooth and quick drop to $0.26, possibly even within just one candle of nearing a new low for 2023.

FTM/USD 4H-chart

Upside moves could and would only come with some positive headlines from global markets. The big driver at the moment is the US debt ceiling debate, which is stuck in a stalemate. Should there be a deal, expect to see a flight into risk assets with FTM primed to head and break back above the important $0.36 level where the 200-day Simple Moving Average, the red descending trendline and the monthly S1 support level all fall in line with one another.