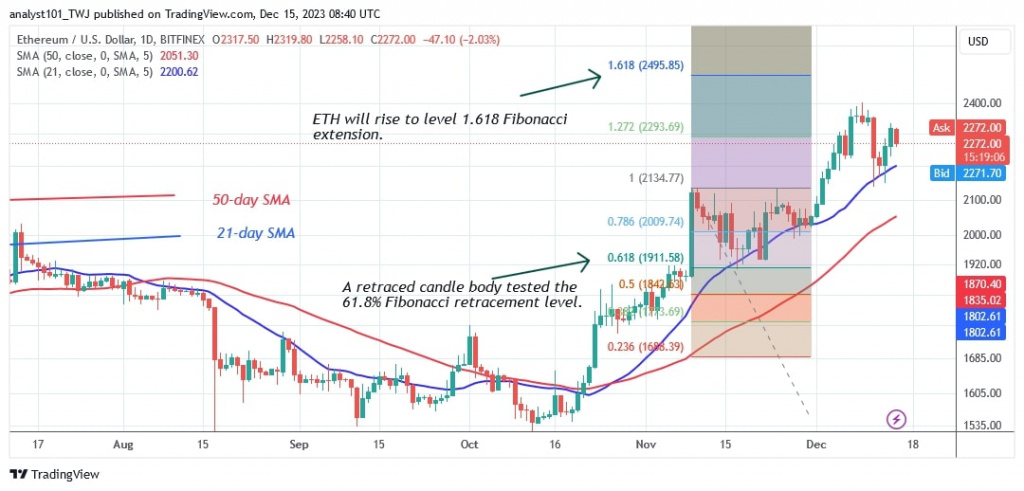

The price of Ethereum (ETH) is trading above the 21-day simple moving average (SMA) and is approaching the previous high of $2,400.

Long-term analysis of the Ethereum price: bullish

Since December 7, buyers have had the intention of continuing the uptrend, but the $2,400 level has prevented further price movement. After the dip on December 11, the altcoin has started a new rally and is currently facing another hurdle at $2,300. In other words, at the time of writing, Ether is worth $2,285.60.

The price rise has come to an end at the high of $2,300. However, a price rise above the current support will take the altcoin above the recent high. The altcoin continues to trade between $2,500 and $3,000. On the downside, sellers have yet to break below the 21-day SMA, indicating that the downtrend has resumed.

Analysis of the Ethereum indicators

The bears tested the 21-day SMA on December 11 and were beaten back. Ether recovered and resumed its uptrend. The altcoin will come under renewed selling pressure if the bears are successful. The price bars remain above the 21-day SMA while the moving average lines are sliding upwards. The uptrend will continue as long as the price bars remain above the 21-day SMA.

Technical indicators:

Key resistance levels – $2,000 and $2,200

Key support levels – $1,800 and $1,600

What is the next direction for Ethereum?

Ethereum has held above the moving average lines, which gives hope for a further uptrend. The largest altcoin is currently trading in a limited range between $2,200 and $2,400. Ether has remained stable below the high of $2,300. A price increase will drive the altcoin upwards.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do the research before investing in funds.