Although it’s the end of the year and things in regular industries tend to slow down, the cryptocurrency space exists in a league of its own. The past week has been predominantly dominated by a few altcoins, and none stand out more than Solana’s SOL token.

Last Friday, the asset traded at just over $70, which was already an impressive result, given its price at the start of the year at $10-12. However, it kept climbing and soared to $100 earlier today, which not only meant that SOL surpassed XRP as the fifth-largest cryptocurrency but also briefly went above BNB as the fourth. Despite losing some ground since then, SOL is now in the top five; it trades above $90 and is up by 23% in the past week.

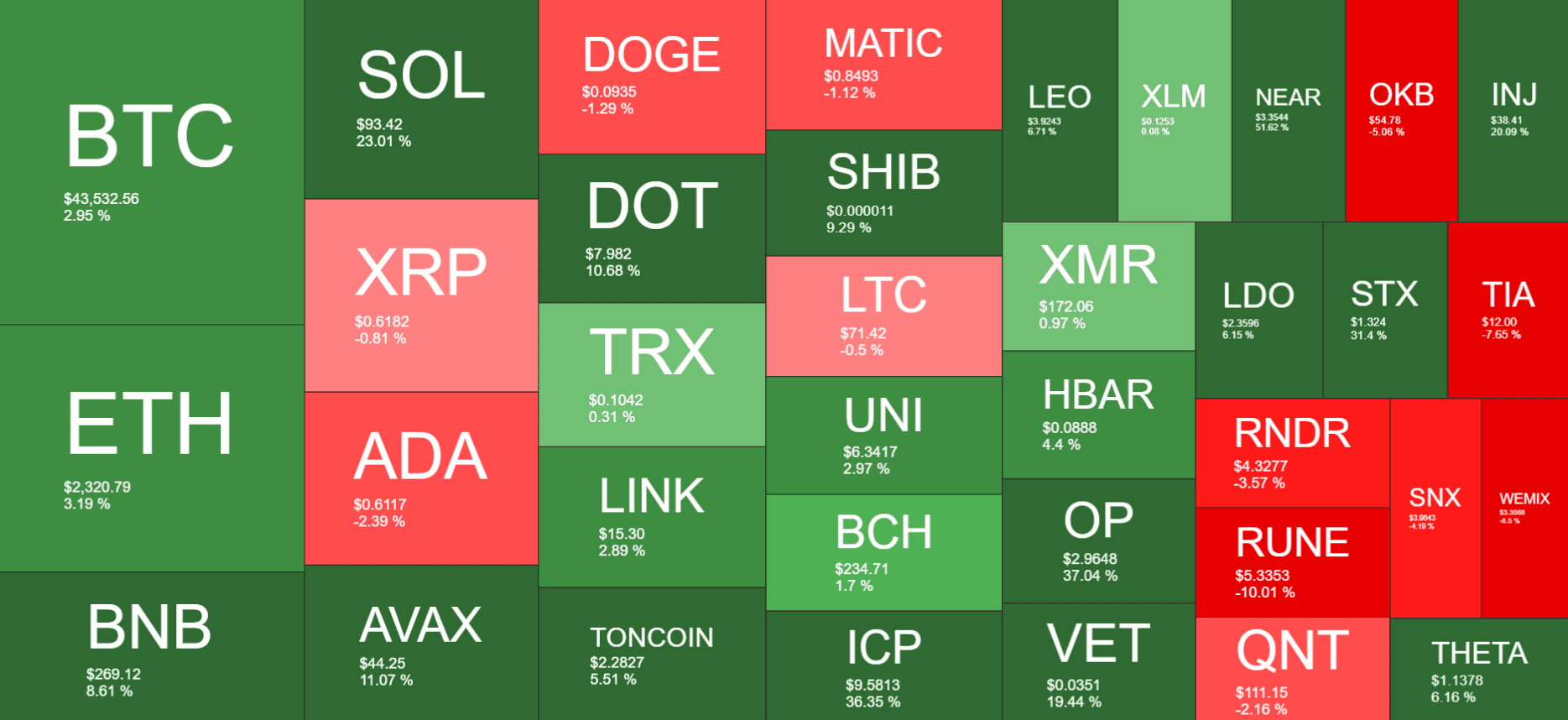

Very few large-cap alts have performed better within the same timeframe – they include ICP (36%), STX (31%), OP (37%), and NEAR (52%).

Bitcoin, on the other hand, had a quieter week. It fell hard on Monday to $40,500, but the bulls stepped up on the gas and pushed it north hard. This culminated in a price surge to $44,400 earlier today, but that was short-lived, and the primary cryptocurrency has since lost the $44,000 line and trades around $500 away from it.

Moreover, its market dominance has suffered quite a bit, losing more than 1% in the past week. As of now, the metric stands way below 50% on CoinGecko.

Overall, though, the total crypto market cap has added nearly $80 billion in the past week and is now beyond $1.7 trillion on the same market data aggregator.

Market Data

Market Cap: $1.734T | 24H Vol: $110B | BTC Dominance: 49.2%

BTC: $43,532 (+3%) | ETH: $2,320 (+3.2%) | BNB: $269 (+8.6%)

This Week’s Crypto Headlines You Can’t Miss

Grayscale CEO Says Spot Bitcoin ETFs to Allow Market Inflow of $30T in Advised Wealth. Michael Sonnenshein, the CEO of the leading digital asset management firm Grayscale, seems to be of the opinion that if the US Securities and Exchange Commission approves a spot Bitcoin ETF, this will allow the market to enjoy exposure to a whopping $30 trillion in advised wealth.

Surge in Inscriptions on EVM Chains: Etherscan Reports. According to recent reports on Etherscan, there’s been a surge in inscriptions on EVM-compatible blockchains. This is a new approach that allows users to inscribe digital artifacts, including texts and images, directly onto a blockchain.

Worldcoin Quietly Halted Orb Verification in India Months Ago: Report. Sam Altman’s Worldcoin seems to have made the decision to discontinue Orb Verification in India silently. This has been undisclosed for several months, sparking questions as to the motives of the move and the project’s future in general.

How a Trader Turned $42 SOL to $1.55M in 16 Days With This Solana-Based Memecoin. Memecoins on Solana have been exploding recently, with Dogwifhat (WIF) being one of the hottest topics. SILLY is another one, and it seems that one user took advantage of it to make massive returns.

Stablecoin Issuer Tether Blacklists Ethereum and Tron Wallets: Report. Tether – the company behind the world’s largest stablecoin USDT – has placed a total of six new wallets on a blacklist. The decision was made on suspicions of an association with the Finiko pyramid scheme.

Three Arrows Capital Founders Face $1 Billion Asset Freeze. The infamous founders of Three Arrows Capital and their now bankrupt hedge fund have seen their assets worth some $1.14 billion frozen by the BVI court. The move seeks to protect creditors amid the ongoing allegations.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and Injective – click here for the complete price analysis.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.