- Ripple price whitewashed all the July 13 gains after the court approved SEC’s request for an interlocutory appeal.

- The court-issued greenlight raises speculation of a possible overturning of Judge Torres’s decision on July 13.

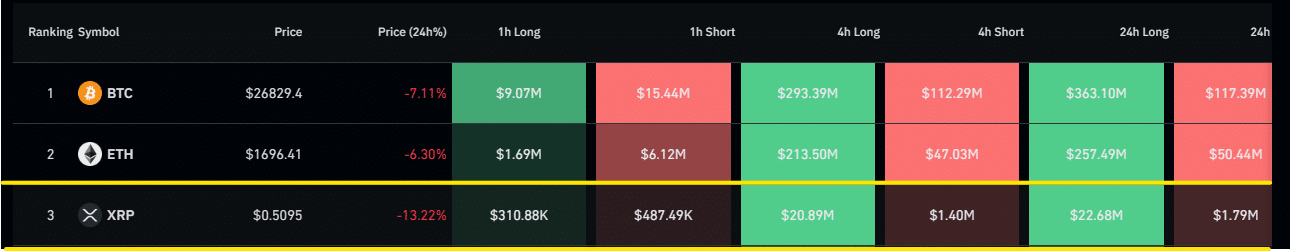

- Almost $23 million XRP long positions was liquidated from the crypto market within the same day, following the news.

- The SEC has 24 hours to file the motion to the US court.

Ripple (XRP) price sprinted south within seconds following the news of the court approving the US Securities and Exchange Commission’s (SEC) request for an interlocutory appeal. The slump comes on the back of fears that Judge Anerlisa Torres’s decision on July 13 could be overturned.

On August 17, during the afternoon of the US session, Judge Analisa Torres approved a recent request (August 9) by the SEC to appeal the July 13 determination, where the same judge had ruled that XRP was a security when sold to institutional investors rather than to retail.

The SEC’s appeal was interlocutory, meaning the appeal happened when all aspects of the case are yet to be finalized and the trial is ongoing.

The financial regulator’s decision to appeal sprouted from the Terraform Labs case, where Judge Jed Rakoff refused the firm’s request to dismiss the case on the grounds of Judge Torres’s previous ruling in the Ripple vs SEC case.

With this latest determination, the SEC has 24 hours to submit a motion to the US Court of Appeals for the Second Circuit. Beyond that, Ripple would have until September 1 to issue a response, which would inturn require a rebuttal within a week from the SEC.

The SEC winning the motion would pave the way for a full-blown appeal of Judge Torres’s landmark ruling.

On this matter, Ripple General Counsel Stu Alderoty believes the odds are still in their favor

Ripple price reaction

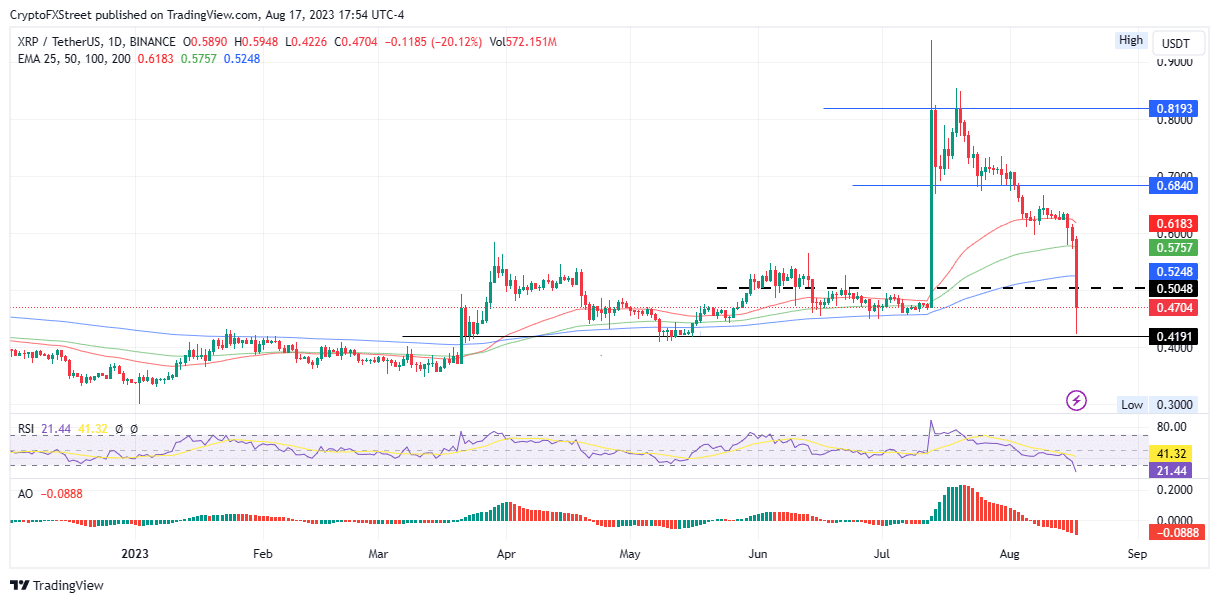

Ripple price has engaged full gear, whitewashing all the ground covered in the July 13 rally. XRP is down 15% over the last hour, 30% over the last day. The Relative Strength Index (RSI) is at a record low.

XRP/USDT 1-day chart

Around this news, almost $23 million XRP long positions were liquidated from the crypto market in under one hour.

XRP liquidations

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.