- Blur price has dropped nearly 27% from its local high of $0.685.

- Investors can expect a further drop of 46% based on on-chain metrics.

- A network-wide decline in activity combined with high unrealized profits and whales offloading tokens could drive BLUR lower.

Blur (BLUR) price rallied 352% in just 43 days between October 12 and November 24, which propelled it to create a local top at $0.685. While this move is impressive, BLUR has already shed 26% and currently trades at $0.502. A minor pullback is likely before the altcoin drops even lower.

Read more: Week Ahead: Bitcoin’s bull trend in question as spot ETF momentum fades

Blur price could slide lower as headwinds multiply

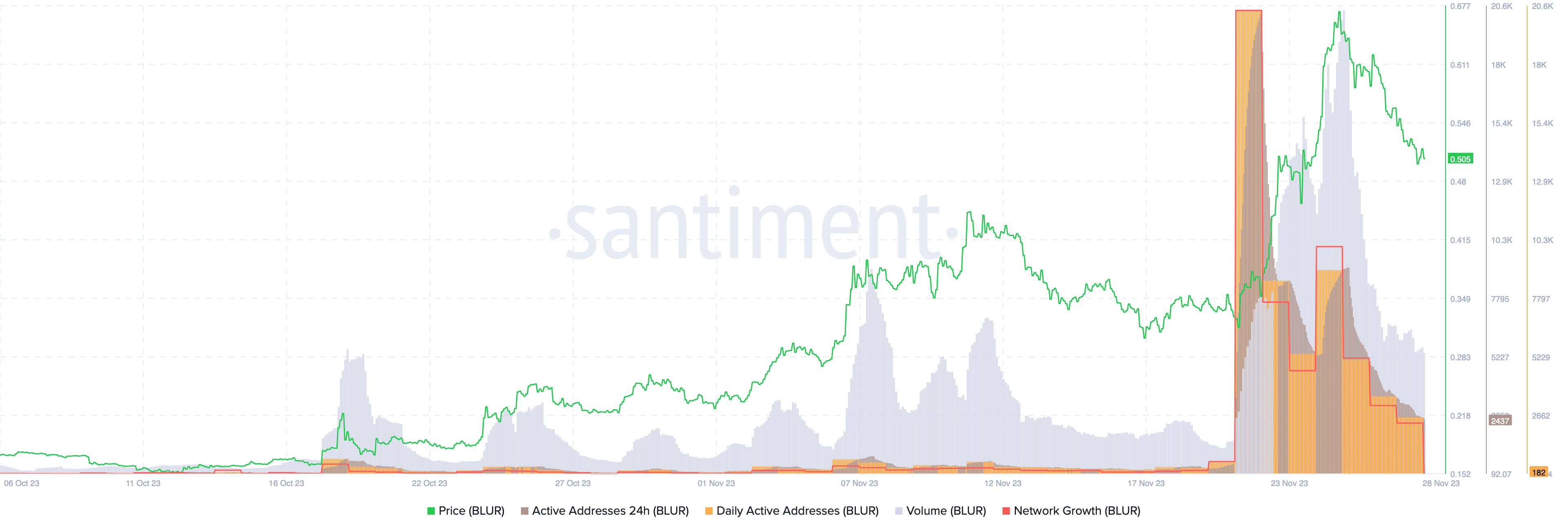

Blur (BLUR) price drop was not a question of if but when. A closer look at Santiment’s on-chain metrics showed that this decline could be anticipated using on-chain metrics. The Daily Active Addresses (DAA) and Network Growth (NG) started to decline after November 22 and formed a lower high on November 24 and 25, when BLUR set up a local top. Shortly after, the volume also declined, adding credence to this bearish thesis.

Currently, the DAA, NG and Volume sit at levels higher than the pre-rally levels.

Also read: Blur price could rally 65% more as BLUR holders panic sold $9 million tokens

BLUR DAA, NG, Volume

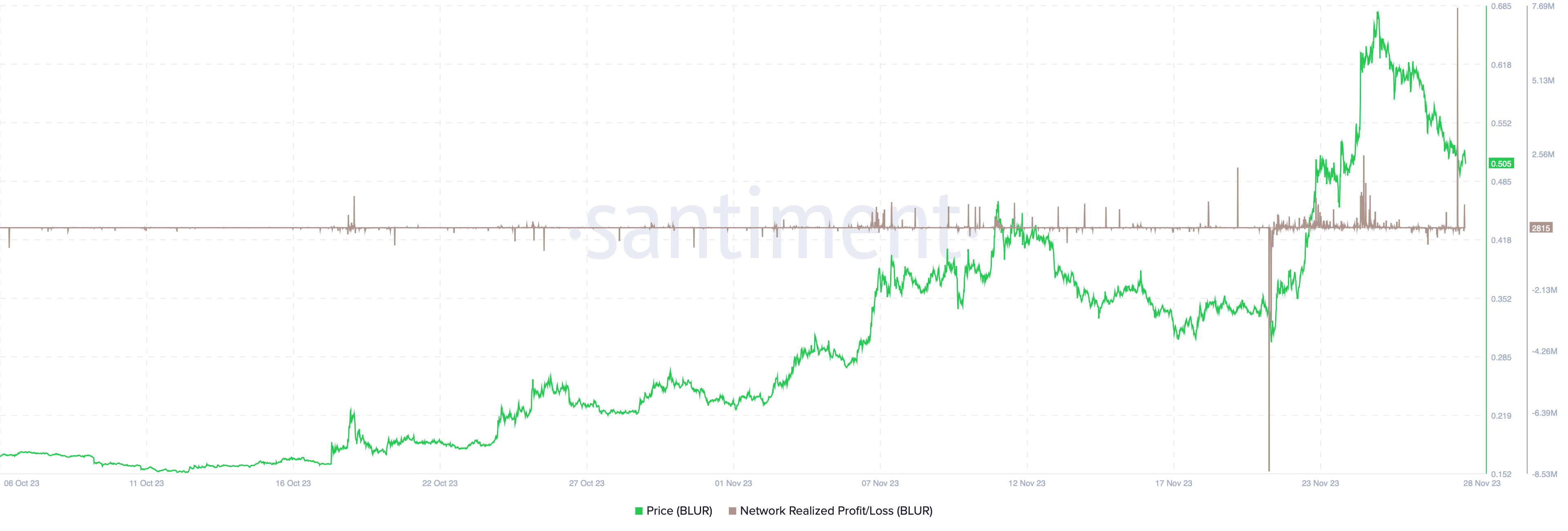

The next key metric to check is the Network Realized Profit/Loss (NPL). This on-chain metric is used to track the average profit/loss as it assumes that the token was sold when it changes addresses. If the change in hands occurs after a price spike, the NPL shows a positive spike as well, and it means that investors are realizing profits and is interpreted a sell signal.

Likewise, a negative spike shows capitulation and can be considered as a buy signal.

The capitulation event on November 21 saw nearly 8.45 million worth of BLUR being sold at a loss, which was followed by a 103% rally in Blur price from $0.337 to $0.685.

On November 27, however, roughly $7.60 million worth of profits were realized, which suggests that there more downside awaits BLUR holders.

BLUR NPL

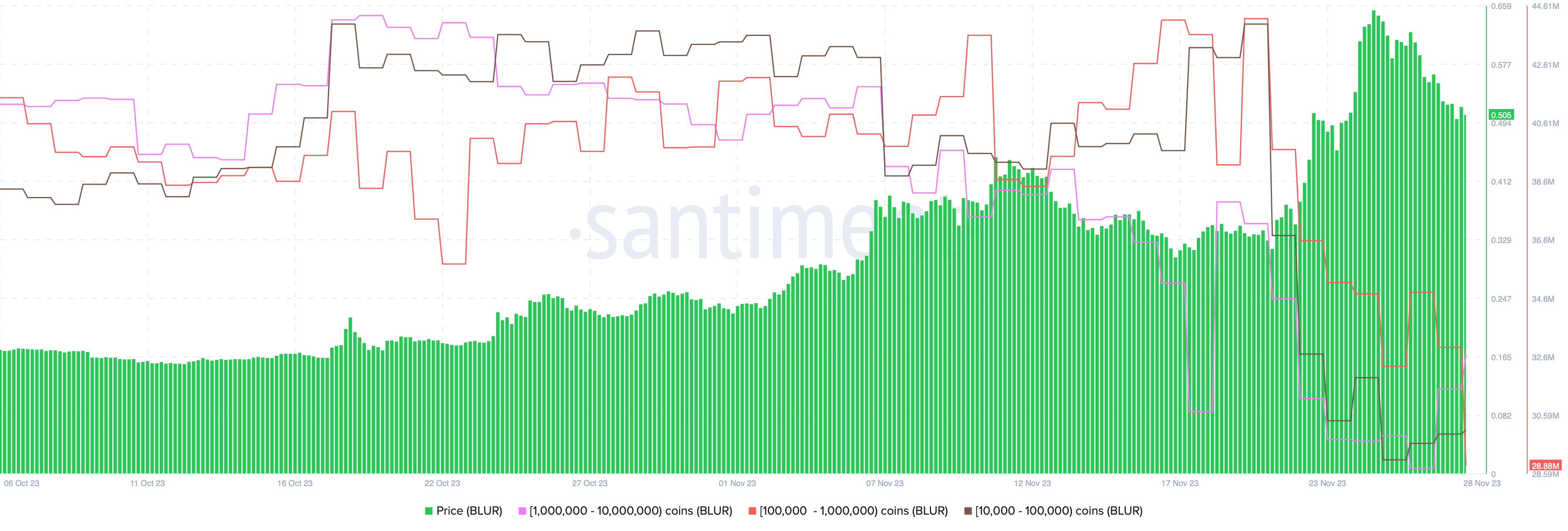

Lastly, the Supply Distribution metric shows that whales holding between 10,000 to 100,000, 100,000 to 1,000,000 and 1,000,000 to 10,000,000 BLUR started to offload their holdings after November 20. This development indicates that whales have had a significant influence on the recent drop in Blur price.

Going forward, it is good to track these investors to determine were the token will head next.

BLUR Supply Distribution

Read more: Blast Layer 2 locks users’ $568 million for three months, drawing criticism from Paradigm

Blur technicals point to another 42% correction

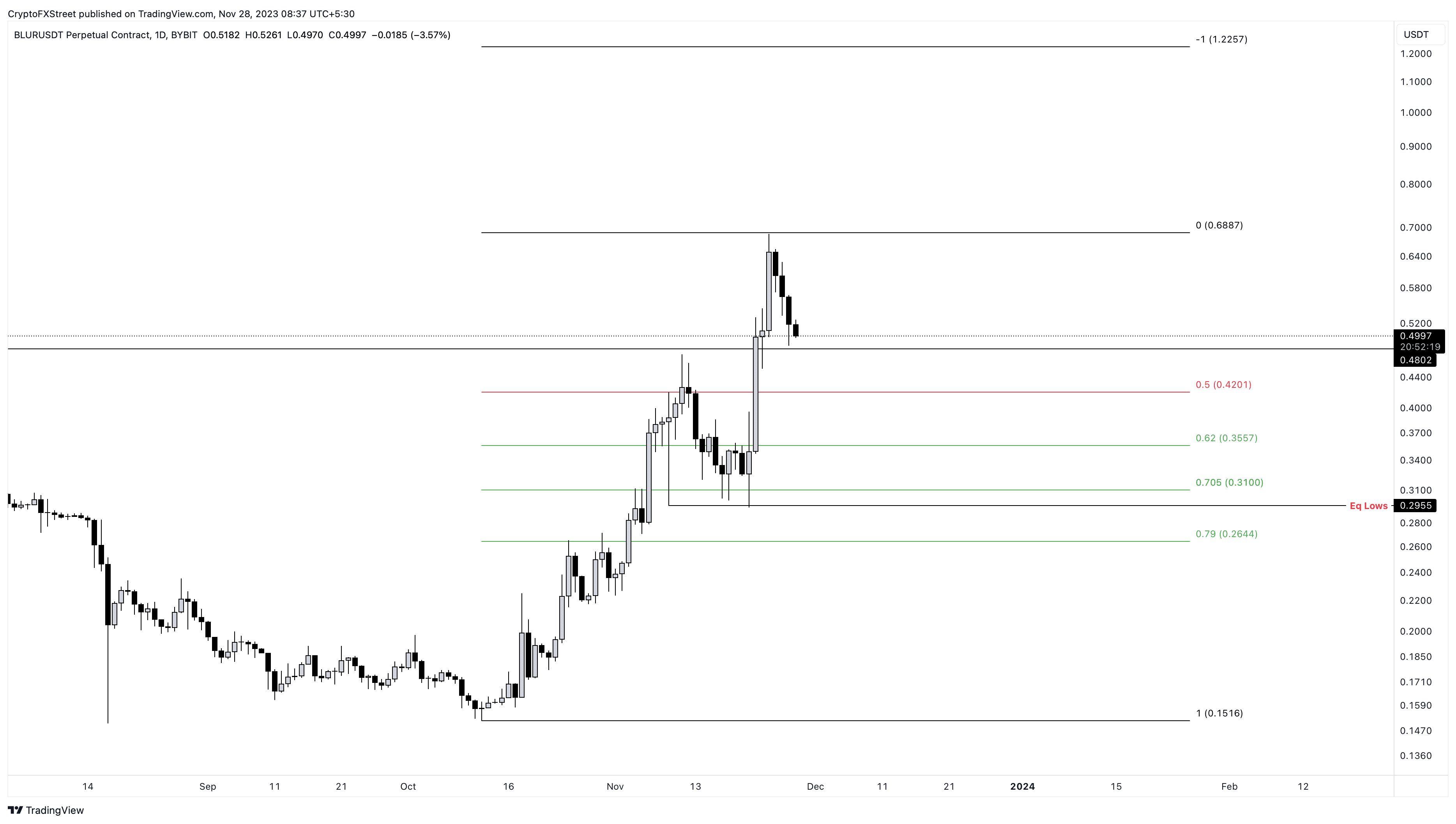

Blur price has shed nearly 30% from its local top of $0.685 and currently sits around the $0.480 support level. If investors continue to realize profits and BTC slides lower, a breakdown of this structure is likely. However, a minor pullback to $0.555 could be plausible before another leg to the downside.

The 50% Fibonacci retracement level of $0.420 will be the next target for bears. Beyond this level, the 62% retracement level at $0.355 could be tagged in a dire scenario.

BLUR/USDT 1-day chart

On the other hand, if Blur price flips the $0.700 hurdle into a support floor, it would invalidate the bearish thesis by producing a higher high. In such a case, BLUR could climb higher to tag the next key psychological level at $1.000.