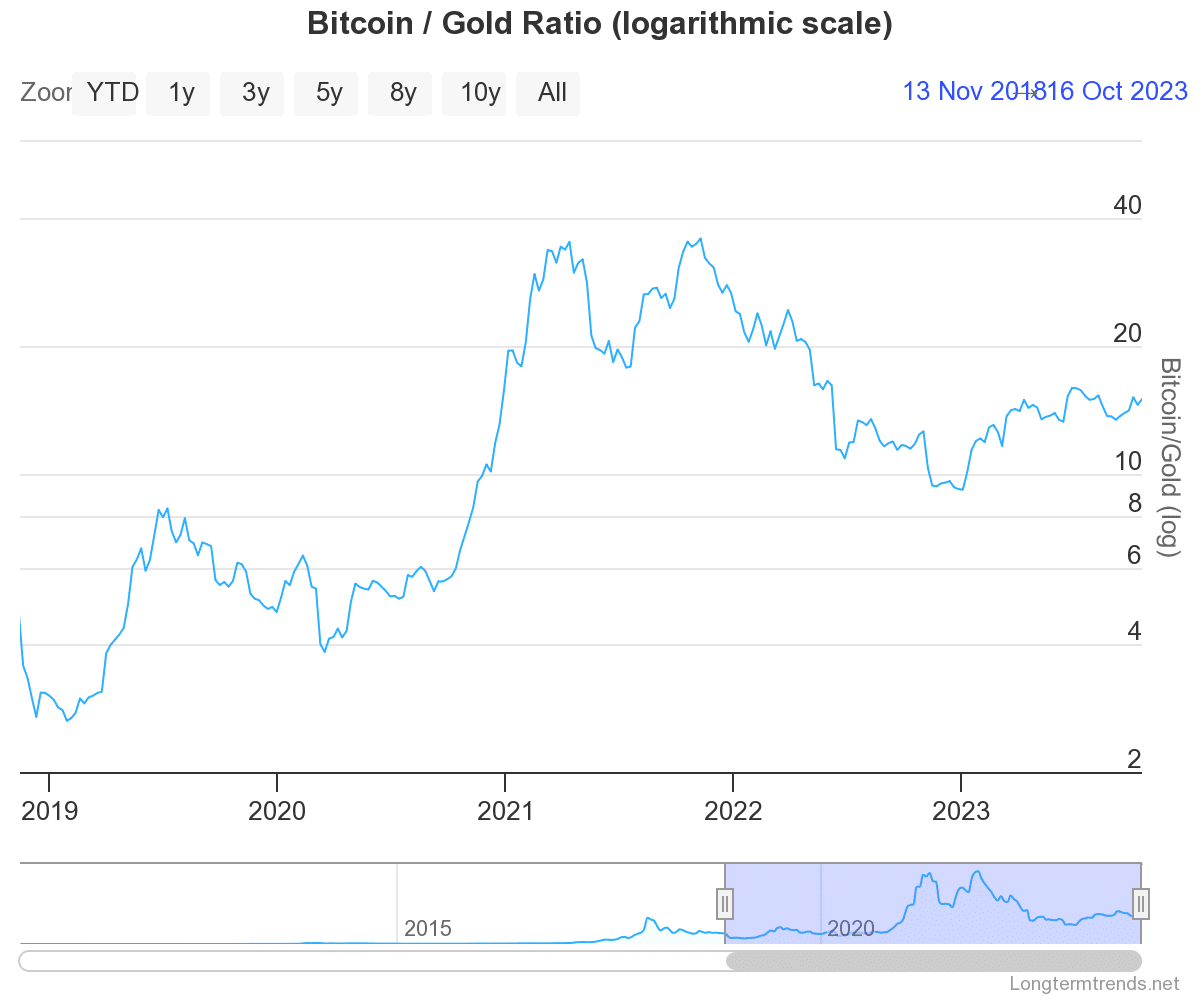

- Bitcoin-to-Gold ratio has more than halved over the past two years.

- Bitcoin is underperforming gold based on the 2023 ratio of 15 against its 2021 figure of 35.

- Fed’s monetary tightening as a response to persistent inflation could propel Bitcoin’s price higher.

The Bitcoin-to-Gold ratio has significantly decreased over the past two years, dropping from 35 in November 2021. The decline in the ratio suggests that gold has outperformed BTC but the impact of the Federal Reserve’s (Fed) monetary tightening, anticipation of the upcoming Bitcoin halving and the potential approval of a spot Bitcoin ETF could change that.

Bitcoin-to-Gold ratio continues to decline

The Bitcoin-to-Gold ratio, a key indicator of how much gold is needed to buy one Bitcoin, has undergone a major decline over the past two years. In November 2021, the ratio stood at 35 but in 2023, this ratio has more than halved to 15. Based on calculations by Longtermtrends, in January 2022, the ratio narrowed from 24 to 9 by year-end during the crypto bear market. In 2023, the ratio has fluctuated between 10 and 15, indicating that it now takes fewer ounces of gold to acquire a Bitcoin, signifying gold’s outperformance over Bitcoin.

Economist Peter Schiff said in a tweet on X, “Maybe #gold traders are finally realizing that while higher #inflation is bearish for bonds, it’s very bullish for gold.”

A monetary policy tightening by the US central bank has sent treasury bill yields to the highest levels since 2007. When inflation is the reason for a rate hike by the Fed, gold and ‘digital gold’ Bitcoin tend to perform better than traditional investment vehicles. However, the narrowing of the Bitcoin-to-Gold ratio signals that gold has performed better than Bitcoin, making it a preferred safe-haven asset.

Analysts also anticipate that uncertainty arising from the Israel-Hamas war could keep Gold’s prices rallying. Crypto analyst Michaël van de Poppe said that Bitcoin could retest the $27,700 level but anticipates an uptick to $30,000 if Bitcoin surpasses the $28,800 mark. At the time of writing, Bitcoin is hovering under the $28,400 mark.

#Bitcoin fighting crucial levels.

A retest around $27,700 would still be possible, while Gold is continuing the upwards run.

Above $28,800 and we’ll be eager towards $30,000 in a matter of time. pic.twitter.com/TK1SiilJxd

— Michaël van de Poppe (@CryptoMichNL) October 18, 2023

Bitcoin awaits comeback with external catalysts

The impact of the Federal Reserve’s decision to maintain or lower interest rates will impact Gold and Bitcoin valuation. While low interest rates are generally seen as positive for Gold because they reduce the opportunity cost of holding the yellow metal, Bitcoin’s price response is dependent on more than one factor.

If the Fed’s monetary policy reflects a response to economic concerns or a recession, it will likely propel Bitcoin’s price higher.

However, there are factors beyond interest rates to consider. There is an impending rally to Bitcoin’s halving event scheduled for April 2024. Meanwhile, the potential approval of a spot Bitcoin ETF by the first SEC deadline on January 10 will likely become a catalyst for Bitcoin. A glimpse of that was seen with recent false ETF approval reports that quickly pushed BTC up by 10%.

This means that if the Fed decides to keep the interest rate high, it creates downward pressure on Gold over time, but Bitcoin can still keep its rally based on other catalysts.

Based on a report by Forbes, markets and policymakers expect that interest rates could go down only by the end of 2024.

Geopolitics and policies also influence price movements for both assets, making the relationship complex. But, based on anticipation around the Fed’s policy decision and catalysts like ETF approval and a potential halving rally, Bitcoin could slowly start recovering its performance against Gold through the next year.