After a gradual uptrend approaching the 100-day and 200-day moving averages, the price has successfully broken above these key indicators, instilling hope and a bullish sentiment in the market.

Currently, Bitcoin is eyeing the pivotal resistance level of $30K.

Technical Analysis

By Shayan

The Daily Chart

Examining the daily chart, the price found substantial support around the $25K region, initiating a healthy uptrend that led to a breakthrough above the critical resistance levels of the 100-day and 200-day moving averages.

This surge in momentum generated increased demand, propelling Bitcoin towards the significant resistance region of $30K, which aligns with the cryptocurrency’s yearly high.

However, this price range acts as a vital psychological barrier where the influence of sellers might temporarily pause the uptrend. Observing Bitcoin’s behavior around this crucial mark in the coming days is essential.

The 4-Hour Chart

Analyzing the 4-hour chart, a clear pattern of higher highs and higher lows is evident. Following this robust upward movement, the price surpassed its descending trendline spanning multiple months and completed a pullback, indicating a continuation of the uptrend with enhanced momentum.

Nevertheless, the price is approaching a substantial resistance zone at the $30K mark, characterized by a significant supply of Bitcoin. If buyers manage to overpower sellers, a sudden breakout could occur, potentially leading to the liquidation of numerous short positions. Conversely, if sellers dominate buyers, the market may face rejection, potentially resulting in a consolidation phase.

Regardless of the outcome, closely monitoring price action in the coming days is imperative.

On-chain Analysis

By Shayan

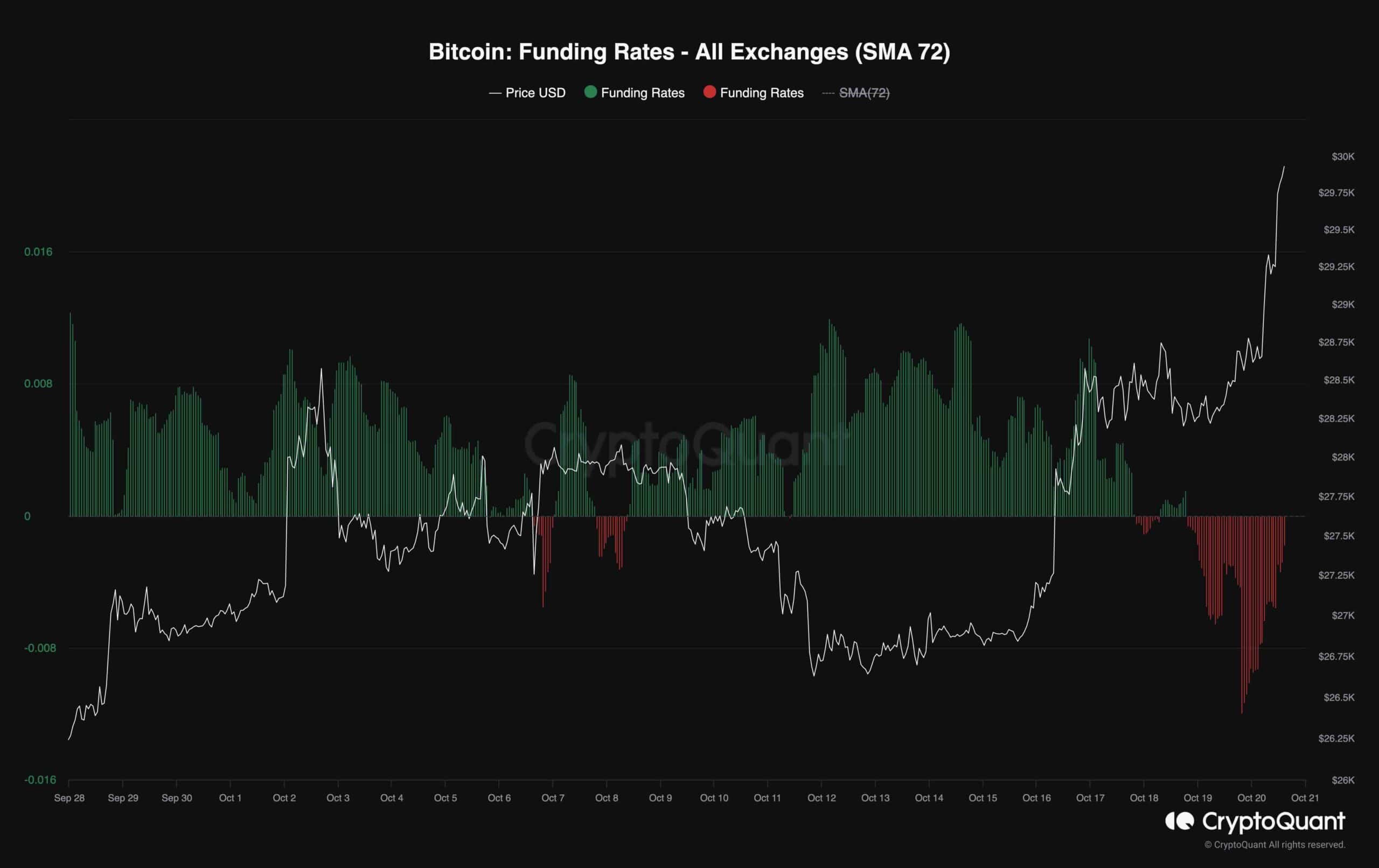

Despite Bitcoin’s recent sharp uptrend, where sellers failed to breach the $25K support region, there’s an intriguing development in the futures market suggesting a potential consolidation correction stage.

The funding rates metric, representing traders’ sentiments in the perpetual futures market, is noteworthy in this context. Positive funding rates signify the dominance of long-position traders, while negative rates indicate the dominance of short-position traders.

At the beginning of the price spike, the funding rates metric stayed above 0, indicating a bullish sentiment. However, recently, amid the impulsive surge in price, the metric has turned negative, signaling the entry of sellers into the market. This shift suggests a possible consolidation correction stage. However, if Bitcoin bulls manage to drive the price higher, there is a possibility of a short squeeze event occurring, resulting in an unexpected spike in prices.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.