- Bitcoin price is attempting to defend the $26,500 support.

- BTC miners seem to be offsetting their losses or paying off their bills to keep their systems running.

- NASDAQ, on the other hand, seemed unbothered by the macroeconomic conditions adding 2.46%, led by Nvidia’s 24% rise.

The concerns regarding Bitcoin price recovery are spreading in the crypto market. Beyond impacting the price of other cryptocurrencies, the bearishness is also reaching miners. The worries surrounding the US debt ceiling are being felt but not reflected in the stock market.

Bitcoin price declines while TradFi booms

Bitcoin price is still in the sub $26,000 levels after observing a 3% decline over the last 24 hours. This has resulted in miners selling their reserves in order to either prevent further losses or to continue to power their systems. In the span of 24 hours, these miners sold nearly 1,000 BTC worth close to $27 million.

Bitcoin miner reserve

At the moment, the US debt ceiling is being hailed as a major reason for the pushback on recovery in the crypto’s price. While the Biden administration and Republicans continue to talk and find common ground, the market suffers from the fear of default. However, on May 25, this fear seemed to have dissipated as the stock market improved.

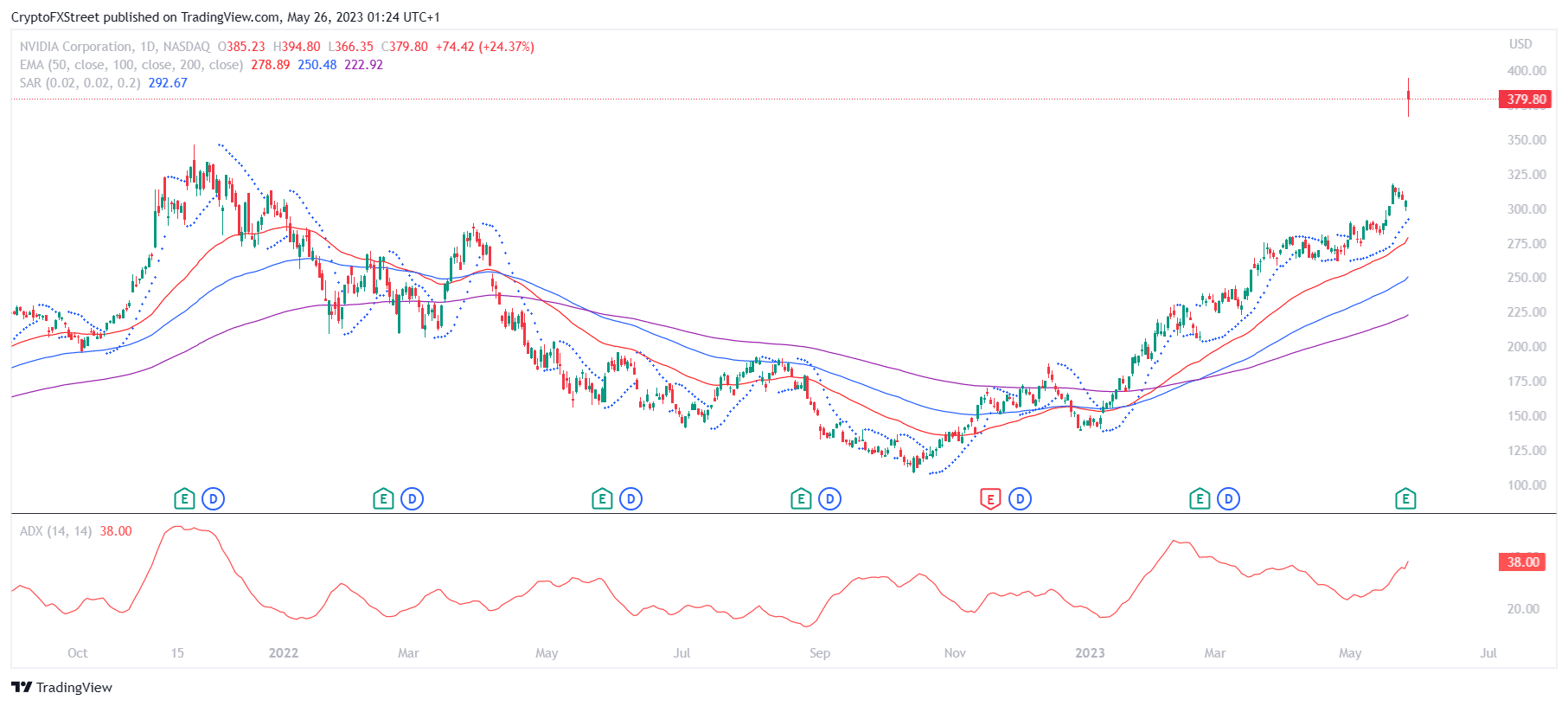

Seemingly unaffected by the adverse macroeconomic conditions, the NASDAQ 100 shot up by 2.46%, hitting a 13-month high of 13,938. This rise was led by Nvidia (NVDA), whose stock prices rose by nearly 24.37%, trading at $379.80.

NVDA 1-day chart

NVDA added nearly $200 billion to its market cap during the intra-day trading hours, which raised eyebrows everywhere. To put this into perspective, the total gain by NVDA on May 25 is four times the amount left in US Treasury’s cash balance of around $49 billion.

Seeing this stellar rise, Crypto Twitter is questioning why Bitcoin did not find the liquidity to benefit from such an increase.

This was explained by analyst CrediBULL Crypto that the liquidity exists in the market as observed in the case of NVDA. And it would not be difficult for the biggest cryptocurrency in the world to find it either, given the crypto space is still small in comparison.

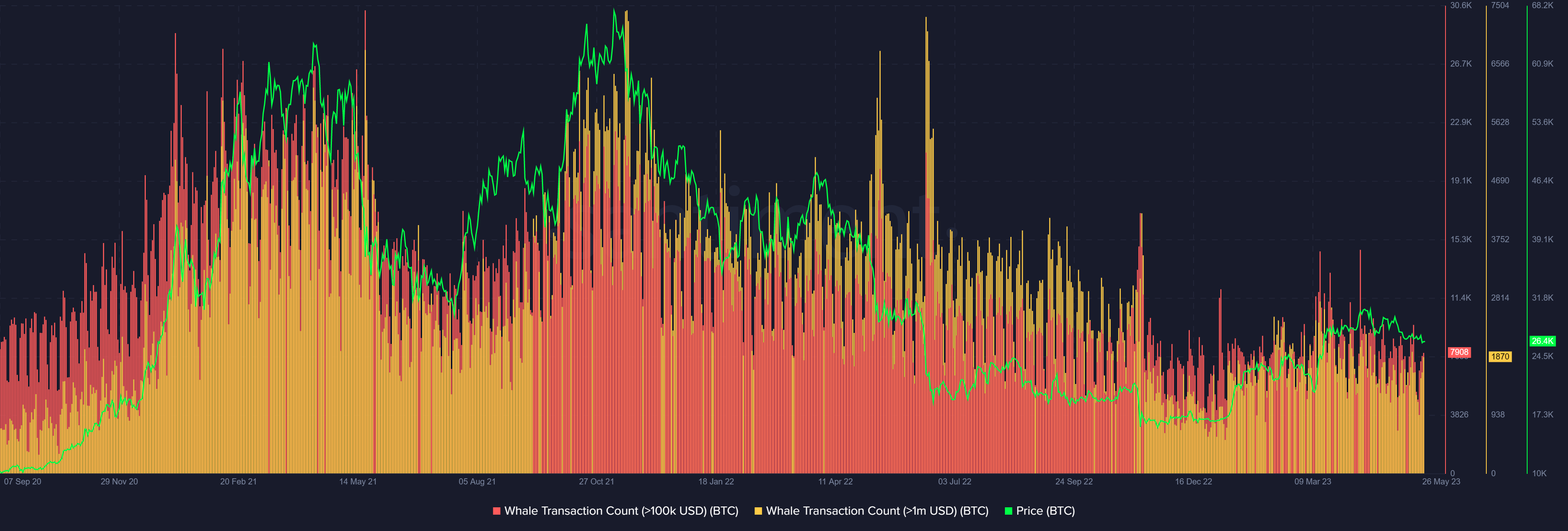

However, the market still needs stimulation from institutional investors and whales since retail investors still operate with fear and caution, pulling back at the first sign of trouble. Besides, Bitcoin whales, for a long while, have been observed as a trigger for a bull cycle.

This was evident back during the 2017 Bitcoin cycle as well when these whales pushed the BTC price to its then-cycle top. The whale activity at the moment is at a two and half year low. The last time it was at this point was back in December 2020, and a rise in the same could prove fruitful for Bitcoin price.

Bitcoin whale activity

Read more – How whale activity fuels Bitcoin cycles: a 2017 vs. 2023 comparison