- The US economy added 150,000 jobs in October, coming in below market expectations of 180,000.

- As the job market cools, the NFP data is likely to drive upside volatility in Bitcoin and altcoins.

- BTC price is hovering around $34,500 at the time of writing.

The US Bureau of Labor Statistics (BLS) released the highly-anticipated Nonfarm Payrolls (NFP) report early on Friday. The economy added 150,000 jobs, 30,000 below the market participants’ expectations.

The US Federal Reserve takes NFP data as input for its decision to hike interest rates or keep them higher for longer. The cooling job market is conducive to a shift in the Fed’s stance and traders’ fears of an interest rate hike are likely to be alleviated.

Also read: Nonfarm Payrolls Quick Analysis: US Dollar set to extend slide as soft-landing scenario takes shape

Bitcoin price reaction to US NFP data for October

The number of Nonfarm Payrolls added in the US economy every month has a key influence on the Greenback and risk assets like Bitcoin and cryptocurrencies. The Federal Reserve scrutinizes jobs and inflation data to determine the need for an interest rate hike, therefore NFP is key to the central bank’s decision as well.

Higher interest rates make borrowing expensive, and this has a negative impact on assets like Bitcoin, where traders use leverage for gains. NFP data therefore tends to induce volatility in Bitcoin and cryptocurrency prices. Still, the impact may be short-lived. The NFP data for October further highlights that the US Federal Reserve may rule out another interest rate hike, as relatively tight financial conditions have dampened the labor market while inflation is slowing down.

Bitcoin price is eyeing a return to the $35,500 level seen on November 2. The asset is currently changing hands at $34,380.

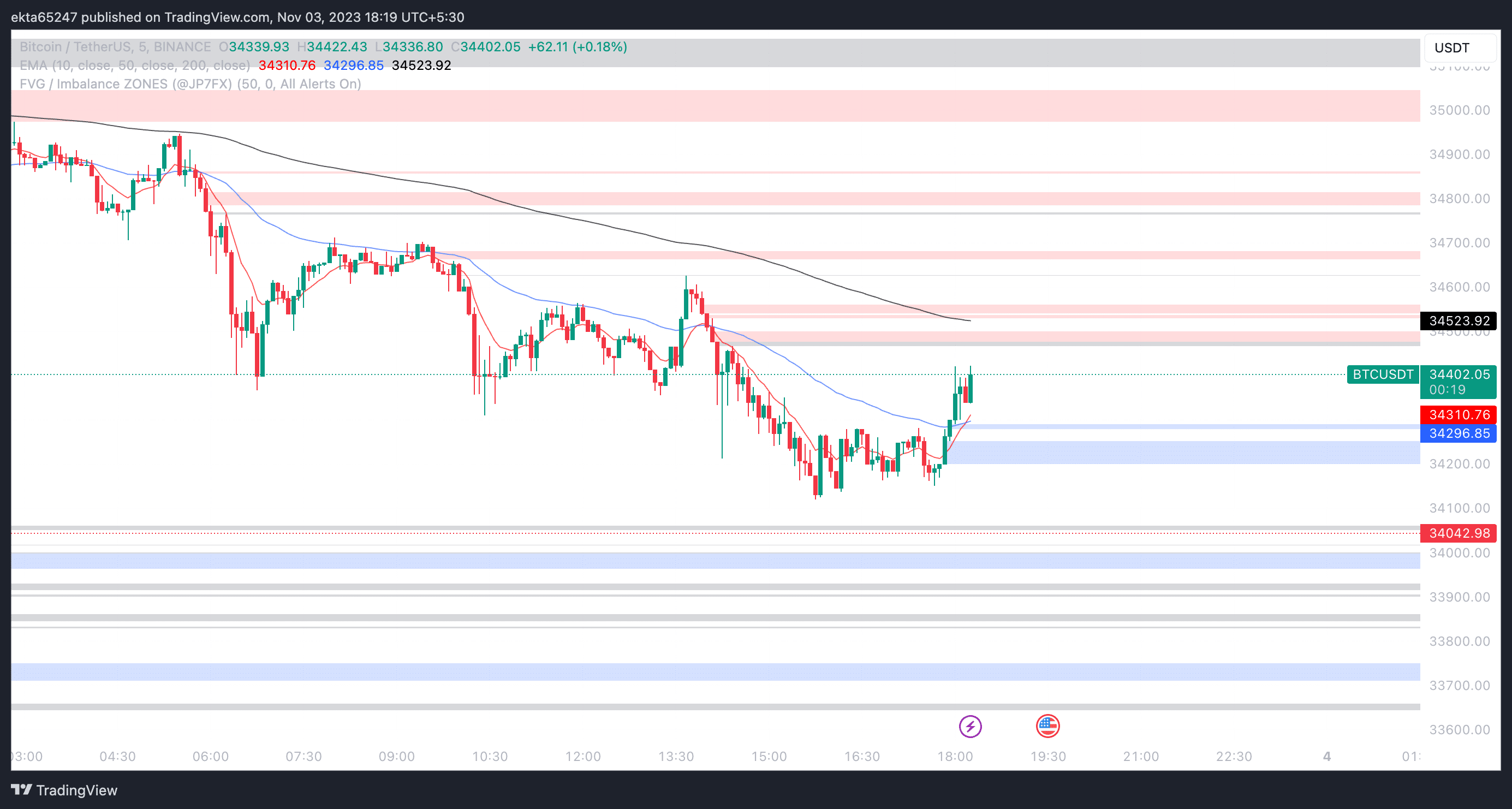

As seen in the price chart below, the $34,466 level, the lower boundary of the Fair Value Gap, is likely to act as immediate resistance for the asset in its uptrend. BTC price could find support at the 10-day Exponential Moving Average (EMA) at $34,325.

BTC/USDT five-minute price chart on Binance

A decline below the 50-day EMA at $34,296 could invalidate the bullish thesis for Bitcoin price.