- Nonfarm Payrolls in the US rose by 187,000 in July, against the expectation of 200,000.

- The reading came in below the market consensus, supporting the likelihood of a recovery in risk assets like Bitcoin and Ethereum.

- An increase in selling pressure on the US Dollar could catalyze a rally in Bitcoin, pushing the asset past the psychological barrier at $30,000.

Bitcoin price is currentlytrading near a six week low. Post the US NFP data release for July, the asset sustained above the 29,000 level, showing likelihood of price recovery in August.

NFP in the US came in below the expectations of market participants, at 187,000 and the Unemployment Rate dropped to 3.5%. The macroeconomic outlook is likely shifting in favor of risk assets, however it remains to be seen whether the selling pressure on the US Dollar rises.

Also read: Breaking: US Nonfarm Payrolls increase 187,000 in July vs. 200,000 expected

Bitcoin remains steady above $29,000, eyes comeback to $30,000

Bitcoin price eyes a comeback to the $30,000 since it consistently declined over the past six weeks. Market participants have been awaiting a catalyst in the asset, like the US Securities and Exchange Commission’s approval of a spot Bitcoin Exchange Traded Fund (ETF). However, US regulatory uncertainty and the regulator’s crackdown on crypto continues, and Bitcoin price is struggling to resume its uptrend.

Amidst the DeFi crisis and regulatory crackdown on crypto exchanges, the US economy added 187,000 Nonfarm Payrolls in July.

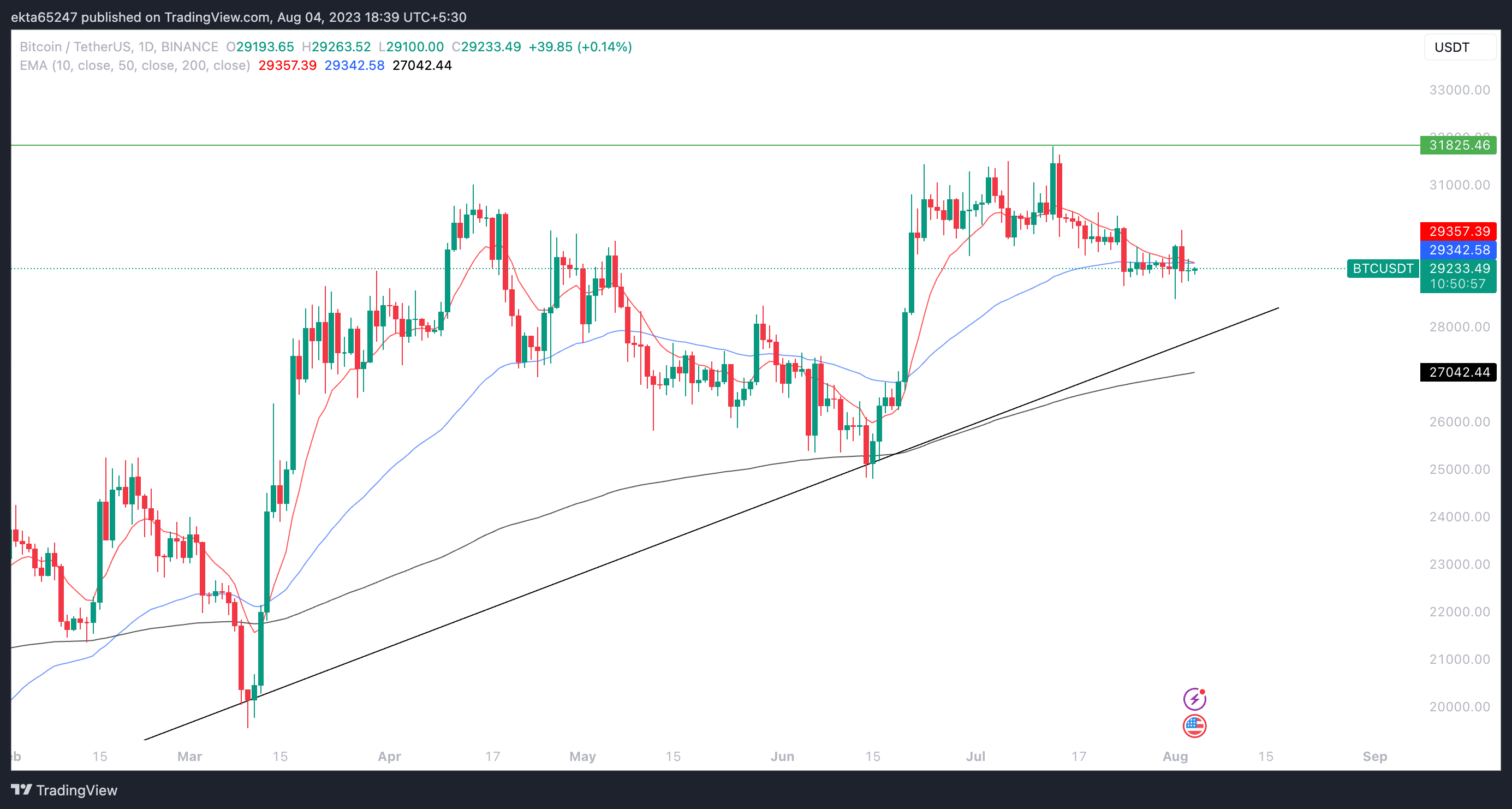

Bitcoin price is in a multi-month uptrend, a definitive close below the $27,700 level would imply a bearish trend reversal is likely. As seen in the price chart below, key resistance for BTC price is the $27,300 level, at the confluence of the 10 and 50-day Exponential Moving Averages (EMAs).

BTC/USDT one-day price chart on Binance

The 200-day EMA at $27,042 is a support for the asset in the event of a decline in BTC price.

At the time of writing, the US Dollar came under modest selling pressure. An increase in selling pressure on the USD could act as a catalyst for risk assets like Bitcoin, Ethereum and altcoins.

NonFarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Like this article? Help us with some feedback by answering this survey: