What a week it’s been. Bitcoin’s price plunged by around 8% throughout the past seven days, which saw the total cryptocurrency market tumble. This comes amid times of considerable geopolitical woes as tension between Iran and Israel continues. Let’s dive in.

Starting off with Bitcoin, it’s currently trading around the $65K mark, down about 8.3% compared to this time last week. But this doesn’t convey the full picture and does the massive volatility BTC went through very little justice.

For context, the primary cryptocurrency started the week trading at around $70K but the bears had other plans. BTC tumbled toward $66K during the weekend and the even more on Sunday evening when it crashed below $62K. The bulls wouldn’t have it and the price had recovered to $66K on the following day, underpinned by considerable volatility.

On Wednesday, the bears made another assault, pushing BTC toward $60K before another recovery. Last night, reports of an explosion in Iran triggered market volatility yet again and Bitcoin dropped below $60K briefly. Iranian officials said they won’t retaliate and the market recovered to where BTC currently trades at around $65K.

A lot of the volatility was caused by the tension between Israel and Iran, with industry observers fearing broader geopolitical conflict.

The total cryptocurrency market capitalization is currently sitting at $2.46 trillion.

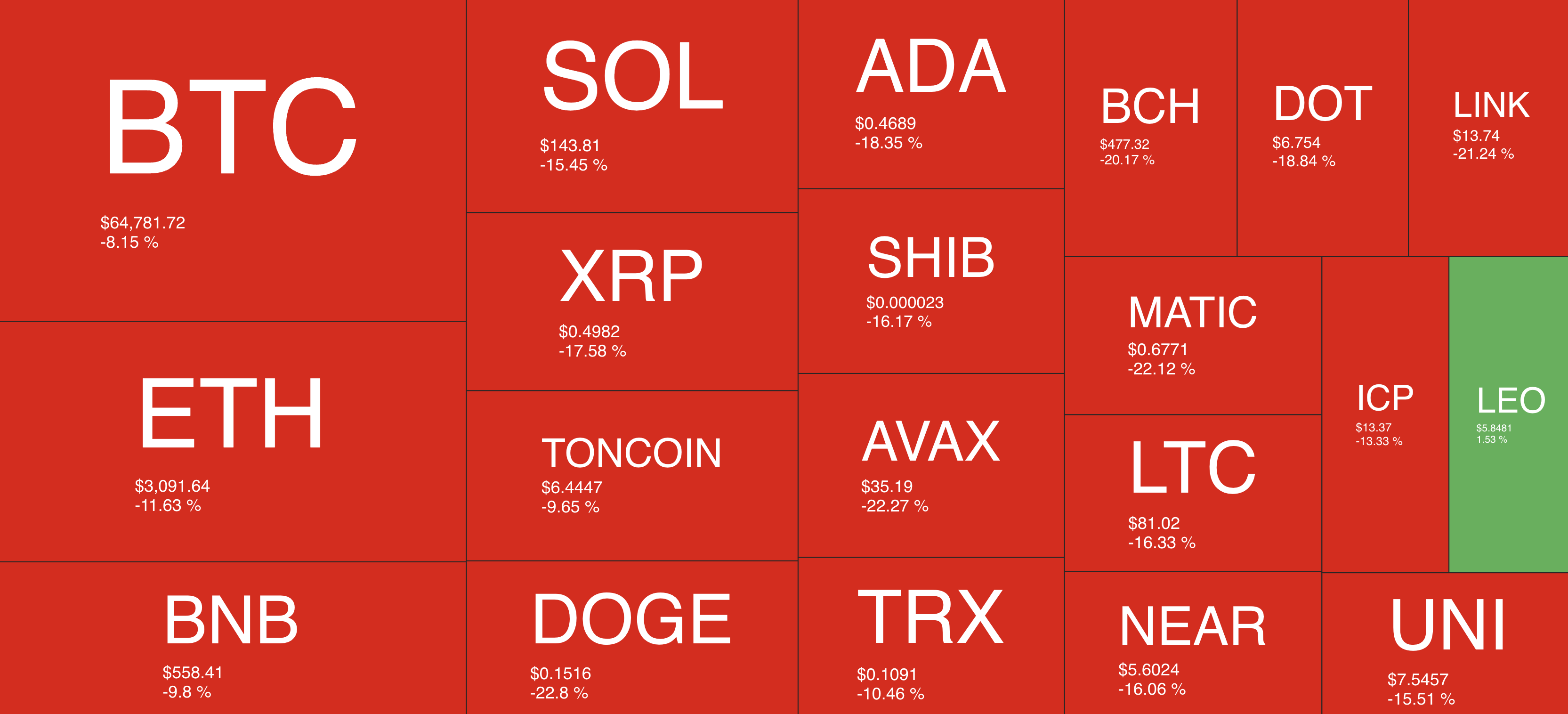

As seen in the heatmap above, the market is covered in red and most of the altcoins are trading at considerable losses.

That said, the Bitcoin halving is supposed to take place during the next few hours. It’s a historically bullish event and it’s interesting to see if it will trigger a much-anticipated and long-awaited bull market.

If one thing is sure, it’s that the weeks ahead are to be interesting in the crypto field!

Market Data

Market Cap: $2.46T | 24H Vol: $134B | BTC Dominance: 51.8%

BTC: $64,751 (-8.3%) | ETH: $3,087 (-12.3%) | BNB: $558 (-9.9%)

This Week’s Crypto Headlines You Better Not Miss

Bitcoin Drops 10% Weekly But Big Players Stay in the Game. Bitcoin’s price has tumbled a lot throughout the past seven days, and many investors are worried about an impending bear market. Big players, however, seem unfazed and continue accumulating.

Why Zero Flows for Spot Bitcoin ETFs Don’t Really Matter. Inflows into spot BTC exchange-traded funds (ETFs) have been the hottest topic ever since the product was greenlighted by the SEC earlier this year. Neutral flows, however, might not have any considerable impact.

Here’s Why Bitcoin (BTC) Will Not Stop at $100K: Arthur Hayes (Live From Token2049). Live from Token2049 in Dubai, Arthur Hayes, the former CEO and co-founder of BitMEX – said that Bitcoin’s price won’t stop at $100K. He outlined a few critical reasons why he shares this belief.

Bitcoin Transaction Fees Overtake Ethereum as Halving Anticipation Grows. As the fourth Bitcoin halving approaches and is currently hours away, transaction fees on the network have overtaken those on Ethereum, highlighting increasing demand but also considerable anticipation.

Binance Set for Indian Comeback with $2 Million Penalty. The world’s largest cryptocurrency exchange is gearing up to make a comeback to the Indian market. It’s reported to operate as a registered entity and to pay a penalty of around $2 million.

Sam Altman’s Worldcoin to Launch L2 Blockchain Prioritizing Human Transactions. Worldcoin, the project co-founded by Sam Altman, who’s also the CEO of Open AI, will be launching its own blockchain as a layer-two solution on Ethereum.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.