After a period of sustained upward momentum characterized by higher highs and higher lows, the price has reached a critical resistance zone where the 100 and 200-day moving averages intersect.

This is a crucial juncture where the price could either undergo a pullback and enter a downtrend or break through the zone and aim for the $30K mark.

Technical Analysis

By Shayan

The Daily Chart

Analyzing the daily chart, Bitcoin went through a consolidation phase around the $25K mark before gaining momentum and entering an uptrend. This bullish move pushed the price towards a significant resistance region at $28K, where the 100-day and 200-day moving averages converge.

Considering the importance of this resistance area, there is a high probability of rejection, leading to a pullback and potentially initiating a sharp downtrend. However, there is a small chance that buyers could hold the price and push it above the moving averages, reinstating bullish sentiment in the market.

Regardless of the outcome, monitoring the price action closely in the coming days is crucial, as increased volatility can be expected in the medium term.

The 4-Hour Chart

Shifting the focus to the 4-hour timeframe, Bitcoin found strong support at $25K after a significant decline. The subsequent uptrend saw the price consistently surpassing previous highs, indicating growing interest among market participants.

However, the cryptocurrency has been trading within an ascending channel and was rejected from the upper trendline, which aligns with the 0.618 Fibonacci retracement level for the third time. This pattern suggests that sellers are dominant and indicates the potential for another downward movement in Bitcoin’s price.

Despite these bearish signals, if the price manages to unexpectedly break through this critical resistance region and shows signs of strength, it could pave the way for a sudden surge toward the $30K mark. The market’s response to these key levels will determine Bitcoin’s short-term trajectory.

On-Chain Analysis

Transaction Count (Mean)

By Edris

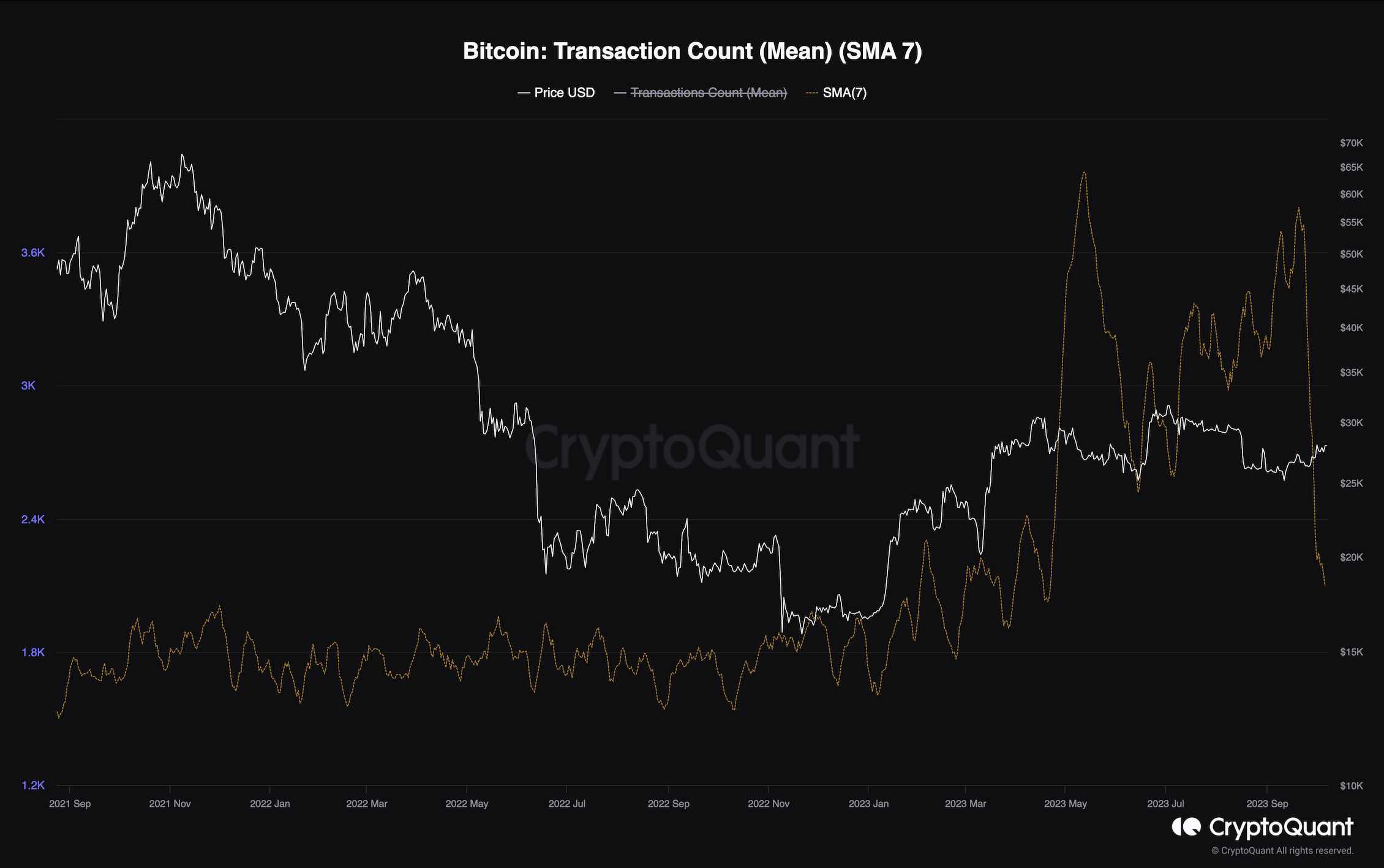

Following the recent bounce in Bitcoin’s price, there has been a significant increase in network activity. The on-chain transaction count is commonly used to measure this activity. Historically, there has been a positive correlation between Bitcoin’s price and this metric, indicating that increases in activity often lead to price rallies.

The chart shows the 7-day moving average of the mean transaction count. This metric has been increasing since the beginning of Bitcoin’s price rise towards $30K. However, there has been a recent sharp drop in transaction counts. This is not a positive sign and could have a negative impact on the market soon. If network activity does not pick up again, the price may experience a decline shortly.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.