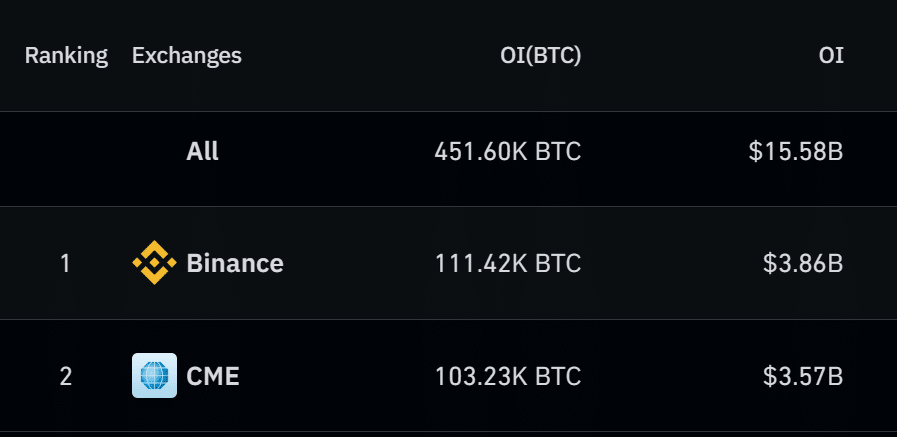

- Binance is facing a challenge from the CME Group as the world’s biggest Bitcoin Futures market, with a difference of just $300 million.

- The increase in institutional interest is one of the biggest contributors to this phenomenon, who are more prone to trade on CME exchanges.

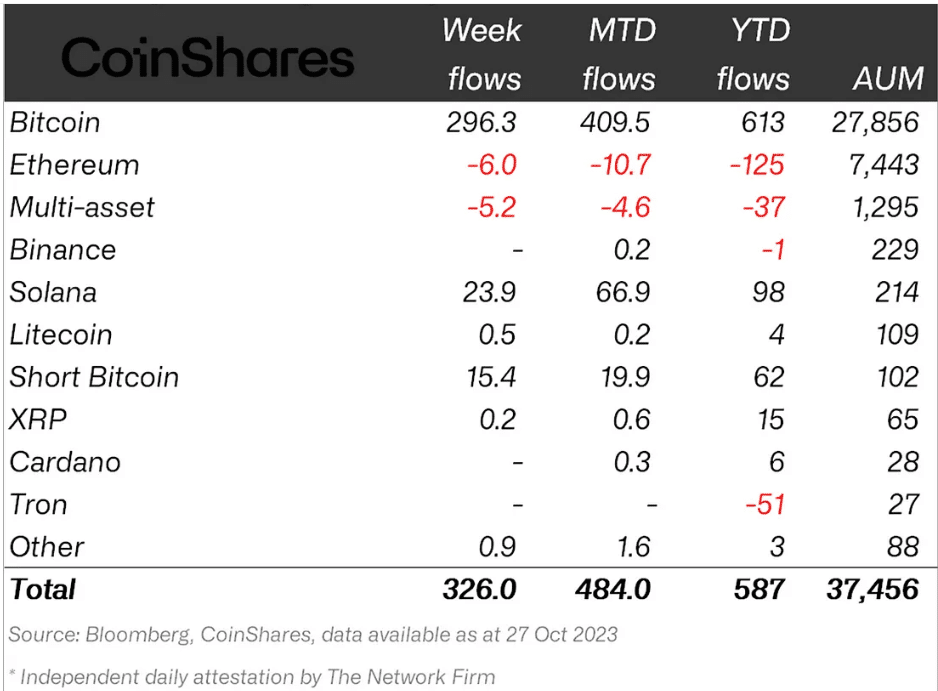

- The past week registered $326 million worth of inflows into crypto products, the highest since July 2022.

The world’s largest derivative market is now close to becoming the world’s leading Bitcoin Futures market as well, potentially replacing Binance. The CME Group is poised to overtake Changpeng Zhao’s company in this regard, given how much institutions are exhibiting interest in Bitcoin at the moment.

Bitcoin receives massive investment from institutions

Over the past week, the crypto market recorded the highest amount of inflows it has since July 2022. According to the Digital Asset Fund Flows report, for the week ending October 27, institutions poured in close to $326 million into digital asset investment products, of which most were received by Bitcoin.

Breakdown of the inflows shows that over 90% of the funds were directed toward Bitcoin, amounting to $296.3 million. The second biggest asset to note the highest inflows of $23.9 million was, surprisingly, Solana and not the second biggest cryptocurrency in the world, Ethereum. Owing to the ongoing Breakpoint conference, SOL is on every investor’s watchlist, whereas Ethereum noted outflows worth $6 million in the same duration.

Institutional investment inflows by asset

The sudden increase in institutional investment is a sign that optimism clearly plays the most important role in determining interest, and the potential of Bitcoin ETF approval is certainly a major driving factor of said optimism.

This could also mean good news for the CME Group

CME goes up against Binance

The CME Group is the world’s leading derivatives marketplace. However, Binance holds the top spot when it comes to the Bitcoin Futures market. CME Group intends to take this away from Binance as it only stands at $300 million below Binance in terms of Open Interest (OI).

Valued at $3.86 billion, Binance OI consists of 111,420 BTC, while CME holds 103,230 BTC worth $3.57 billion at the time of writing.

Total Bitcoin Futures Open Interest

While the next bull market is expected to be influenced significantly and potentially even driven by institutions, this shift in domination would be the first evidence that institutions would choose the safer option of the two since Binance continues to remain at a crossroads with the Securities and Exchange Commission (SEC) in the United States.