Investors believe it is highly likely that the target rate will remain unchanged at the June 14 Federal Open Market Committee (FOMC) meeting, following the U.S. Federal Reserve’s decision to increase the federal funds rate by 25 basis points on May 3. As the battle against inflation in the U.S. rages on, the Biden administration appointed Philip Jefferson as the new vice chair to replace Lael Brainard. The American president stated that his nominees will play a “crucial role” in maintaining price stability and overseeing the country’s financial institutions.

Fedwatch Tool Points to Low Chance of Rate Hike

Just over a week ago, on May 3, 2023, the U.S. central bank raised the federal funds rate to 5.25% after a quarter-point rate hike. Fed chair Jerome Powell was quick to emphasize that inflation was still a major concern and that the FOMC was committed to bringing the inflation rate back down to the 2% target. However, the latest Consumer Price Index (CPI) report, released on May 10, revealed that over the past 12 months, “the all items index increased 4.9%.”

Last Friday was a rough day for the stock market, with the S&P 500, Dow Jones Industrial Average, Nasdaq Composite, and Russell 2000 Index all closing in the red. The crypto economy has also been experiencing a downward trend, while precious metals like gold and silver have been trading sideways.

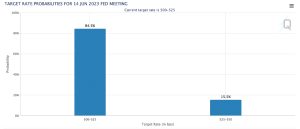

The next FOMC meeting is shaping up to be a nail-biter, with the latest data from the CME Fedwatch tool indicating that there’s an 84.5% chance the interest rate will remain unchanged. However, there’s also a slim chance of a quarter-point rate hike to 5.50%, with the Fedwatch tool showing a probability of roughly 15.5%.

Biden’s New Fed Vice Chair Faces High Expectations

Forbes journalist Simon Moore reports that most policymakers favor keeping interest rates at their current level, according to the latest data from March. However, Moore says a few believe rates should be closer to 6%, and one participant predicts rates will not remain at their current level by the end of the year.

According to the reporter, the question on every market investor’s mind is whether or not the central bank will pivot this year. In addition to the expectations concerning the next FOMC meeting, president Joe Biden has also made some major changes to the Fed’s leadership.

With fresh blood at the helm, many are wondering how this will impact the central bank’s policies and priorities moving forward. Powell will now have a new second-in-command as president Biden appointed Philip Jefferson as the new vice chair. Biden stated that Jefferson was confirmed by the Senate with a strong bipartisan vote of 91-7 and stressed that he looks forward to his “swift confirmation” as vice chair.

Reports suggest that Jefferson is aligned with Powell’s efforts to curb inflation and is unlikely to push back against the Fed’s current policies.

What do you think the appointment of Philip Jefferson as the new Fed vice chair means for the future of the central bank’s policies? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.