- IntoTheBlock noted that the amount of ETH whales has been on the rise recently.

- This ETH accumulation trend among whales could be an indication of trust and confidence in the project as a whole.

- At press time, ETH was worth about $1,814.41 after it experienced a 1.61% price increase in the past 24 hours.

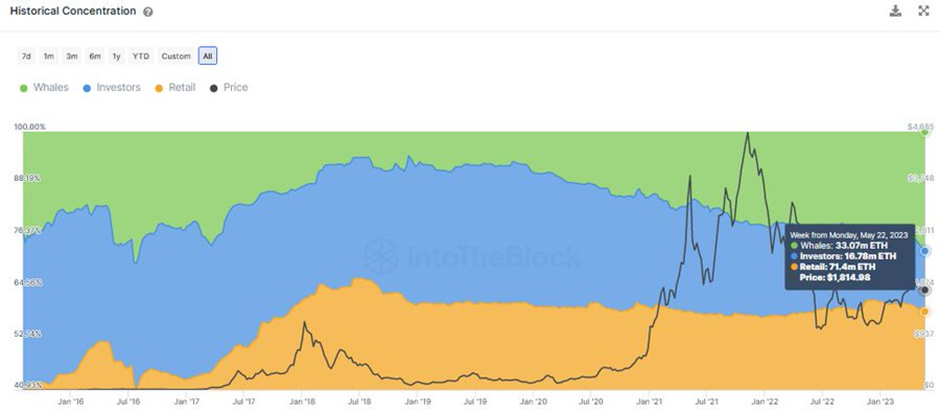

The market intelligence platform, IntoTheBlock, took to Twitter earlier this morning to announce that the amount of Ethereum (ETH) whales is on the rise. According to the post, the collective holdings of ETH whales have surged to 30.07 million ETH, marking a significant increase from 26.56 million ETH recorded earlier this year.

This rise indicates a growing trend of accumulation among addresses holding over 0.1% of the total Ethereum supply. In addition to this, the presence of these large holders suggests potential market confidence and long-term investment strategies within the Ethereum ecosystem.

The fact that whales continue to gather more ETH underscores their belief in the value and future prospects of the cryptocurrency. At press time, CoinMarketCap indicated that ETH was one of the cryptos trading in the green heading into the weekend.

The altcoin market leader was worth about $1,814.41 after it experienced a 1.61% price increase over the past 24 hours of trading. As a result, ETH was trading just below its daily high of $1,817.16.

This price increase also allowed the altcoin to strengthen against its biggest competitor, Bitcoin (BTC), by about 0.71% throughout the past day. In addition, it succeeded in flipping its weekly performance back into the green. At press time, ETH was up 0.29% over the past seven days.

On the other hand, the crypto’s 24-hour trading volume experienced a decrease of more than 20%. As a result, ETH’s trading volume ended up settling at $5,470,852,175 at press time.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss