Ethereum price is still trading below all the key bull market indicators despite Bitcoin’s rally to $30,000 this week. The second-largest cryptocurrency is trading below its $1,600 support/resistance on Thursday and might need to drop further to sweep through fresh liquidity preferably at $1,500 and build the momentum for a rebound.

Addresses On The Ethereum Blockchain Hit 100 Million

Ethereum price might be caught up in the crypto winter but the same does not apply to the network, which has continued to experience significant growth over the last few years.

According to on-chain insight shared by @finelady_p on X (formerly Twitter) and reposted by blockchain analytics firm IntoTheBlock (ITB), “ the number of addresses with a balance has been steadily increasing over the past few years,” affirming the positive outlook for Ethereum, in that, “ there is growing interest in Ethereum and that people are holding onto their ETH for the long-term.”

100.01M addresses on the ETH blockchain!

The ETH blockchain ahs been clearly and obviously have been in the bears with the rest of other cryptocurrencies, but there was a turning point for ETH today.

One great insight from the image is that the number of Ethereum addresses with… pic.twitter.com/tcOZaiYCvv

— €mm¥ (🐳’👑) (@finelady_p) October 18, 2023

Interest in Ethereum has over the last few weeks continued to rise and this can be attributed to the Securities and Exchange Commission (SEC) approving a bunch of Ether futures exchange-traded funds (ETFs) in the US.

“The fact that the number of Ethereum addresses with a balance is increasing and that the price has started to rebound in recent weeks are positive signs for the future of Ethereum,” the X user added.

Santiment, another leading on-chain analytics platform, highlighted that Ethereum addresses belonging to whales in the “billionaire tier (holding at least 1M #ETH)” currently account for 32.3% of the circulating supply and this is the first milestone of this kind since 2016.

Network activity involving these high net worth addresses achieved “transactions valued at more than $1 million on Wednesday, the second highest day in five weeks. According to Santiment, history is unfolding ahead of the anticipated bull run in 2024 and 2025.

🐋 #Ethereum‘s whale addresses in the #billionaire tier (holding at least 1M $ETH) now hold 32.3% of the available supply for the first time since 2016. Yesterday’s transactions valued at $1M+ also had its 2nd highest day in 5 weeks. History is being made. https://t.co/sywdtn14k5 pic.twitter.com/SdbSrChJCf

— Santiment (@santimentfeed) October 17, 2023

ETH Bulls Hunt For Support

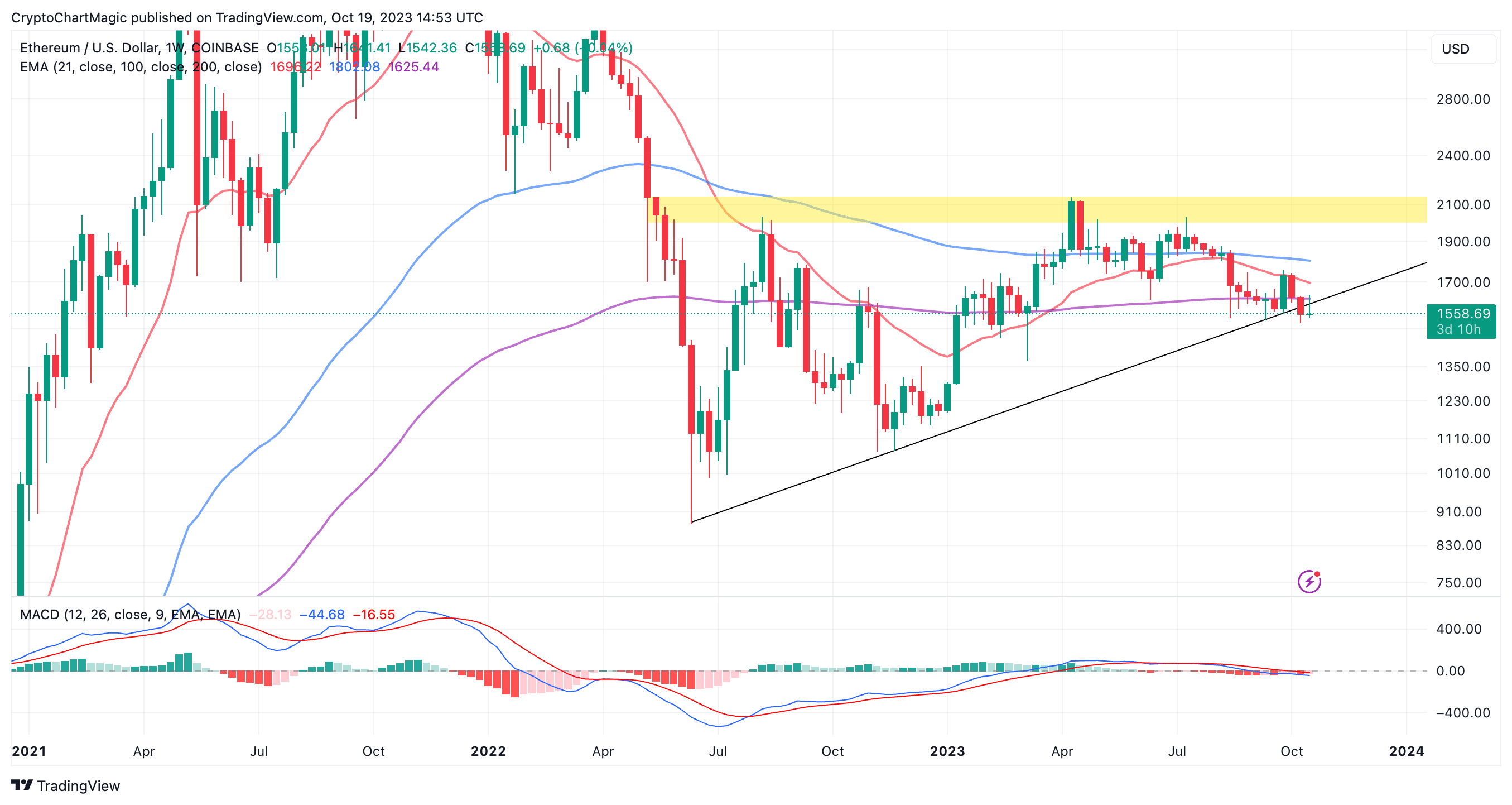

The Moving Average Convergence Divergence (MACD) indicator reinforces the bearish outlook in Ethereum price as it slides into the negative region — below the mean line (0.00).

Traders are bound to seek exposure to short positions in ETH as long as the sell signal holds. In other words, if the blue MACD line holds below the signal line in red.

The position of Ethereum price below the ascending trendline as shown on the weekly chart puts bulls at a significant disadvantage. Therefore, the downtrend might need to extend to $1,500 support to collect more liquidity as more investors buy lower-priced ETH tokens, thus building the momentum for a substantial recovery above $1,600.

On the upside, Ethereum could start to flip bullish after stepping above some of the bull market indicators like the 200-week Exponential Moving Average (EMA) (purple) at $1,625 and the 21-week EMA (red) at $1,696. The subsequent movement above the 100-week EMA could propel ETH to $2,000 and possibly trigger the next bullish phase to $3,000.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: