Ethereum price remains relatively unchanged on Monday. However, ETH bulls displayed a brief but stellar performance over the weekend to the extent, ETH price spiked to $1,765.

The second-largest crypto is down 0.1% on Monday as investors usher in the European session. In addition to climbing into the lower $1,700 range, several buy signals are coming up to validate higher price swings.

Ethereum Price is One Heartbeat Away From $2,000

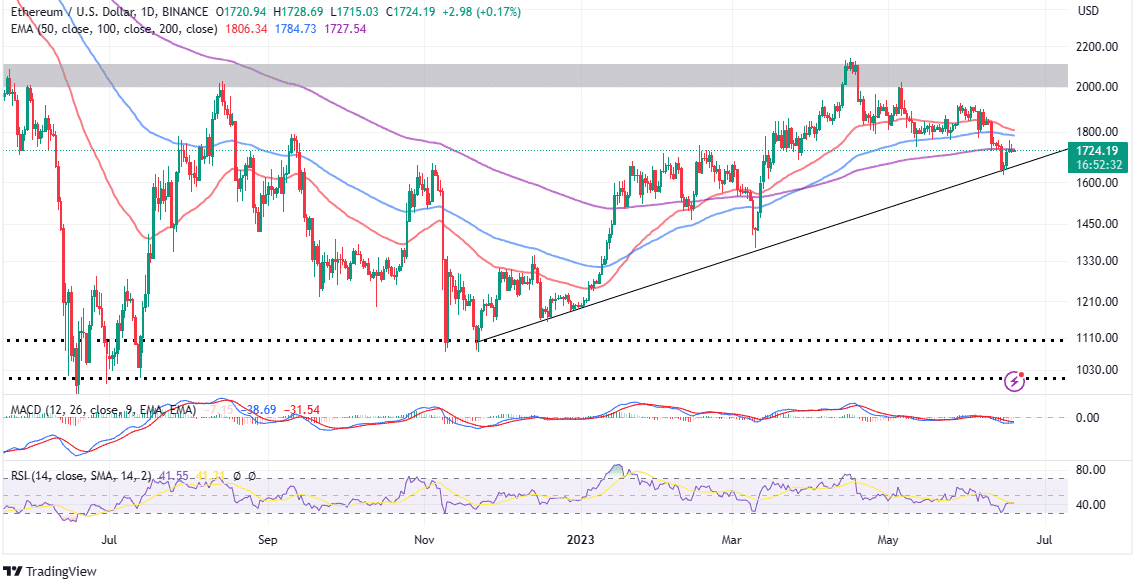

Ethereum price is trading at $1,729 while holding onto short-term support, highlighted by the 200-day Exponential Moving Average (EMA) (in purple). A glance at the daily chart affirms the bulls’ steadiness above a credible ascending trendline.

If support provided by that trendline holds, Ethereum price is bound to wake up stronger, aiming for highs above $2,000.

The path with the least resistance is currently to the upside, aided by a buy signal from the Moving Average Convergence Divergence (MACD) indicator. As the MACD line in blue flips above the signal line in red, price action to $1,800 and $2,000 is quickly becoming apparent.

A similar positive outlook can be observed with the Relative Strength Index (RSI), which now holds above 40. Traders would like to see the RSI above the midline and heading toward the overbought region (above 70) to validate the expected rally to $2,000.

Other key levels and actions to watch out for in the meantime are a daily close above the 200-day EMA at $1,727 followed by the reclamation of $1,800.

On the downside, if push comes to shove, declines under the 200-day EMA must not make it below the ascending trendline. It would be detrimental for Ethereum if this critical support is lost, opening the door for losses targeting $1,450 and $1,200, respectively.

30,000 ‘Ethscriptions’ Debut on Ethereum Blockchain

The emergence of Bitcoin Ordinals was a game changer in the decentralized finance (DeFi) industry, especially for enthusiasts of nonfungible tokens (NFTs). The technology allowed NFTs to be inscribed on the Bitcoin blockchain, thus drastically increasing the network’s utility.

Now, users within the Ethereum ecosystem, have a new Bitcoin Ordinals-inspired method to launch NFTs as well as other digital assets, thanks to a newly released protocol.

According to a report by Cointelegraph, “Ethscriptions,” the new protocol launched on June 17, is the brainchild of Tom Lehman, the co-founder of the site Genius.com.

In a Twitter thread on June 17, Lehman touted the project as an “enormous triumph”, highlighting that nearly 30,000 ‘Ethscriptions’ were generated in the initial 18 hours following the protocol’s activation.

With almost 30k Ethscriptions in

Thank you for seeing the massive potential here!

I am on Ethscriptions 24/7, but I need your help!

DM @proroketh to join our protocol Twitter chat. Ideas, bug reports, NO alpha, NO trading, NERDS ONLY! pic.twitter.com/udKdsVT0L8

— Middlemarch (@dumbnamenumbers) June 17, 2023

Lehman explained that Ethscriptions assets use Ethereum’s “calldata” – the information within a smart contract. This method offers a more cost-effective and decentralized minting process compared to traditional smart contract-based techniques.

As of now, users can only inscribe images, but Lehman assures that future upgrades will permit diverse file types. Currently, one can “ethscribe” any picture as long as it doesn’t exceed 96 kilobytes.

The first venture Lehman launched on the Ethscriptions protocol, known as “Ethereum Punks”, received an overwhelmingly positive reception. The entire lot of 10,000 assets was claimed almost immediately by the community.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.