Ethereum price is on the verge of breaking out and closing in the coveted psychological resistance at $2,000. Interest in the largest smart contracts token has continued to increase with Bitcoin price reclaiming resistance/support at $31,000.

Most traders anticipate a continued bullish action across the market, with ETH following closely in the footsteps of the bellwether cryptocurrency and starting the second recovery phase beyond $2,000 and targeting areas around $2,500 and $3,000 respectively.

Ethereum Price Prediction: ETH On The Cusp of Validating 12% Move

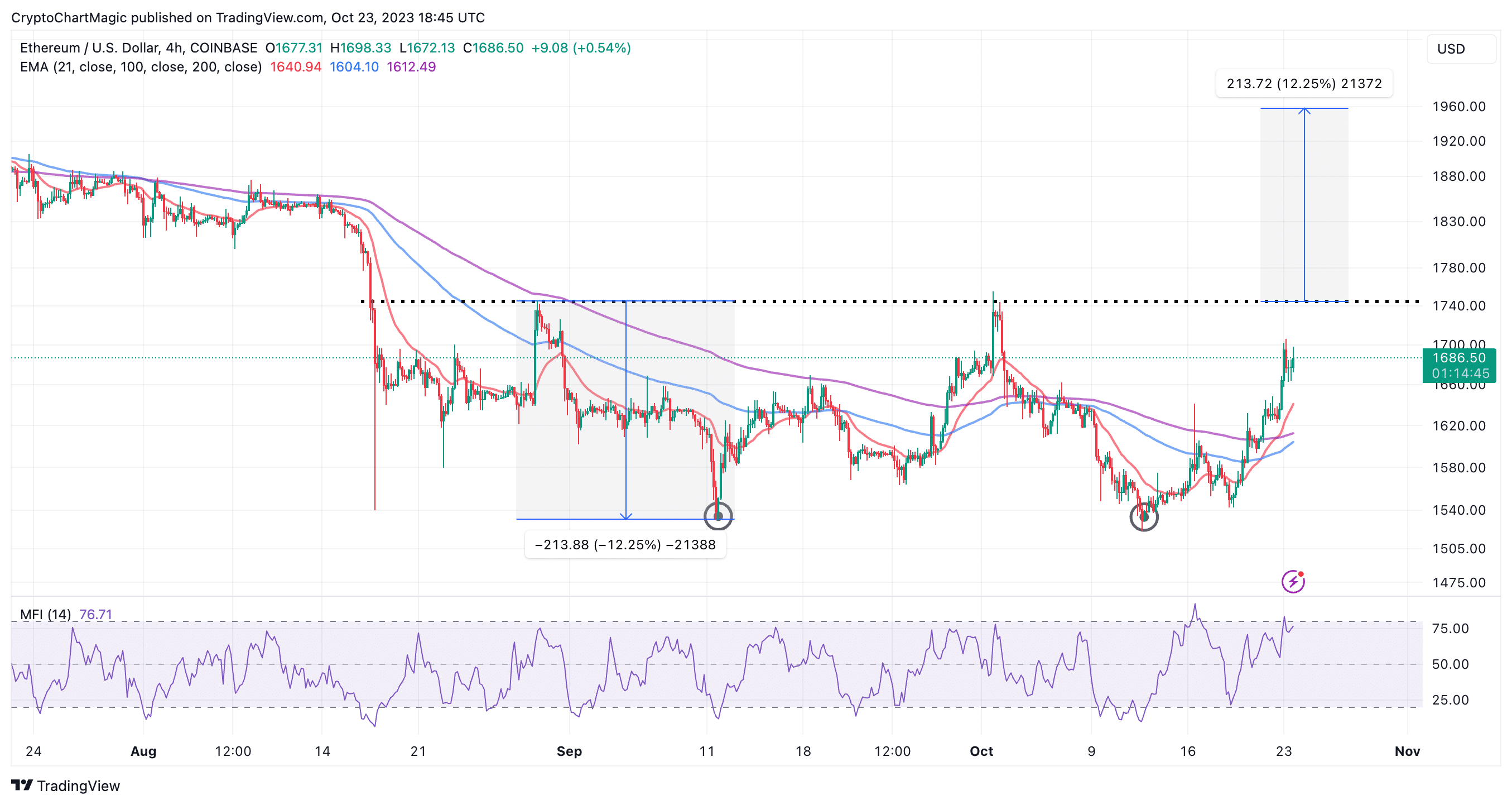

Ethereum completed the formation of a double-bottom pattern following a rebound from support at $1,530, which currently awaits validation at $1,745 (neckline resistance).

The presence of two golden cross patterns formed when the 21-day Exponential Moving Average (EMA) (red) crossed above the 1000-day EMA (blue) and subsequently above the 200-day EMA (purple), hints at the uptrend’s continuation.

If traders keep their buy orders open, they are likely to build momentum for a 12.25% breakout to $1,958. Following the breakout, trading volume is expected to surge significantly as traders seek fresh exposure to Ether above the neckline resistance.

The Relative Strength Index (RSI) with a strength of 75 reveals that Ethereum price is in a position to keep the uptrend intact. However, caution is advised due to the oversold conditions likely to encourage traders to sell ETH to book profits, or protect their capital.

Based on the money floor index (MFI), bulls have the upper hand. This indicator tracks the inflow and outflow of money, hence a persistent increase implies that buyers are in control of the uptrend.

The MFI with a strength of 76 is not yet oversold implying that there is still room for growth. With Ethereum price at $1,690 on Monday, a break above $1,700 is required to secure the uptrend and affirm the bullish outlook to $2,000.

Trading above $2,000 would be a game changer for Ethereum bulls and might be the catalyst the token has been waiting for to start the bull run. On the downside, failure to retain support at $1,670 and $1,630 could trigger another sell-off to $1,550. However, as long as Ethereum holds above all the moving averages, the path with the least resistance will remain to the upside.

Ethereum DeFi TVL Grows To $21 Billion

The transition to the proof-of-stake (PoS) consensus mechanism from a proof-of-work (PoW) protocol opened Ethereum to a whole new decentralized finance (DeFi) world backed by the rise of liquid staking tokens like Lido and Rocket Pool.

Despite the lengthy crypto winter, investors have maintained exposure to DeFi products within the Ethereum ecosystem, which according to data by Defi Llama has a total value locked of $21.27 billion. The ecosystem’s 24-hour inflows increased to $45 million with with $1.49 million recorded as revenue.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: