- Santiment published a tweet earlier today about BTC’s and ETH’s performances against a few other altcoins.

- The post stated that BTC and ETH have been able to stay afloat while many altcoins have continued to print losses.

- In related news, LTC, SRM, RAD, HIGH, and VIDT all experienced price drops over the past 24 hours of trading.

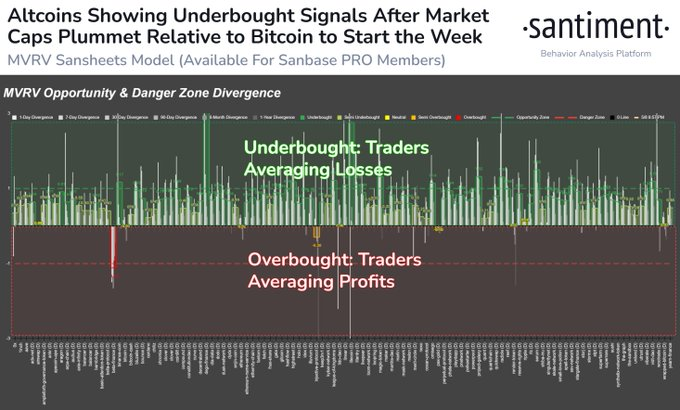

The market intelligence platform, Santiment, shared a post on Twitter today about what has been happening to Bitcoin (BTC), Ethereum (ETH) and a few other altcoins in the market over the past few weeks. According to the post, both BTC and ETH have been able to “stay afloat in their ranges,” while certain altcoins continued to flush.

Santiment’s MVRV model (Source: Twitter)

Santiment also predicted that there could be some buy opportunities for altcoins such as Litecoin (LTC), Serum (SRM), Radicle (RAD), VIDT DAO (VIDT), and Highstreet (HIGH). Traders invested in these cryptos have been suffering in recent weeks, but Santiment forecasted that some buy opportunities may soon emerge as these altcoins are close to bottoming out.

With regards to the two market leaders BTC and ETH, CoinMarketCap indicates that they experienced losses of 1.26% and 0.32% respectively over the past 24 hours. As a result, BTC was trading at $27,643.93 while ETH was worth about $1,847.47.

The last 24 hours were not kind to LTC, as the altcoin was worth $78.78 at press time after a price drop of more than 3%. This succeeded in pushing LTC’s weekly performance even more into the red at -10.05%.

Things did not go much better for SRM and RAD as both of the altcoins experienced 24-hour losses of more than 10%. At press time, SRM was worth $0.08496 while RAD was trading hands at $2.62.

Both VIDT and HIGH also suffered losses of more than 4% throughout the past day. VIDT was outperformed by BTC and ETH by about 3.80% and 4.79% respectively, while HIGH had weakened against BTC by 3.60% as well as ETH by 4.57%.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.