Bitcoin (BTC) has been trying to break above the $27,500 resistance for the past week, but to no avail. One of the reasons limiting Bitcoin’s upside is the risk of an eventual U.S. default as the government struggles to get the debt limit increase approved in Congress.

Still, some analysts and investors argue that the U.S. debt ceiling standoff is merely a “show” because, ultimately, additional money will hit the markets.

The US Debt Ceiling talks are all show.

They’re going to print the dollar into oblivion.

You need to own hard assets to protect your wealth.#Bitcoin is the fastest horse in the race.

— MacroJack (@macrojack21) May 17, 2023

Notice how MacroJack correlates Bitcoin’s digital scarcity to the next logical step: additional inflationary pressure. The stimulus measures, meaning, increasing the government debt limit, might initially sound positive because they avoid a default and favor more economic activity. However, the unintended consequences are future budget constraints as the debt interest payment increases.

Bitcoin price increases while gold breaks a 45-day low

Bitcoin’s gains above $27,000 happened while gold traded down 2.5% from May 15 to May 18, reaching its lowest level in 45 days at $1,970. Meanwhile, the U.S. Dollar Index (DYX), which measures the currency against a basket of foreign exchanges, reached its highest level in 2 months on May 18, meaning the U.S. currency gained strength relative to its global peers.

This data should not be interpreted as a vote of confidence in the government’s ability to avoid a shutdown, as the global economy would be negatively impacted in the event of a U.S. debt default. For instance, Eurozone members hold $1.54 trillion in U.S. Treasuries, followed by Japan’s $1.1 trillion, China’s $860 billion and the United Kingdom’s $668 billion.

Strong macroeconomic data explains the resilience of equities markets

While the global economy may deteriorate in the coming months, recent macroeconomic data has been mostly positive, causing the S&P 500 index to hold modest gains in May, standing merely 13% below its all-time high.

For instance, China’s retail sales grew 18.4% year-over-year in April, while the Eurozone’s first quarter gross domestic product increased by 1.3% versus the previous year. In the U.S., retail sales rose 0.5% year-over-year in April, slightly lower than expected but far from being a recession indicator.

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioned in the current market environment.

Bitcoin margin and futures favor bullish momentum

Margin markets provide insight into how professional traders are positioned because they allow investors to borrow cryptocurrency to leverage their positions.

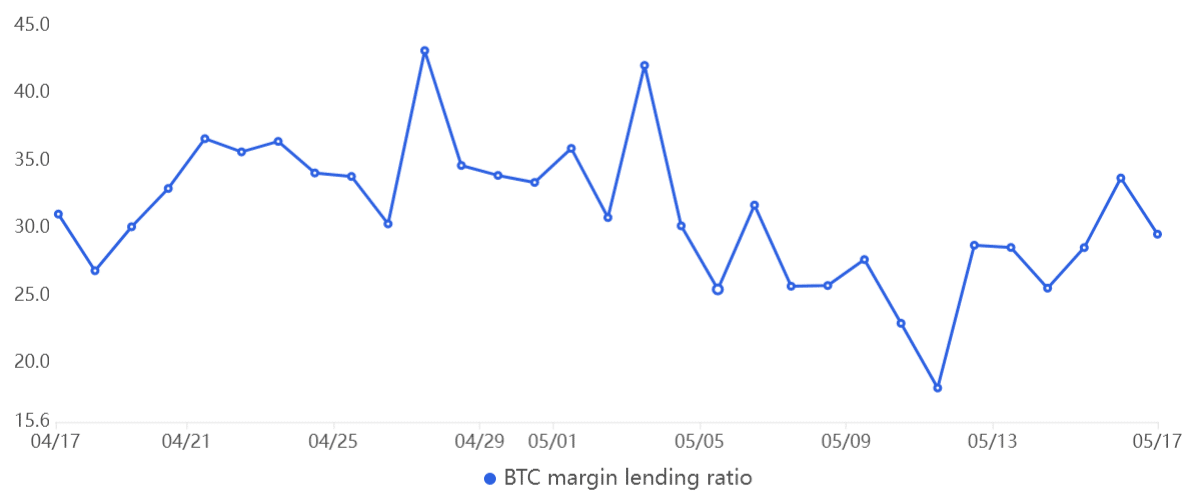

OKX, for instance, provides a margin lending indicator based on the stablecoin/BTC ratio. Traders can increase their exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only bet on the decline of a cryptocurrency’s price.

The above chart shows that OKX traders’ margin lending ratio increased between May 12 and May 17. Such data coincides with Bitcoin’s price recovery in the period, although it is not troublesome as the current 31 margin lending ratio nears its 30-day average.

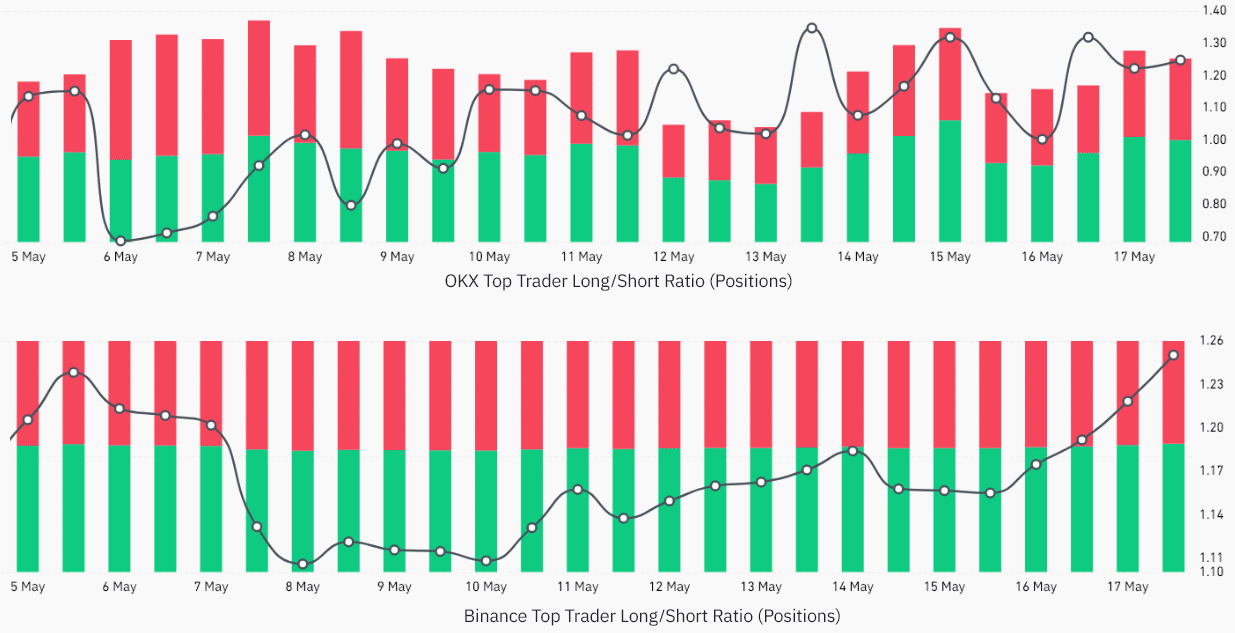

Investors should also analyze the BTC futures long-to-short metric, as it excludes externalities that might have solely impacted the margin markets. There are occasional methodological discrepancies between exchanges, so readers should monitor changes instead of absolute figures.

Despite Bitcoin trading down 8% since May 5, pro traders have recently increased their bullish positions to their highest level in two weeks, according to the long-to-short indicator.

For instance, the ratio for OKX increased from 1.08 on May 12 to 1.25 on May 18. Meanwhile, at crypto exchange Binance, the long-to-short ratio increased from 1.14 on May 12 to the current 1.25.

Related: Bitcoin price capitulation below $26K possible as Friday’s BTC options expiry looms

Bitcoin bulls are in a better position as there has been weak demand from short-sellers and no sign of excessive leverage from buyers. In other words, Bitcoin’s market structure is bullish, so odds favor a rally toward $28,000 if the U.S. debt ceiling stand-off continues.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.