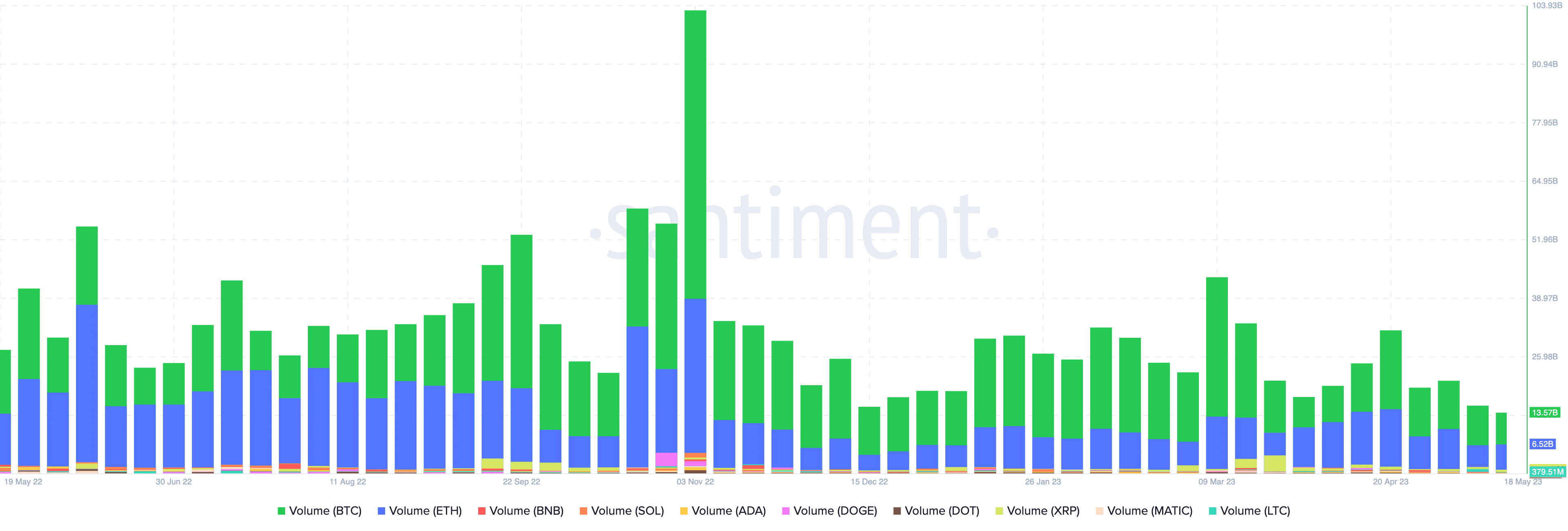

According to a report by intelligence portal Santiment, top digital assets like XRP, BTC or Cardano (ADA) are experiencing their lowest combined trading volume in over a year. This decline in trading activity is particularly noticeable among altcoins, which have seen a significant decrease in their trading volume.

The report highlights that even when considering the trading volumes of only Bitcoin and Ethereum (ETH), the figures are the second lowest recorded since September 2019. The dwindling trading volumes indicate a lack of investor participation and enthusiasm on the market.

“Sell in April”

One notable trend mentioned in the report is the drying up of trading volumes since the beginning of the March price rally. While the crypto market experienced a surge in prices during this period, the trading volumes failed to keep up, raising concerns among market participants. It appears that the market has been preparing for the age-old adage, “sell in May and go away,” as early as April.

The decline in trading volume can have several implications for the cryptocurrency ecosystem. Low trading volumes suggest reduced liquidity and increased price volatility, making it challenging for traders to enter and exit positions with ease. Furthermore, it may indicate a lack of confidence among investors, as they refrain from actively participating in the market.