- In his recent YouTube video, Dan Gambardello shared some of his expected targets for ADA.

- The trader also explained that although he expects the price of ADA to drop soon, he does not disregard ADA’s potential for a move up.

- At press time, ADA was trading hands at $0.365 after a 0.06% price decrease.

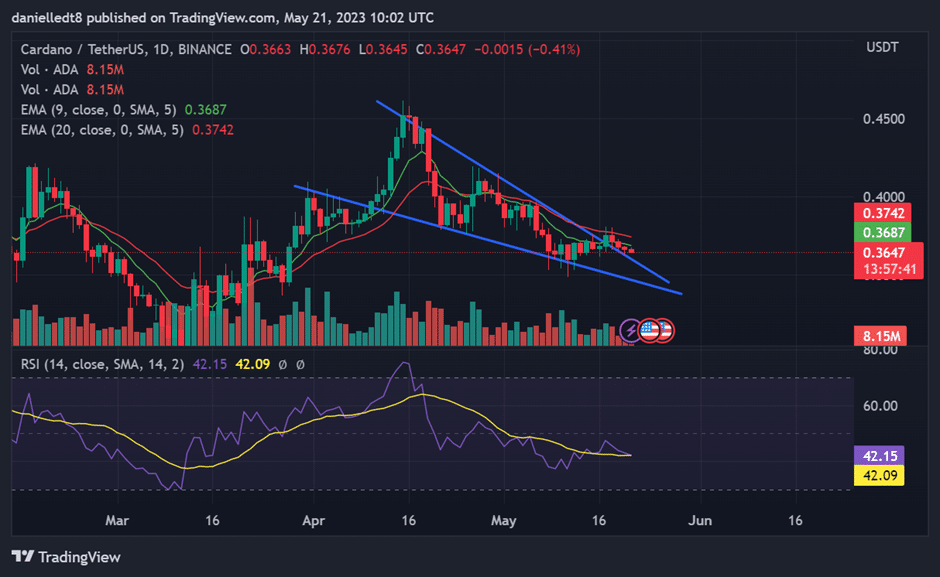

Yesterday, the popular crypto trader and analyst, Dan Gambardello, shared some of his targets for the price of Cardano (ADA) in his latest YouTube video. According to Gambardello, ADA has been stuck in a prolonged period of sideways price action, causing frustration among investors.

He added that ADA’s chart formed a large red rectangle, symbolizing nine months of consolidation with a narrow price range between $0.44 and $0.30. While the altcoin’s price broke out of this range, it quickly retreated back into it. He did, however, add that this extended period of sideways movement is not uncommon during bear market transitions.

From a technical analysis standpoint, Gambardello pointed out that ADA’s daily chart revealed a recent breakout from a falling wedge pattern. Despite this, the Ethereum-killer’s price was struggling to surpass the 20-day moving average resistance.

Gambardello then highlighted the fact that there is a critical support level around $0.35, and a break below this level could lead to further downside towards the $0.33 range. Such a move would represent a significant decline, potentially around 9% to 10% from the current price level.

However, Gambardello did not cast aside ADA’s potential for an upside move. If Cardano manages to find support and bounce back, the trader believes that the immediate target would be around $0.44 to $0.45. Zooming out, there is still a larger bullish scenario at play, according to him, with a potential target of $0.70 or higher in the long term.

At press time, ADA was trading hands at $0.365 after a 0.06% price decrease over the past 24 hours. ADA’s weekly performance was also in the red and stood at -0.70%.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.