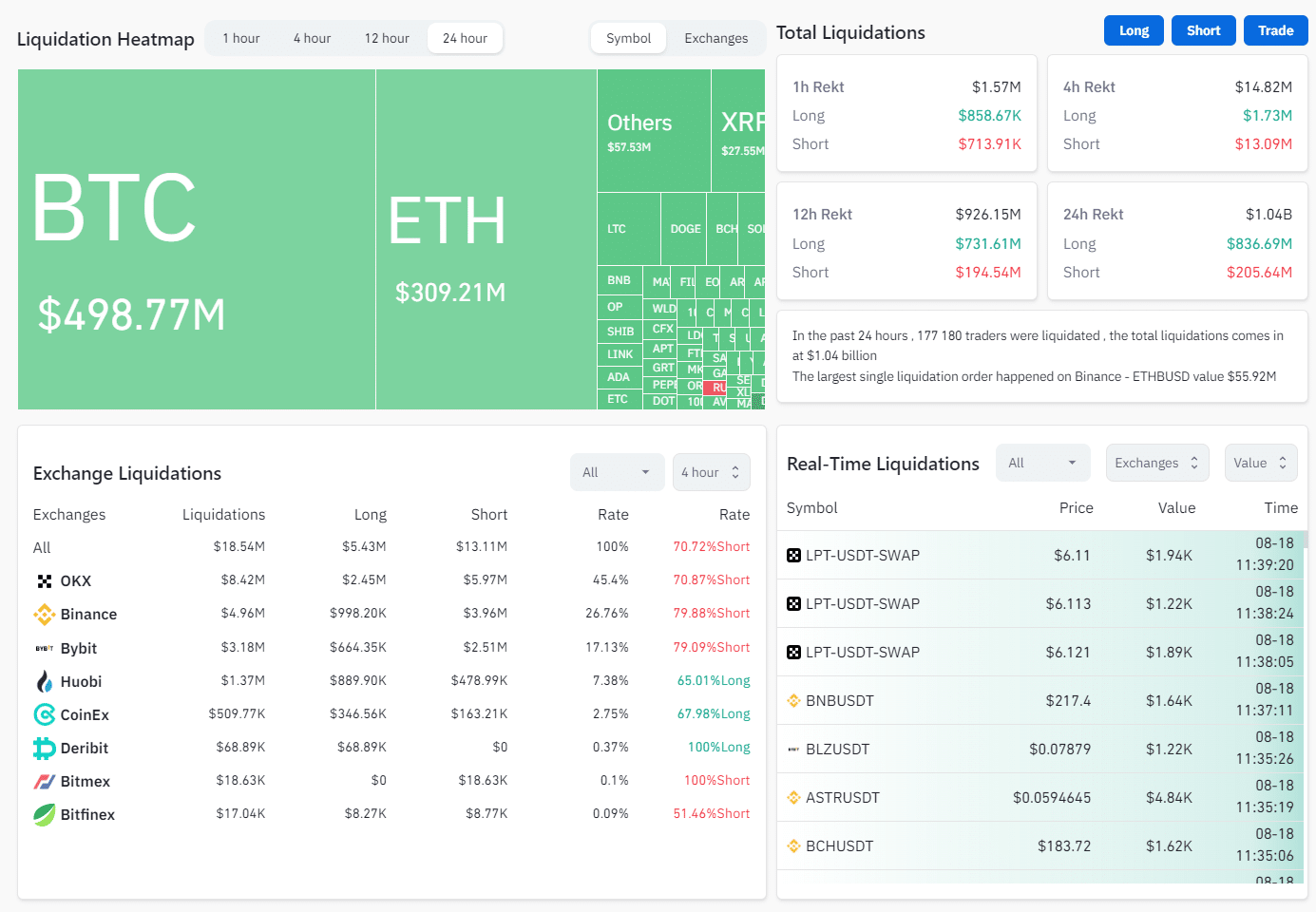

The cryptocurrency market has been in turmoil, with a staggering $1 billion in liquidations occurring in the past 24 hours. Even more alarming is the fact that 90% of these liquidations took place within the last 12 hours, indicating a rapid and severe market downturn. This event marks the most significant two-sided liquidation in at least the past four months, and possibly even longer.

Bitcoin (BTC), the flagship cryptocurrency, has not been spared from the market’s wrath. Currently trading at $26,439, BTC has experienced significant volatility, reflecting the broader market’s instability. The sudden and sharp decline in Bitcoin’s price can be attributed to the massive liquidations, as traders and investors scramble to exit their positions.

The sheer magnitude of these liquidations is reminiscent of the extreme market volatility seen during the early days of the cryptocurrency industry. However, the current situation is unique in that it represents one of the largest two-sided liquidation events in recent history. Such events typically occur when both long and short positions are forcibly closed by exchanges due to insufficient collateral, leading to a cascade of selling pressure.

The reasons behind this massive correction are multifaceted. External factors, such as global economic uncertainties, regulatory pressures and macroeconomic indicators, play a role. However, the internal dynamics of the cryptocurrency market, including high leverage trading and speculative behavior, have amplified the effects of these external factors.

Bitcoin’s price performance serves as a barometer for the overall health of the cryptocurrency market. Its decline, coupled with massive liquidations, paints a picture of a market in distress. However, it is essential to note that the cryptocurrency industry is known for its resilience. While short-term price fluctuations can be severe, the long-term potential and value proposition of cryptocurrencies remain intact.