- Robinhood app will not feature Solana, Cardano, and Polygon after Tuesday, June 27, 22:59 GMT.

- The decision follows the SEC’s move to label these tokens as securities in the Binance and Coinbase lawsuits.

- While the fate is similar for the three altcoins, ADA and SOL seem to be taking the brunt of it.

Robinhood app users only have a few hours before three cryptocurrencies are delisted from the financial services company following a clampdown by the US Securities and Exchange Commission (SEC) on two giant cryptocurrency exchanges, Binance and Coinbase. While the brokerage firm prepares for this transition, other institutional investors continue to leverage the Exchange Traded Fund (ETF) hype with new applications.

Also Read: Fidelity Investment set to file for spot Bitcoin ETF following BlackRock’s lead

Robinhood app to delist Cardano, Polygon and Solana

Robinhood announced plans to delist three altcoins by June 27, meaning investors only have hours to buy, sell, or hold the three tokens. This comes after the US SEC deemed these tokens to be securities in the crackdown against Binance and Coinbase exchanges.

During the labeling, the SEC alleged that the following crypto assets traded on Binance’s exchange platform are securities:

Binance Coin (BNB), Binance USD (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos Hub (ATOM), Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS) and COTI (COTI)

In response to the branding, Robinhood’s legal chief and former SEC commissioner, Dan Gallagher, informed Congress during a presser with Bloomberg that the platform was reviewing the SEC’s analysis to determine whether any actions needed to be taken.

Fast forward 18 days, Robinhood’s timeline is due, and Cardano, Polygon, and Solana face an expected fate. It is worth mentioning, however, that the deadline closing in does not compel investors to sell their ADA, MATIC, and SOL holdings. Instead, they can be sent to different wallets or cryptocurrency firms. Once the remaining time elapses, any leftover tokens will be sold and credited automatically.

Meanwhile, the three tokens continue to suffer the brunt of regulatory clampdown and the ripples of the prolonged bear market. Consequently, while other altcoins enjoy the overflows of the recent Bitcoin (BTC) rally, Cardano and Solana are suffering the worst of it, as indicated in the daily chart below.

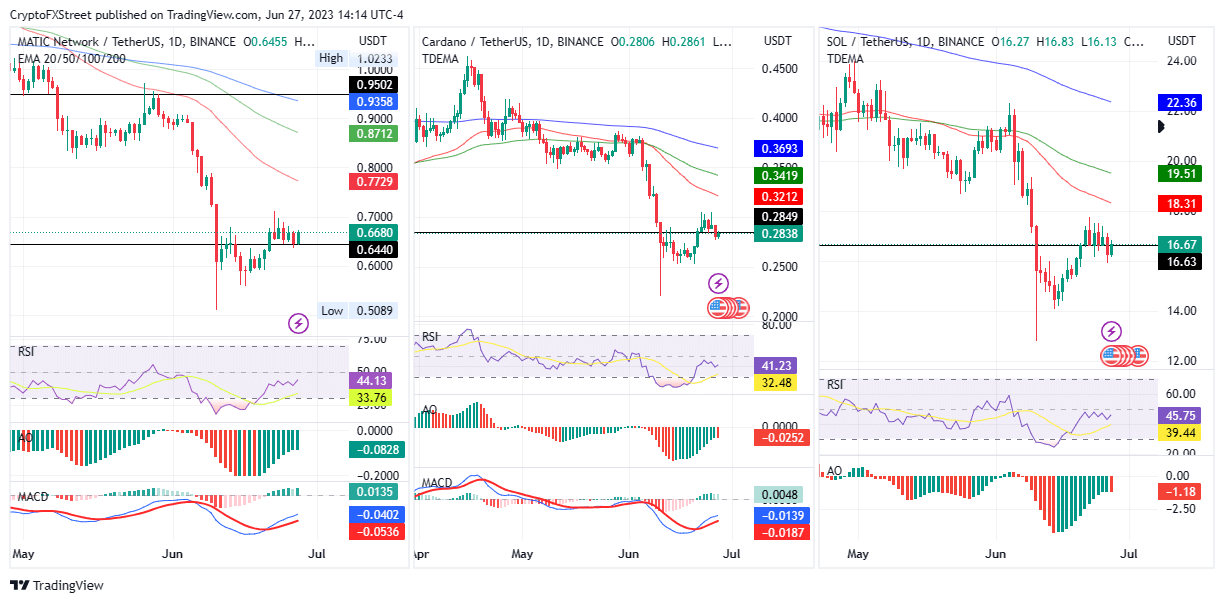

MATIC/USDT 1-Day Chart, ADA/USDT 1-Day Chart, SOL/USDT 1-Day Chart

Polygon price is holding above the critical support above $0.64 while Cardano and Solana price have flipped their support levels into resistances at $0.28 and $16.63, respectively.

Similarly, while bears still dominate the market for the three altcoins, the Awesome Oscillator (AO) indicators show that MATIC bulls are steadily gaining ground while ADA and SOL bears continue to overpower the bulls.

At the time of writing, Polygon, Cardano, and Solana are auctioning for $0.66, $0.28, and $16.67, respectively. This represents an hourly drop of 0.23% and 0.07% for MATIC and SOL, while ADA boasts a 0.15% increase on the hour.

Robinhood delisting ADA does not stop Vodafone from expressing interest in the Cardano ecosystem

Recently, Vodafone has expressed interest in Cardano’s non-fungible tokens (NFTs). The giant telecommunications company hinted at this integration in a tweet.

The speculation was invigorated by one of the Cardano NFT project NMKR’s developers, Patrick Tobler, who commented on the cryptic message. The developer’s comment vaguely pointed to Vodafone using NMKR to mint NFTs.

One of Vodafone’s employees, Twitter user @Mantax, has confirmed the purported foray in a tweet.

Nevertheless, while details remain unclear, the recent move by traditional companies to show interest in blockchain technology and digital assets bodes well for cryptocurrency prices, sparking excitement and speculation that translate into buying momentum.