- Cardano, Polygon and Arbitrum holders have emerged as some of the biggest losers.

- Following the recent crash in these tokens, more than 95% of the investors are facing losses.

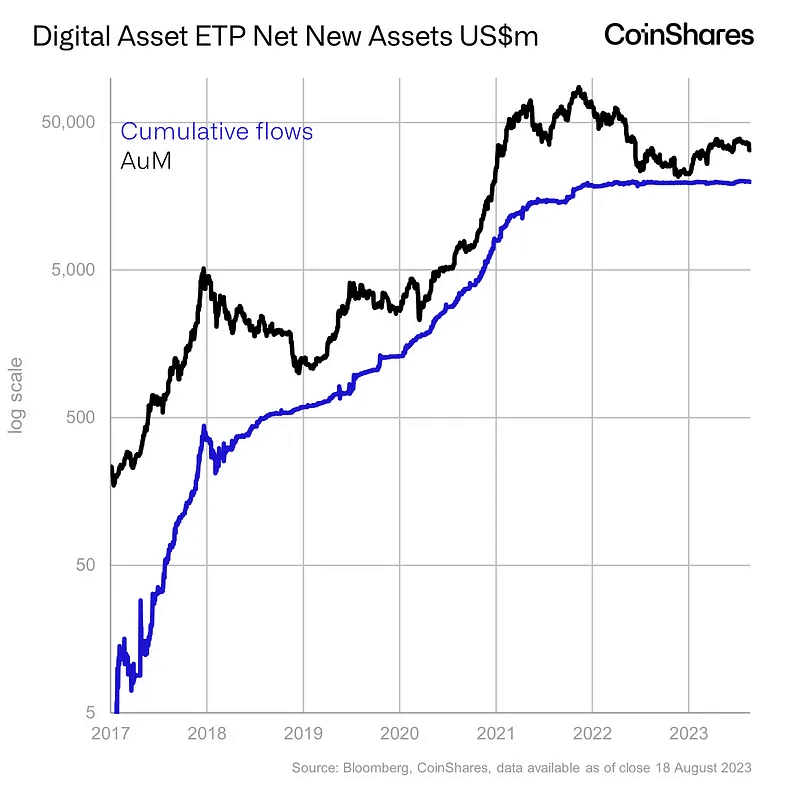

- Institutional investors pulled their investments despite observing inflows earlier in the month.

The crypto market is currently in the hands of the bears as the altcoins, along with Bitcoin, are all facing a decline. Investors are suffering losses across the market, but the ones noting the most amount of lost gains are the ones that put their money and faith in Cardano, Polygon and Arbitrum.

Cardano, Polygon and Arbitrum holders see red

The drawdown observed in the past three weeks has resulted in many altcoins falling to their lowest point year to date. Some came close to registering new 2023 lows. Regardless, profits have been wiped clean for most of the investors, with the holders of Cardano, Polygon and Arbitrum taking the biggest hits.

Since most of the addresses holding ADA, MATIC and ARB bought their supply above the current trading price, they are facing losses. The only problem is that such addresses make up more than 95% of all investors holding some amount of tokens in their wallets.

In general, crashes have been followed by either a period of sideways movement or a quick recovery.

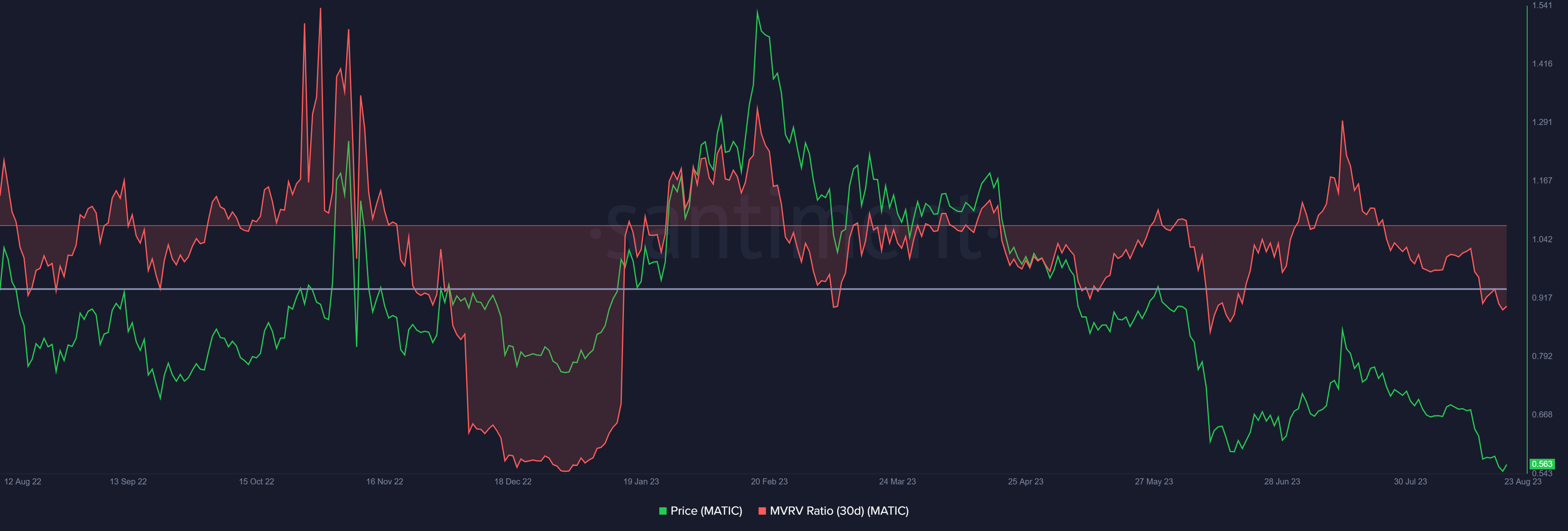

In the case of MATIC, the chance of accumulation at the hands of investors is more likely. Investors holding ARB and ADA can, however, expect further drawdowns as the Market Value to Realized Ratio (MVRV) ratio is yet to reach the opportunity zone. This area is set below a certain point, which historically has led to recovery as investors tend to halt selling and begin accumulating to make the most once recovery begins.

Polygon’s MVRV ratio is already sitting in the opportunity zone below 13%, making it susceptible to a bounce back.

Polygon MVRV ratio

Institutional investors pull back

Nevertheless, since the market is vulnerable to a decline, retail investors might hold back. As is, institutional investors are already pulling their money out, evinced by the $55 million outflows from digital asset products. The week ending August 18 noted skepticism in institutional investors after ending the bearish streak the previous week.

Institutional investors’ holdings

Put simply, the entire market still remains vulnerable to a decline, but of the three biggest loss-bearing assets, Polygon investors have a better shot at recovery. Cardano and Arbitrum holders should still remain cautious.

Like this article? Help us with some feedback by answering this survey: