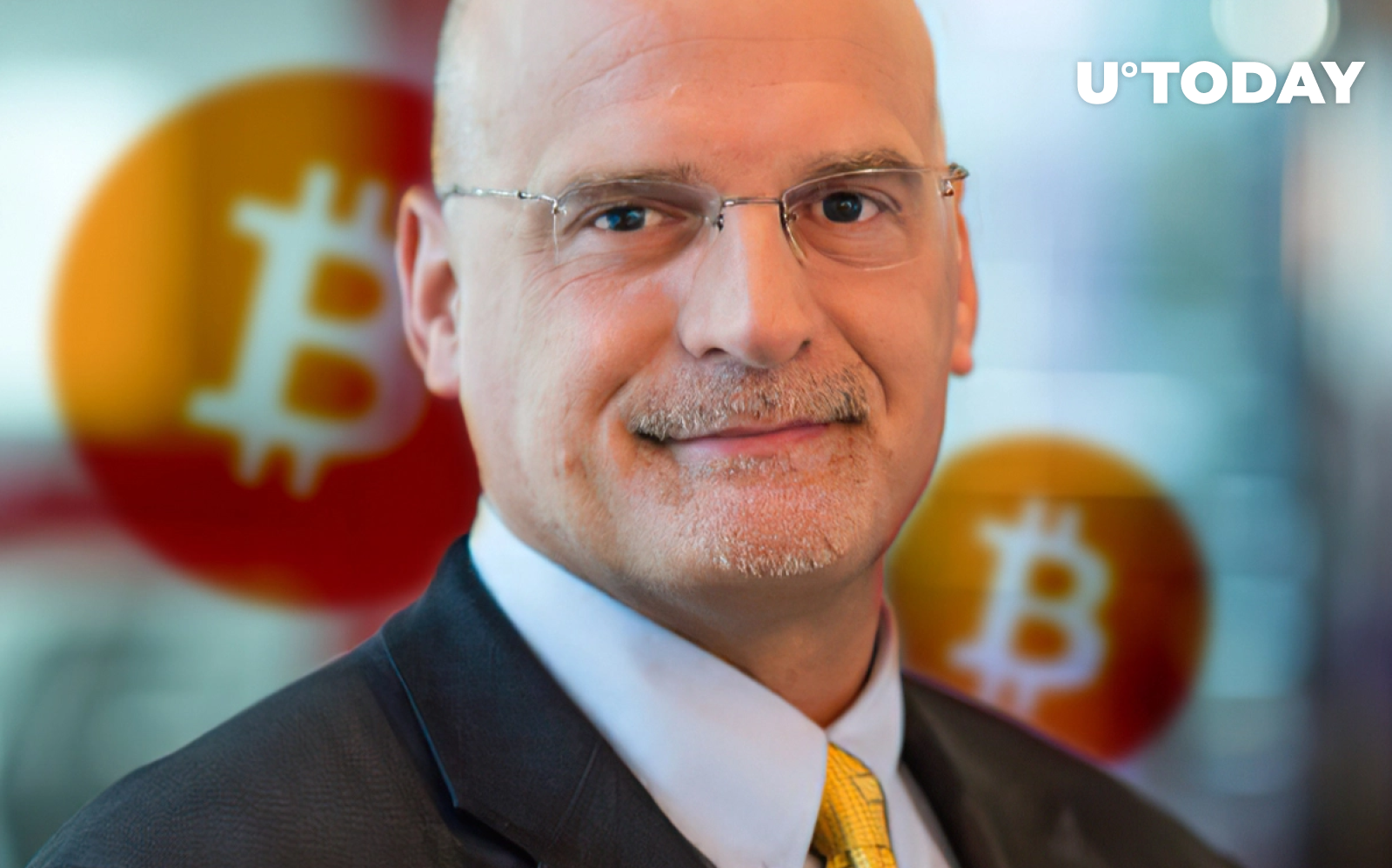

Cryptocurrencies, known for their volatility, pose the greatest risk in the event of a recession, warns Mike McGlone, Bloomberg Intelligence’s senior commodity strategist, in a recent tweet.

Despite Bitcoin being the least of concerns among cryptocurrencies, McGlone predicts that the U.S. is unlikely to dodge an economic downturn by year-end.

As a consequence of an imminent recession, central banks may resort to injecting more liquidity into the system, a practice that usually results in struggling risk assets and lower interest rates. The strategist also anticipates a negative impact on stocks that have bounced back.

McGlone bases his prediction on the historical relationship between liquidity and risk assets, noting significant negative liquidity at the end of the first half of 2023.

He suggests that this could signal the arrival of a long-anticipated recession, which would add headwinds for both cryptocurrencies and bounced-back stocks. The prediction comes in the face of an unfriendly Federal Reserve, which, according to Bloomberg, seems more inclined to continue hiking interest rates.

Interestingly, the strategist also draws a parallel between the performance of Bitcoin, the so-called “digital gold,” and that of physical gold during the 2008 financial crisis.

He notes that gold saw a drop of approximately 30% from its peak before rallying. The implication here being that Bitcoin could potentially follow a similar trajectory in the second half of 2023. As of now, Bitcoin is on an upward trajectory, despite the New York Federal Reserve’s probability of recession from the yield curve being at its highest since 1982.

However, the impact of these economic indicators on Bitcoin’s price remains uncertain. Despite the warnings of potential risks, investors, particularly those with a high-risk tolerance, may still view any dips as potential buying opportunities.