- Cardano price has shed 34% in the last two months with no signs of recovery.

- While development activity and transaction volume are on an uptrend, other key on-chain metrics remain lull.

- ADA needs to produce a higher high on a large-enough timeframe and sustain to suggest a shift in trend.

Cardano (ADA) price has been on a downtrend since September 2021, with no meaningful attempts to break higher. This persistent southbound move is accompanied by a steady rise in transaction volume and a steep rise in development activity.

Also read: Cardano price could move soon after 30% fall

Cardano price needs to get out of consolidation

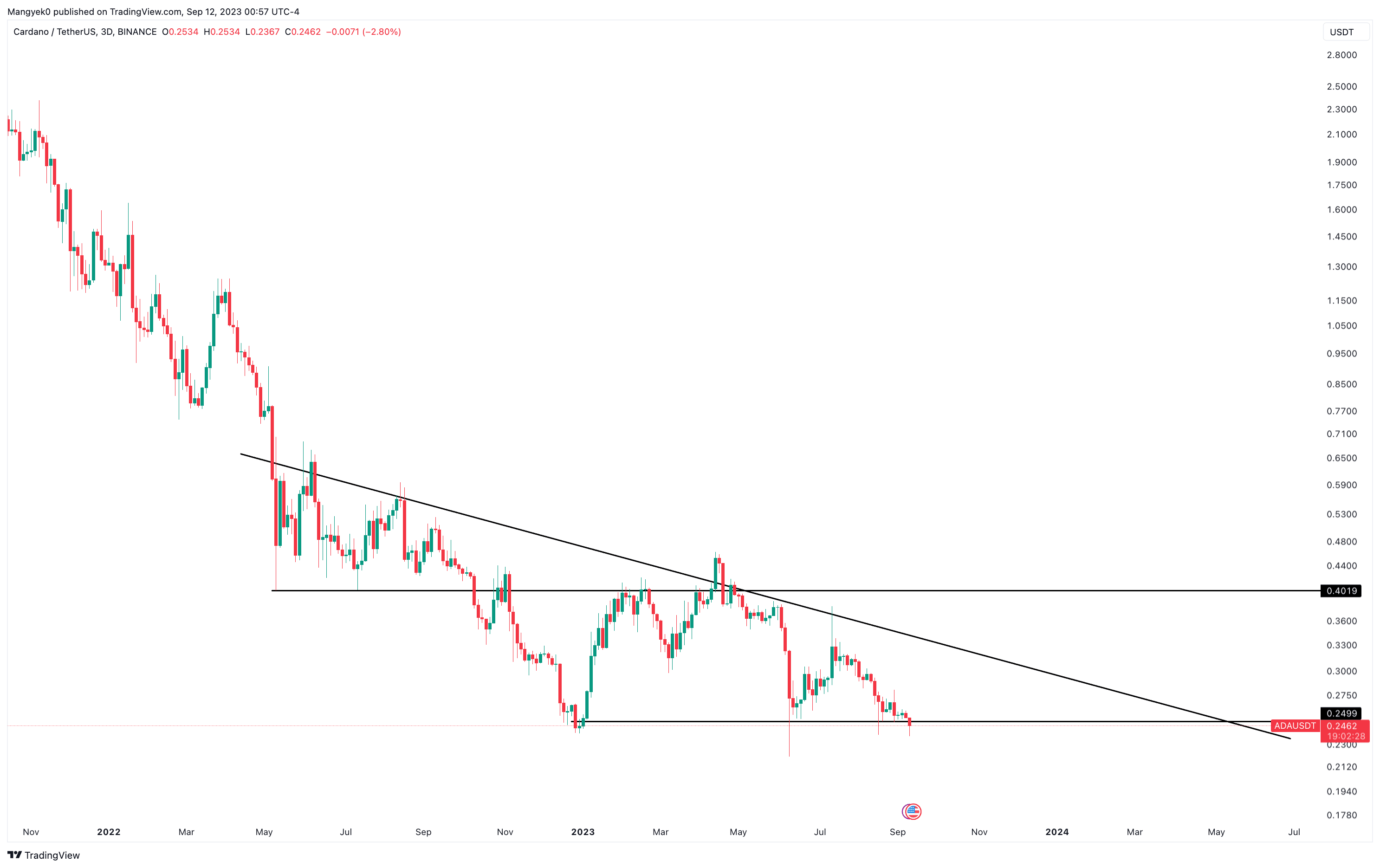

Cardano price is currently trading at $0.2477, attempting to form a bottom above the key support level at $0.2500. This barrier has supported downward trending ADA not once but twice in the last eight months, with the current retest being the third.

A swift bounce here could result in ADA producing another lower high, as has been happening since June 2022.

ADA bulls can get excited if Cardano price breaches the declining trend line connecting the aforementioned lower highs. A successful flip of this hurdle into a support floor would put the smart contract token in front of another key resistance level of $0.4019.

A retest of the aforementioned level would constitute a 63% gain for ADA.

ADA/USDT 3-day chart

On-chain metrics for ADA remain lull

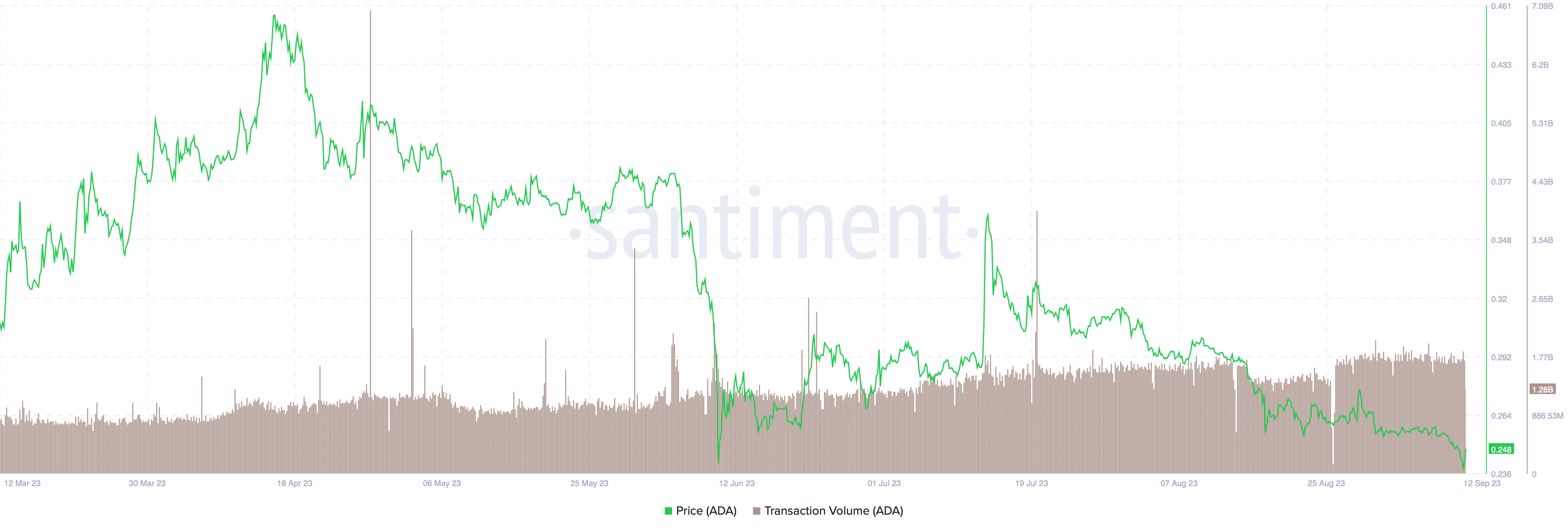

With the exception of transaction volume and development activity, other on-chain metrics show no signs of improvement, which only adds to ADA’s bearish outlook. The consistent uptrend of transaction volume seen over the last six months indicates massive on-chain activity. Currently, this metric stands at 1.72 billion ADA, denoting 129.33% growth from roughly 750 million ADA in March 2023.

ADA transaction volume

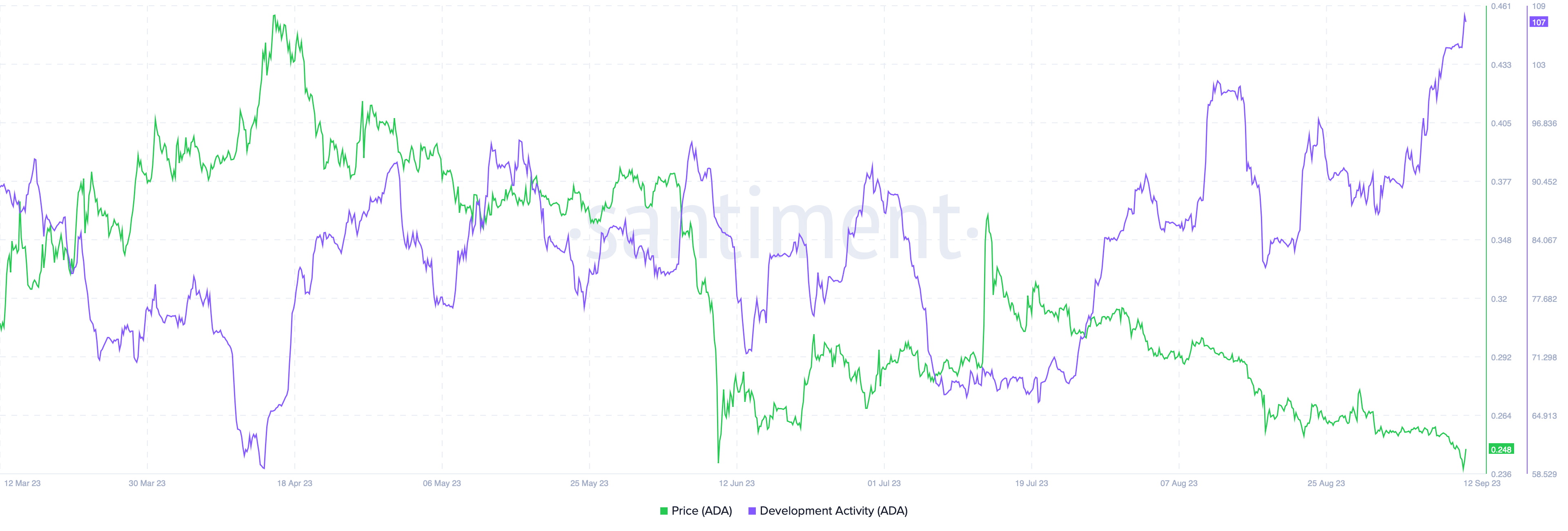

Furthermore, the development activity for ADA has seen massive growth between July 20 and September 12. Typically, a spike in development activity is seen before major releases or network upgrades. Investors usually correlate the uptick to a bullish sign. But considering the current market condition, the increase in development activity is unlikely to push ADA price higher.

ADA development activity

Why the slump in Cardano price?

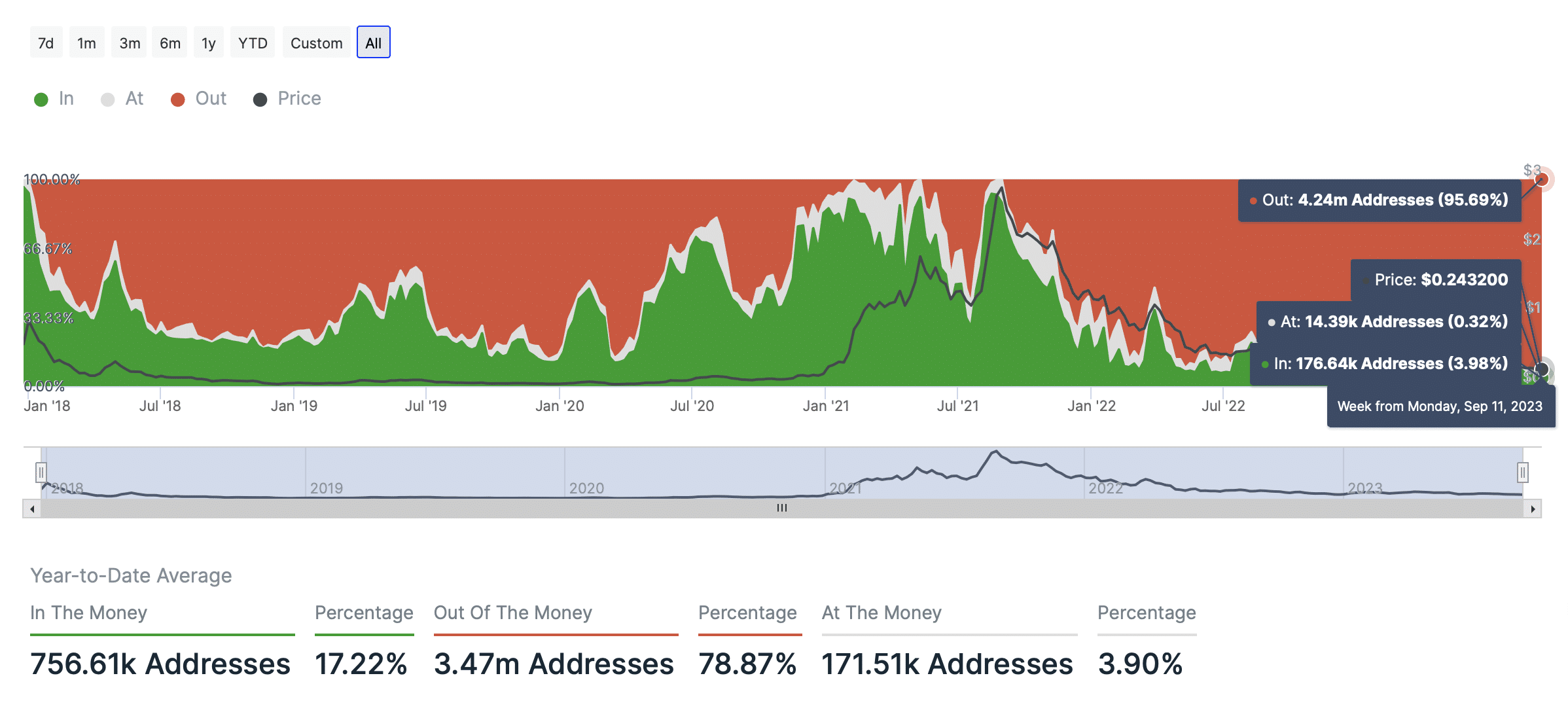

As seen in IntoTheBlock’s Historical In/Out of the Money chart, nearly 4% of the investors are “In the Money,” while 0.32% are “At the Money.” Nearly 95.69% of investors are “Out of the Money.”

ADA Historical In/Out of the Money

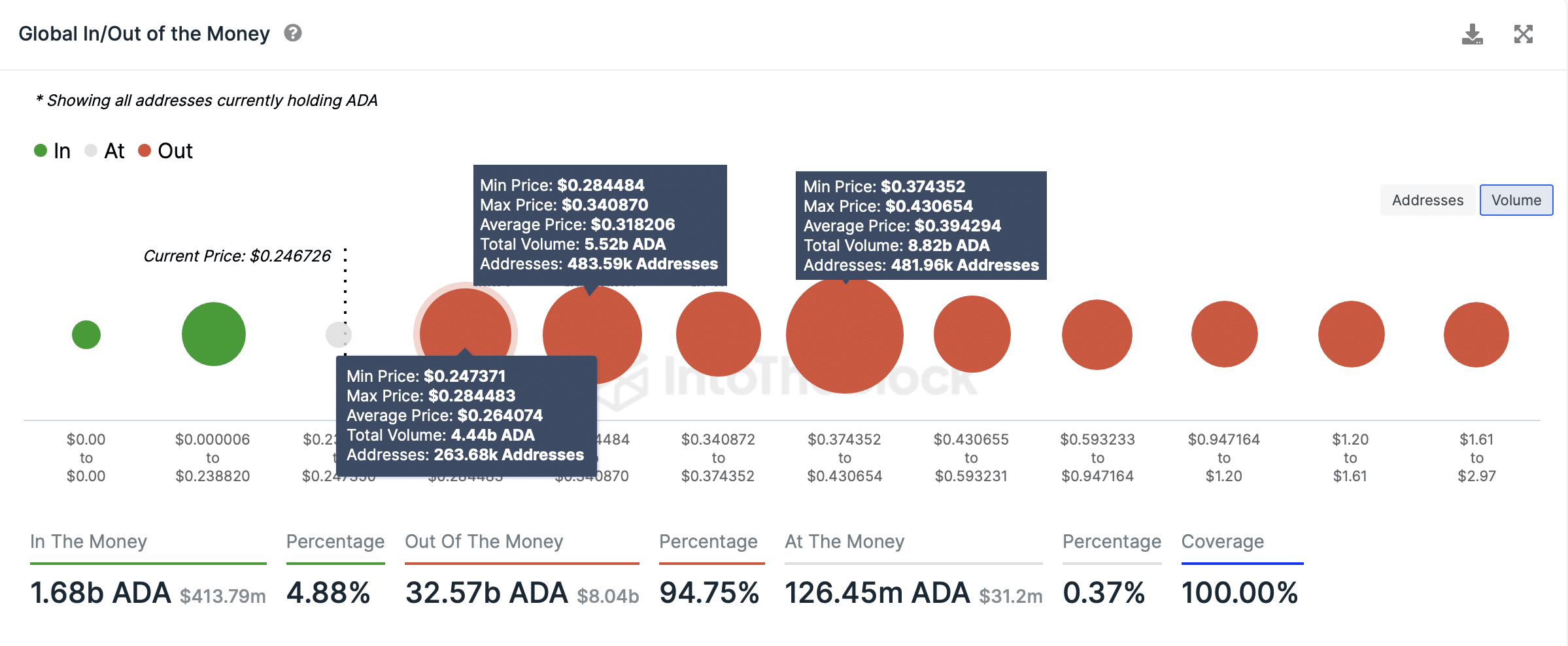

To further visualize the “Out of the Money” holders, investors can take a look at IntoTheBlock’s Global In/Out of the Money (GIOM). This indicator shows three major clusters of underwater investors at $0.2640, $0.3182 and $0.3942.

At these respective key hurdles, 4.40 billion, 5.52 billion and 8.82 billion ADAs purchased by 263,000, 482,000 and 481,000 addresses are being held at a loss relative to the current price of Cardano.

So, any attempts to overcome the $0.2640, $0.3182 and $0.3942 resistances will likely be met with significant spikes in selling pressure from these investors trying to breakeven. Hence, investors opening long positions for ADA from the current level should consider these levels as key take-profit levels.

ADA GIOM

Hence, the reason why ADA is not rallying higher is due to the sell-side pressure present in the ecosystem from underwater holders. But, considering the current position of Cardano price, a short-term rally could be possible if the $0.2500 support level holds and bulls make a comeback.

On the other hand, if Cardano price flips the aforementioned level into a resistance barrier on the three-day timeframe, it would create a lower low and invalidate the recovery rally thesis. In such a case, the GIOM shows the next key support is at $0.0995, where nearly 160,000 addresses purchased 1.55 billion ADA.

Like this article? Help us with some feedback by answering this survey: