- Cardano has noted a spike in daily active address activity and trade volume of ADA tokens, in the past month.

- The count of whale transactions valued at $1 million or higher increased considerably between November 3 and 6.

- Cardano retail traders continue accumulating the asset as price prints nearly 20% weekly gains.

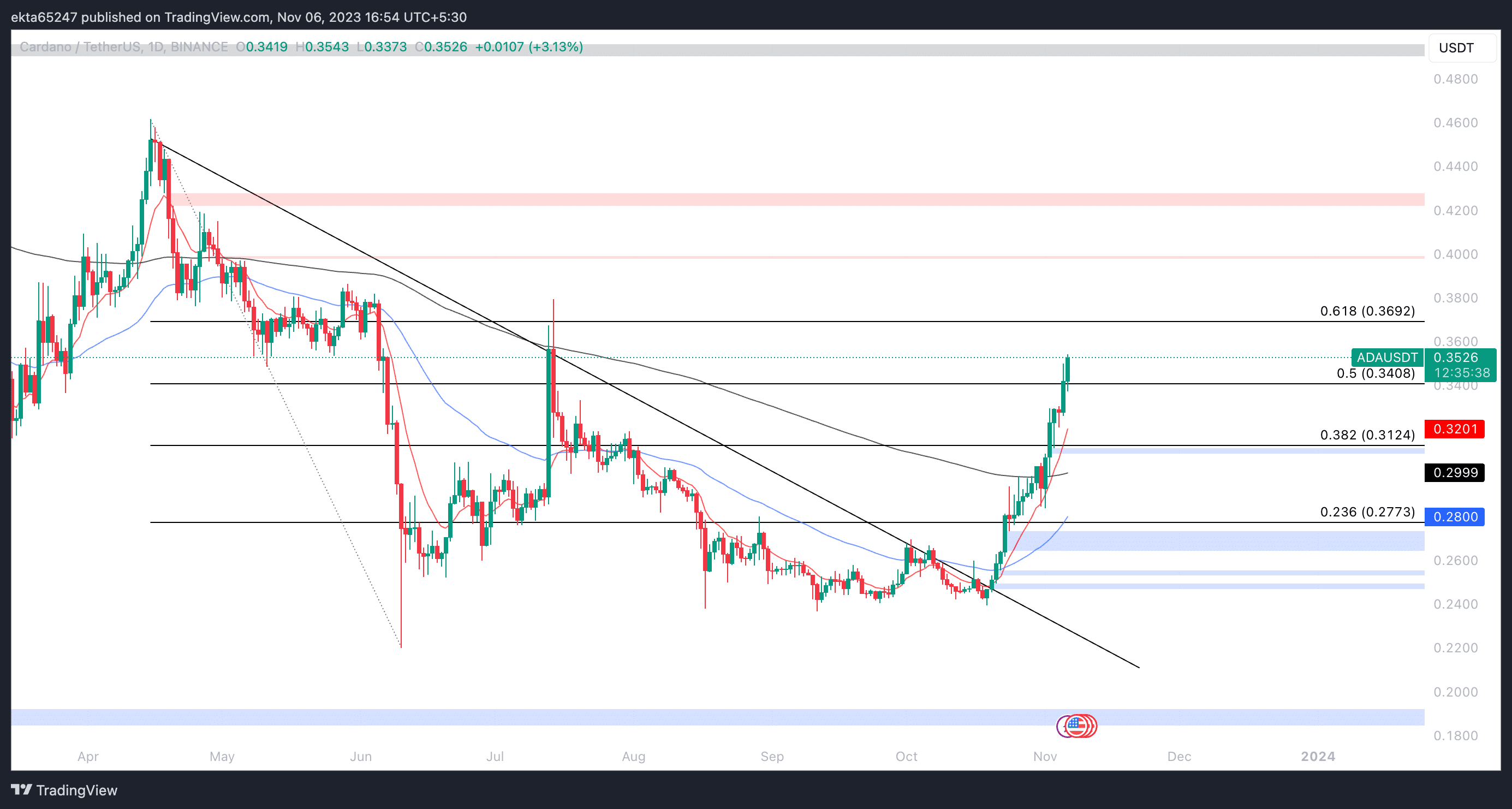

Cardano, one of the largest competitors of the Ethereum network and a Layer-1 blockchain token is set to extend its gains this week. The altcoin’s price climbed nearly 20% on Binance in the first week of November and on-chain metrics of the asset point at a bullish scenario.

Also read: Cardano price suffers decline with rising whale activity, ADA holders remain optimistic

Cardano on-chain metrics signal likely gains in ADA price

Three key on-chain metrics are pointing at ADA price gains.

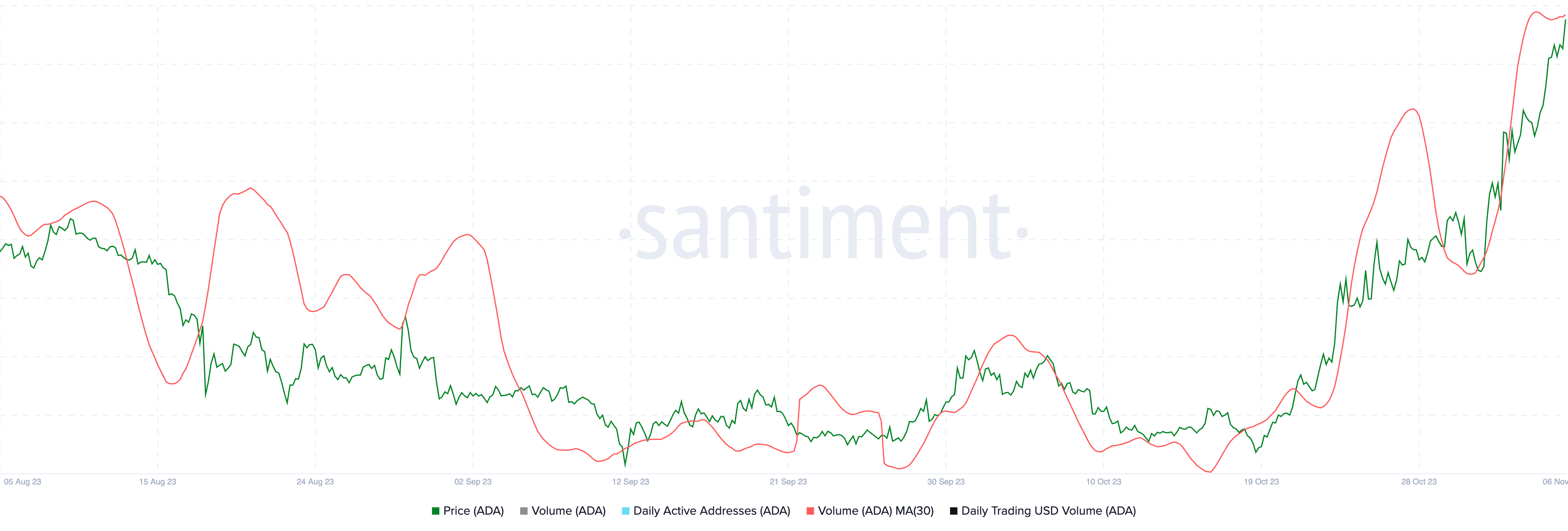

Transaction volume

As seen in the chart below, the transaction volume has climbed steadily over the past three months, hitting a top in November. Transaction volume rallied from 237.63 million to 332.08 million on November 6.

The peak of 332.08 million marks a three-month high in Cardano blockchains transaction volume. This supports a bullish thesis for ADA price.

Volume (ADA) vs price

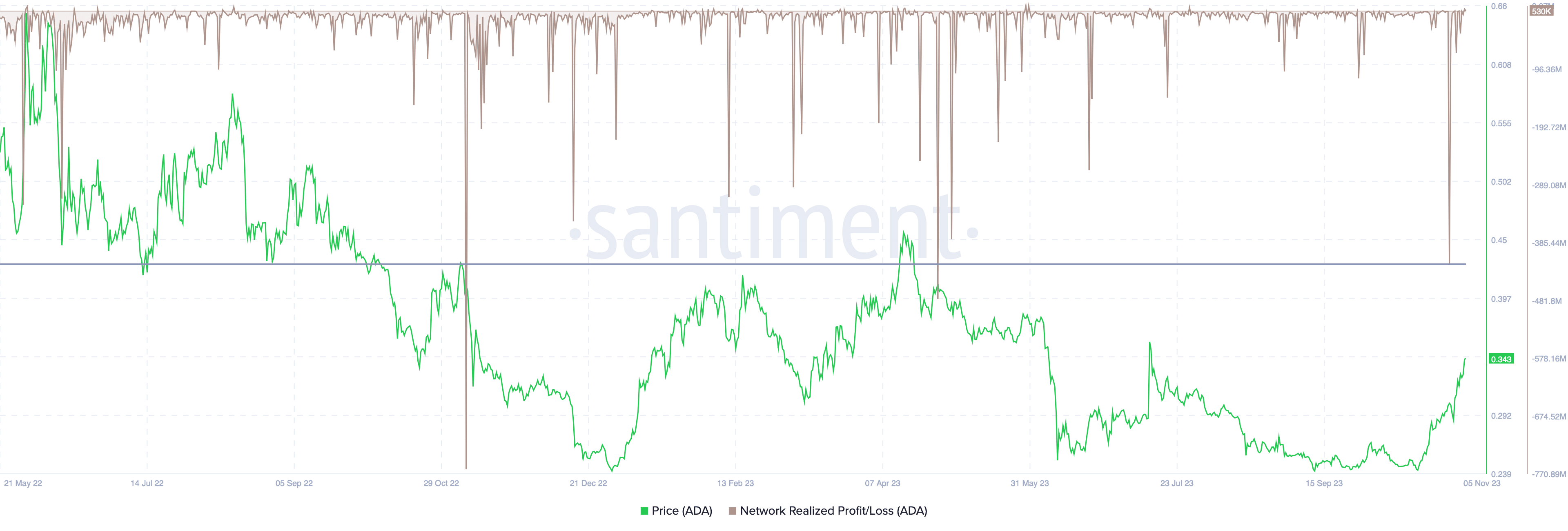

Network Realized Profit/Loss

Net Realized Profit/Loss is a metric that calculates the net profit or loss (USD value) for all Cardano tokens coins spent over the six month time frame, as seen in the chart below. The NPL chart shows that the last massive capitulation event took place on October 30, a five-month high for Cardano.

NPL vs Cardano price

All tokens being spent in November are largely profitable trades according to this metric and this supports a bullish thesis for Cardano price.

Whale transaction count (>$1 million)

The count of whale transactions valued at higher than $1 million is indicative of the movements made by large wallet investors holding Cardano. Typically, whale activity is bullish during a downtrend in the asset’s price.

In Cardano’s case, whale transactions valued at $1 million or higher, exceeded 6,700 between November 2 and early on Monday, alongside an uptrend in ADA price. In conclusion, whales are likely accumulating Cardano, supporting ADA price rally. As seen in the chart below, whale transaction counts at the current level typically coincide with a local top. This occurred in January 2022 and June 2022. ADA price could therefore rally to form a local top, before a pullback in the asset.