- Cardano price has risen to a three-month high in the past two weeks, testing the barrier at $0.3208.

- ADA active addresses & whale transactions are at their highest since June, resulting in the rally.

- MVRV ratio touching the danger zone suggests a possible pullback fuelled by profit booking.

Cardano price followed in the footsteps of Bitcoin over the past couple of days and managed to impress investors. However, more than the influence of BTC, the credit for the rally goes to ADA’s loyal investors, who are also now a huge threat to this rise.

Cardano price at a critical junction

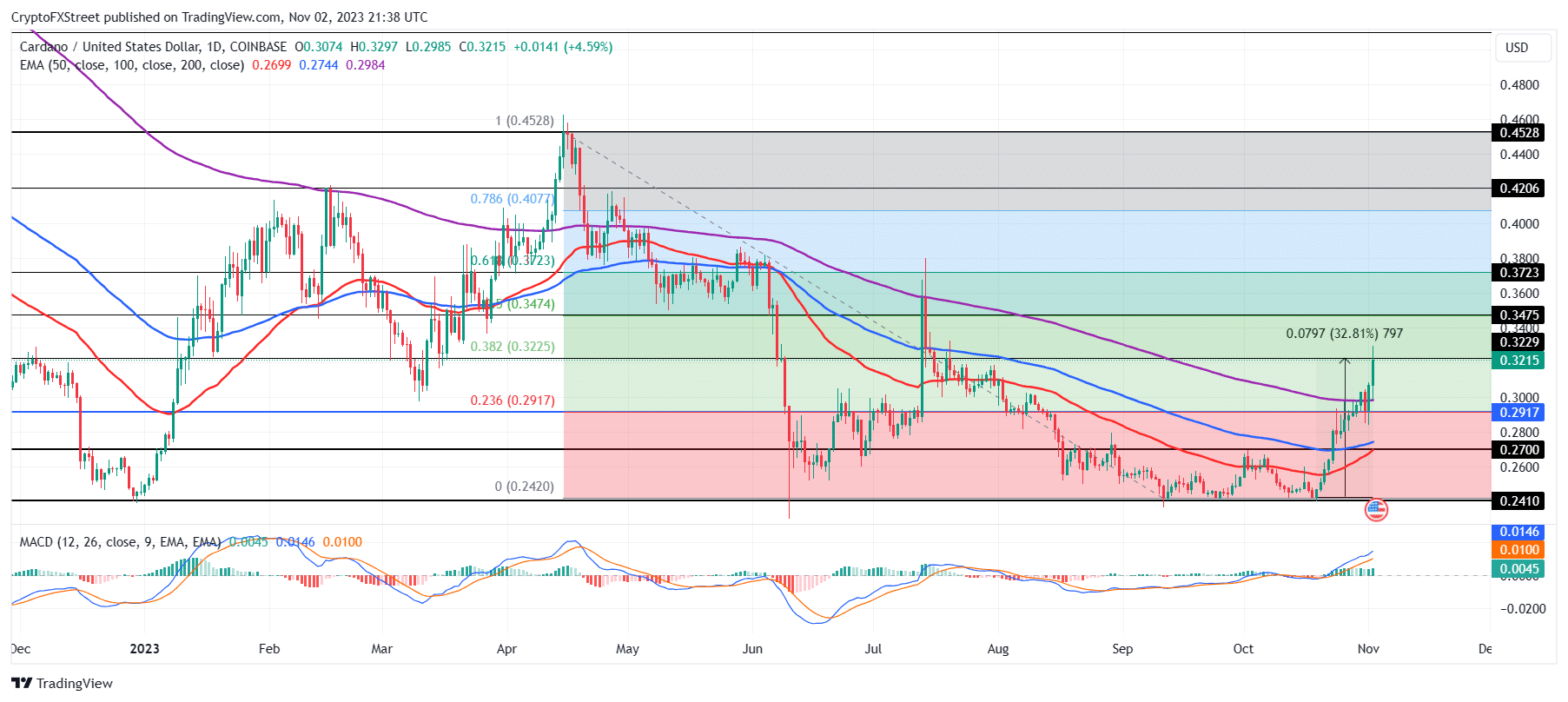

Cardano price trading at $0.3215 has charted a 32% rally in the last two weeks, rising from $0.2429 to nearly breaching the $0.3229 resistance today during the intra-day trading hours. This price point also marks the 38.2% Fibonacci (Fib) retracement from $0.4528 to $0.2420.

Flipping this level into support would serve as an important step for Cardano price in sustaining the gains achieved recently. This would also provide ADA the boost necessary for tagging $0.3475, coinciding with the 50% Fib retracement.

The Moving Average Convergence Divergence (MACD) indicator, which is used to measure the strength of the trend, suggests that the bullishness is not waning as of now, judging by the green bars on the histogram. Thus, if Cardano continues receiving support from its investors, a further rise might be possible.

ADA/USD 1-day chart

But if the breach fails and investors choose to sell their holdings to guarantee profits, a decline would not be too surprising. Consequently, ADA would fall to test the 23.6% Fib retracement marked at $0.2917. Losing this critical support level would invalidate the bullish thesis and send Cardano price to $0.2700.

ADA investors are prone to selling

As mentioned above, the credit for the recent rally, in addition to broader market bullish cues, goes to the investors’ recently found enthusiasm.

Their on-chain activity noted a boost, with active addresses rising by 23% in the span of a month and whale transactions increasing by 32% in the same duration. With both the measures at their three-month highs, the price found bullishness to continue rallying.

Cardano whale transactions and active addresses

However, now, the key to preventing a decline also sits in the hands of these investors, as observed on the Market Value to Realized Value (MVRV) ratio. MVRV is an indicator that is used to assess the average profit/loss of investors who purchase an asset. The 30-day MVRV ratio measures the average profit/loss of investors who purchased an asset in the past month.

As for Cardano, the 30-day MVRV sits at 9.5%, which indicates that investors who purchased the coin in the past month are sitting at 9.5% profit. These addresses are also likely to sell their holdings to realize profits, which could trigger a sell-off. As seen on the chart, when MVRV hits 6% to 15%, ADA has witnessed major corrections; hence, this area is termed a danger zone.

Cardano MVRV ratio

So if ADA holders decide to lock in their gains, Cardano price will fail to lock its rise and notice an eventual decline.