Cardano’s ADA has been on a steady decline since July 14 after attaining highs of $0.38. That said, ADA will mark its fifth consecutive day of trading in red if a negative close is achieved today.

ADA saw a massive price spike from July 13 to July 14 as hopes were revived of Cardano being exempt from the SEC’s regulatory threats as a result of Ripple’s victory.

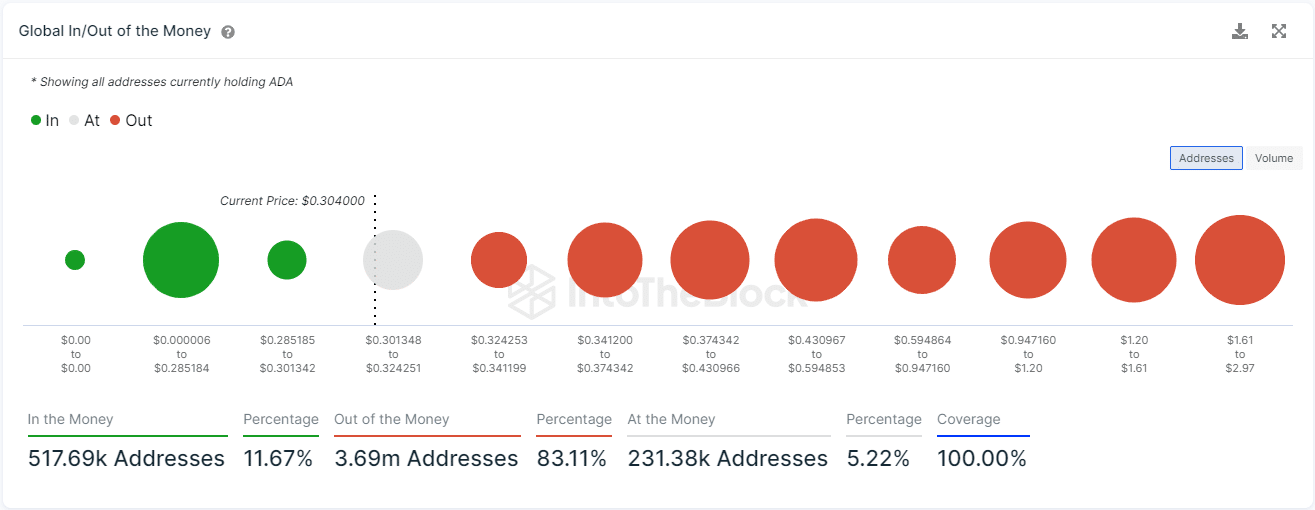

After then, sellers took profits as ADA perpetually closed days in red. At the time of writing, ADA was down 3.05% in the last 24 hours to $0.305. That said, according to on-chain data from IntoTheBlock, a two billion ADA demand wall might push back bears.

At its current price levels, Cardano rests at the two billion ADA support level, which coincides with the $0.285 to $0.301 range. Here, 62,400 addresses bought 2.08 billion ADA at an average price of $0.292.

Here, buying activity is expected to pick up given the fact that addresses that had previously bought in this price range are likely to provide support.

Technically speaking, the demand wall highlighted above is just slightly below the daily MA 50, which is currently located at $0.301.

Given that the MA 50 price level has hindered the ADA price in recent months, the task might not be an easy one for the bulls, as they would have to flip this level into support.

The RSI is close to mid-50, indicating an impending consolidation, where bulls and bears will duel until equilibrium is reached.

If the bears are pushed back and the ADA price initiates a price increase from its current levels, buyers might aim for a retest of the $0.38 level.

On the other hand, a break and close below $0.30 could tip the balance in bears’ favor. A major support is envisaged below the $0.30 demand wall; this is where 439,220 addresses bought 6.12 billion ADA at an average price of $0.203.