Bitcoin has been on a tear, with the cryptocurrency recently surging past $35,000, boosted by key developments within the crypto community and a decisive break above the $31,000 resistance level. What makes this rally particularly interesting is the growing sentiment among experts and analysts that the bottom may be in for Bitcoin. The latest individual to join this chorus has been the veteran trader and market analyst, Peter Brandt.

Brandt’s Prediction on Bitcoin Price

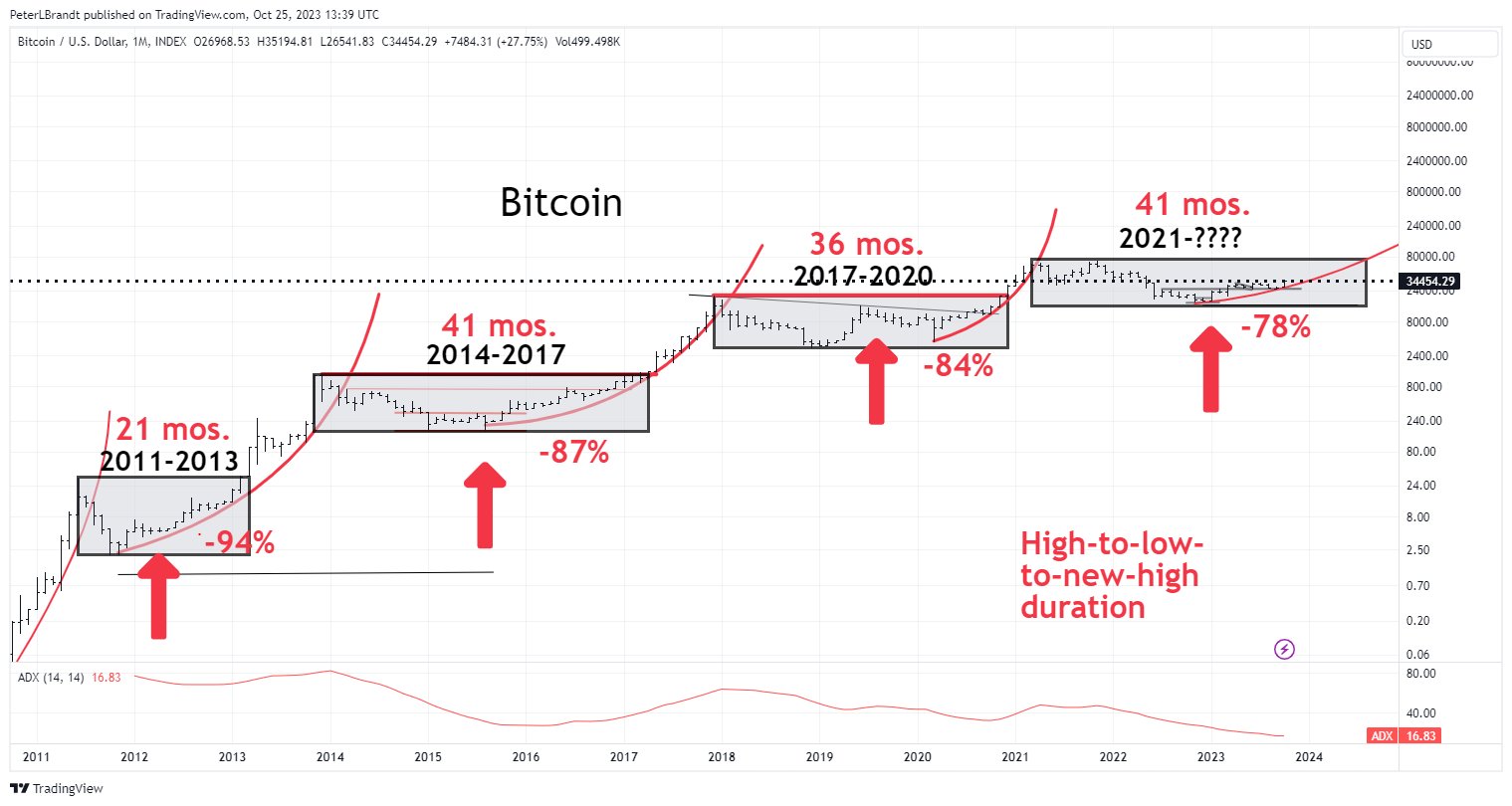

On Wednesday, Brandt took to Twitter emphasizing the unpredictability of market paths while signaling his conviction that the Bitcoin bottom has been reached.

“Anyone who declares they know the future path of any market is a fool. Markets will ALWAYS surprise. Yet, with this disclaimer, I believe; The BTC bottom is in; New ATHs not coming until Q3 2024.” Tweeted Brandt.

The pundit however predicted that Bitcoin might potentially face an extended period of price consolidation or sideways movement prior to reaching the all-time highs, saying he had used the blueprint for two years.

That said, Brandt isn’t the only analyst with a bullish outlook. Popular crypto analyst Kevin Svenson also highlighted that the best buying opportunity for Bitcoin is typically before its halving events, underlining that historical cycles continue to rhyme with each other.

What Other Traders Predict

However, not everyone in the crypto space shares this optimism. Peter Schiff, a well-known gold advocate, has continued to express his skepticism tweeting today,

“Bitcoin speculators have overestimated the demand for a new Bitcoin ETF. It’s hard to believe that with numerous existing avenues for Bitcoin exposure, there is a significant group of would-be buyers who’ve been waiting to buy. It’s Bitcoin owners who’ve been waiting to sell.”

Jim Cramer, the host of CNBC’s “Mad Money,” have also been making pessimistic predictions about Bitcoin’s future price. Earlie this month, he declared that Bitcoin was about to experience a significant decline. However, Bitcoin enthusiasts have responded to such forecasts with skepticism and have taken pride in the cryptocurrency’s recent price surge.

That said, as Bitcoin continues to demonstrate its strength, experts and analysts continue to debate its future trajectory. Crypto analyst ‘Rekt Capital’ noted that all key bearish fractal invalidation criteria have been met, emphasizing that Bitcoin’s break above the $31,000 yearly high, could help fuel price higher.

Meanwhile, crypto fund manager Dan Tapiero also shared his bullish sentiments proclaiming Bitcoin’s $25,000 support is poised to launch the cryptocurrency into the $35,000 to $45,000 range in the short term and new heights by 2024.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: